On his blog, Urs Birchler offers different perspectives on the question whether the Swiss National Bank (SNB) is obliged to pay out banks’ reserves in cash. One view: Reserves are legal tender. The SNB therefore is not obliged to exchange reserves against cash. Another view: According to the law, the SNB is required to provide sufficient cash. Moreover, reserves and cash were meant to be perfect substitutes. Yet another view: Lawmakers would have written a different law had they known that...

Read More »Central Bank Independence in Switzerland: A Farce

Each week we will publish the best articles by Marc Meyer, one of the most critical voices against the SNB.This post explains 3 points: That the SNB does not understand what assets and liabilities are – and due to this misunderstanding – it speculates with massive leverage. The difference between good and bad deflation, and that Switzerland has good deflation. That both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank...

Read More »Central Banks Shiny New Tool: Cash-Escape-Inhibitors

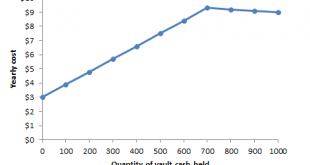

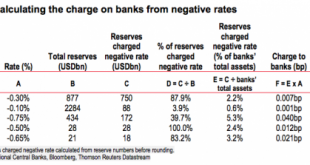

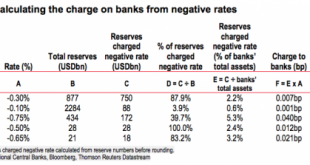

Submitted by JP Koning via Moneyness blog, Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative rate space. Same old tool, different sign. What about the tiering mechanisms that have been introduced by the Bank of Japan, Swiss National Bank, and Danmarks Nationalbank? Aren't they new? The SNB, for instance, provides an exemption...

Read More »Central Banks Shiny New Tool: Cash-Escape-Inhibitors

Submitted by JP Koning via Moneyness blog, Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative rate space. Same old tool, different sign. What about the tiering mechanisms that have been introduced by the Bank of Japan, Swiss National Bank, and Danmarks Nationalbank? Aren't they new? The SNB, for instance, provides an exemption...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

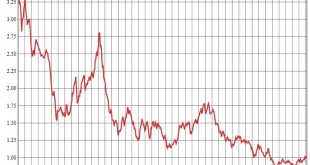

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More »Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr, There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s...

Read More »Are Central Banks Setting Each Other Up?

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s venture down some roads...

Read More »Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thing has to be abolished: cash. This explains the recent flurry of articles in outlets such as BBG and the FT, and op-eds by such "established" economists as Larry Summers, all advocating the death of cash, a process which would begin by...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org