Summary:

Submitted by JP Koning via Moneyness blog, Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative rate space. Same old tool, different sign. What about the tiering mechanisms that have been introduced by the Bank of Japan, Swiss National Bank, and Danmarks Nationalbank? Aren't they new? The SNB, for instance, provides an exemption threshold whereby any amount of deposits that a bank holds above a certain amount is charged -0.75% but everything within the exemption incurs no penalty. As for the Bank of Japan, it has three tiers: reserves up to a certain level (the 'basic balance') are allowed to earn 0.1%, the next tier earns 0%, and all remaining reserves above that are docked -0.1%. But as Nick Rowe writes, negative rate tiers—which can be thought of as maximum allowed reserves—are simply the mirror image of minimum required reserves at positive rates. So tiering isn't an innovation, it's just the same old tool we learnt in Macro 101, except in reverse. No, the novel tool that has been created is what I'm going to call a cash escape inhibitor. Consider this. When central bank deposit rates are positive, banks will try to minimize storage of 0%-yielding banknotes by converting them into deposits at the central bank.

Topics:

jp_koning considers the following as important: Bank of Japan, Central Banks, Featured, fixed, Japan, Monetary Policy, newsletter, Swiss National Bank, zerohedge

This could be interesting, too:

Submitted by JP Koning via Moneyness blog, Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative rate space. Same old tool, different sign. What about the tiering mechanisms that have been introduced by the Bank of Japan, Swiss National Bank, and Danmarks Nationalbank? Aren't they new? The SNB, for instance, provides an exemption threshold whereby any amount of deposits that a bank holds above a certain amount is charged -0.75% but everything within the exemption incurs no penalty. As for the Bank of Japan, it has three tiers: reserves up to a certain level (the 'basic balance') are allowed to earn 0.1%, the next tier earns 0%, and all remaining reserves above that are docked -0.1%. But as Nick Rowe writes, negative rate tiers—which can be thought of as maximum allowed reserves—are simply the mirror image of minimum required reserves at positive rates. So tiering isn't an innovation, it's just the same old tool we learnt in Macro 101, except in reverse.

Submitted by JP Koning via Moneyness blog, Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative rate space. Same old tool, different sign. What about the tiering mechanisms that have been introduced by the Bank of Japan, Swiss National Bank, and Danmarks Nationalbank? Aren't they new? The SNB, for instance, provides an exemption threshold whereby any amount of deposits that a bank holds above a certain amount is charged -0.75% but everything within the exemption incurs no penalty. As for the Bank of Japan, it has three tiers: reserves up to a certain level (the 'basic balance') are allowed to earn 0.1%, the next tier earns 0%, and all remaining reserves above that are docked -0.1%. But as Nick Rowe writes, negative rate tiers—which can be thought of as maximum allowed reserves—are simply the mirror image of minimum required reserves at positive rates. So tiering isn't an innovation, it's just the same old tool we learnt in Macro 101, except in reverse. No, the novel tool that has been created is what I'm going to call a cash escape inhibitor. Consider this. When central bank deposit rates are positive, banks will try to minimize storage of 0%-yielding banknotes by converting them into deposits at the central bank.

Topics:

jp_koning considers the following as important: Bank of Japan, Central Banks, Featured, fixed, Japan, Monetary Policy, newsletter, Swiss National Bank, zerohedge

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

No, the novel tool that has been created is what I'm going to call a cash escape inhibitor.

Consider this. When central bank deposit rates are positive, banks will try to minimize storage of 0%-yielding banknotes by converting them into deposits at the central bank. When rates fall into negative territory, banks do the opposite; they try to maximize storage of 0% banknote storage. Nothing novel here, just mirror images. But an asymmetry emerges. Central bankers don't care if banks minimize the storage of banknotes when rates are positive, but they do care about the maximization of paper storage at negative rates. After all, if banks escape from negative yielding central bank deposits into 0% yielding cash, this spells the end of monetary policy. Because once every bank holds only cash, the central bank has effectively lost its interest rate tool. If you really want to find something innovative in the shift from positive to negative rate territory, it's the mechanism that central bankers have instituted to inhibit the combined threat of mass paper storage and monetary policy impotence. Designed by the Swiss and recently adopted by the Bank of Japan, these cash escape inhibitors have no counterpart in positive rate land.The mechanics of cash escape inhibitors

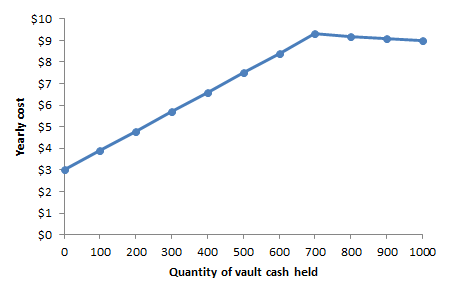

Cash escape inhibitors delay the onset of mass paper storage by penalizing any bank that tries to replace their holdings of negative yielding central bank deposits with 0%-yielding cash. The best way to get a feel for how they work is through an example. Say a central bank has issued a total of $1000 in deposits, all of it held by banks. The central bank currently charges banks 0% on deposits. Let's assume that if banks choose to hold cash in their vaults they will face handling & storage costs of 0.9% a year. Our central bank, which uses tiering, now reduces deposit rates from 0% to -1%. The first tier of deposits, say $700, is protected from negative rates, but the second tier of $300 is docked 1%, or $3 a year. Banks can improve their position by converting the entire second tier, the penalized portion of deposits, into cash. Each $100 worth of deposits that is swapped into cash results in cost savings of 10 cents since the $0.90 that banks will incur on storage & handling is an improvement over the $1 in negative interest they would otherwise have to pay. Banks will very rapidly withdraw all their tier-2 deposits, monetary impotence being the result. To avoid this scenario, central banks can install a Swiss-style cash escape inhibitor. The way this mechanism works is that each additional deposit that banks convert into vault cash reduces the size of the first tier, or the shield, rather than the second tier, the exposed portion. So when rates are reduced to -1%, should banks try to evade this charge by converting $100 worth of deposits into vault cash they will only succeed in reducing the protected tier from $700 to $600, the second tier still containing the same $300 in penalized deposits. This evasion effort will only have made banks worse off. Not only will they still be paying $3 a year in negative interest but they will also be incurring an extra $0.90 in storage & handling ($100 more in vault cash x 0.9% storage costs). Continuing on, if the banks convert $200 worth of deposits into vault cash, they end up worsening their position even more, accumulating $1.80 in storage & handling costs on top of $3.00 in interest. We can calculate the net loss that the inhibitor imposes on banks for each quantity of deposits converted into vault cash and plot it: |

| The yearly cost of holding various quantities of cash at a -1% central bank deposit rate |

How deep can rates go?

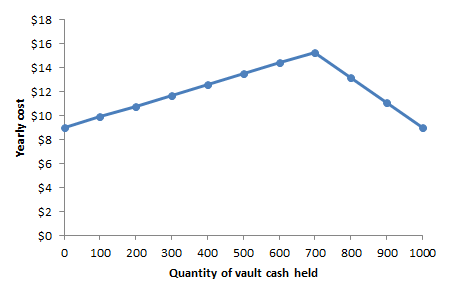

How powerful are these inhibitors? Specifically, how deep into negative rate territory can a central bank go before they start to be ineffective? Let's say our central banker reduces deposit rates to -2%. Banks must now pay $6 a year in interest ($300 x 2%). If banks convert all $1000 in deposits into cash, they will have to bear $9 in storage and handling costs, a more expensive option than remaining in deposits. So even at -2% rates, the cash inhibitor mechanism performs its task admirably. If the central bank ratchets rates down to -3%, banks will now be paying $9 a year in interest ($300 x 3%). If they convert all $1000 in deposits into cash, they'll have to pay $9 in storage & handling. So at -3%, bankers will be indifferent between staying invested in deposits or converting into cash. If rates go down just a bit more, say to -3.1%, interest costs are now $9.30. A tipping point is reached and cash will be the cheaper option. Mass cash storage ensues, the cash escape inhibitor having lost its effectiveness. The chart below shows the costs faced by banks at various levels of cash holdings when rates fall to -3%. The extreme left and right options on the plot, $0 in cash or $1000, bear the same costs. |

|

|