As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thing has to be abolished: cash. This explains the recent flurry of articles in outlets such as BBG and the FT, and op-eds by such "established" economists as Larry Summers, all advocating the death of cash, a process which would begin by...

Read More »MXN Shorts Crushed After Mexican Central Bank Unexpectedly Hikes Rate By 50bps, Peso Soars

It was already a torrid day for commodity currencies, among which the MXN, or Mexican Peso, which were surging on today's latest crude short squeeze and then as if pulling a PBOC with just one intention - to crush the shorts - the Mexican Central Bank or Banxico, dealt a crushing blow on anyone short the MXN when it announced an unexpected 50 bps rate hike in the overnight rate to 3.75%. From the central bank: "The target for the overnight interbank funding rate is increased by 50 basis...

Read More »MXN Shorts Crushed After Mexican Central Bank Unexpectedly Hikes Rate By 50bps, Peso Soars

It was already a torrid day for commodity currencies, among which the MXN, or Mexican Peso, which were surging on today's latest crude short squeeze and then as if pulling a PBOC with just one intention - to crush the shorts - the Mexican Central Bank or Banxico, dealt a crushing blow on anyone short the MXN when it announced an unexpected 50 bps rate hike in the overnight rate to 3.75%. From the central bank: "The target for the overnight interbank funding rate is increased by 50 basis...

Read More »The Chinese Yuan Countdown Is On

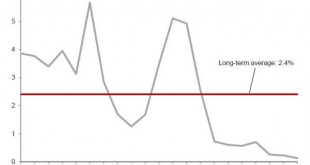

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com, Currency stability is a prerequisite for China's economic transition Defending the yuan is prohibitively expensive – China cannot beat the market Progressive devaluation managed by PBoC is the most probable scenario for 2016 Remember that the country is on the capitalism learning curve Exchange rates will inevitably be a key discussion point at Shanghai G20 China has moved from being a net importer to a net exporter of...

Read More »The Chinese Yuan Countdown Is On

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com, Currency stability is a prerequisite for China's economic transition Defending the yuan is prohibitively expensive – China cannot beat the market Progressive devaluation managed by PBoC is the most probable scenario for 2016 Remember that the country is on the capitalism learning curve Exchange rates will inevitably be a key discussion point at Shanghai G20 China has moved from being a net importer to a net exporter of...

Read More »The Swiss National Bank Doubled Its Apple Holdings in 2015

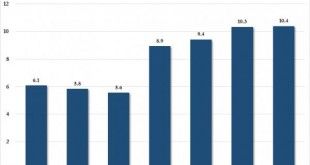

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled – in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions in losses – largest hedge fund in Switzerland, its central bank, the Swiss National Bank. What is curious is that unlike the Fed, the hedge fund also known as the Swiss National Bank not only proudly admits it purchases stocks, ETFs and...

Read More »How Low Can The Bank Of Japan Cut Rates? Ask Gold

As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Panic, desperately tried to pull of his best "Draghi", up to and even stealing the ECB's trademark catch phrase, to wit: KURODA: POSSIBLE TO CUT NEGATIVE RATE FURTHER IF NEEDED KURODA: NO LIMIT TO MONETARY EASING MEASURES KURODA: WILL EXPAND EASING...

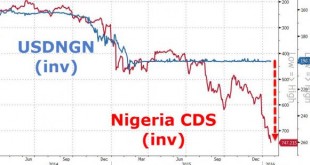

Read More »“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3.5bn in emergency loans to help fund a $15bn deficit in a budget heavy on public spending amid collapsing oil revenues. Just as we warned in December, the dollar shortage has arrived, perhaps now is time to panic after all. In September,...

Read More »BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is no ammo to lift stocks. An almost 200 point surge in Dow futures has been erased and Nikkei 225 has dropped 1000 points from its post BOJ highs... Dow futures have plunged... What a mess... And Nikkei has crashed over 1000 points... And...

Read More »SNB’s history of balance sheet and Monthly bulletin

Since 2015, the SNB provides its balance sheet items in a different form. Previously the monthly bulletins provided a history of the balance sheet. The last monthly bulletin appeared for August 2015. It contained all important data of the SNB and the Swiss economy. The balance sheet data is often 2 months or older. The weekly monetary data and the IMF data about FX reserves and more are published a lot more quickly, but they are not that complete like the monthly bulletin. SNB...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org