Marc Meyer argues that the Swiss National Bank must build up reserves, but this does not mean “foreign exchange reserves”, but “Swiss Franc reserves”. According to the constitution these reserves are owners’ equity denominated in Swiss Franc and some gold. Thomas Jordan’s famous paper “Does the SNB need equity” tries to overturn the constitution suggesting that the constitution accepts FX investments as “reserves”. Russia builds up foreign reserves with national resources, with equity, the SNB, however, with more and more Swiss Franc debt.Effectively Meyer seems to be right: The euro lost 6% per year on average since 2008, but SNB’s yield on investment is under 1.5%. This implies that debt (or FX losses) rise far more quickly than foreign assets can yield. This post originally appeared on Insideparadeplatz in German, it was written in 2013, far before the end of the euro peg. Swiss imperial ambitions killed at the Berezina Over 200 years ago, there was a widespread opinion that Switzerland should compete with the other European nations. This idea attracted 8,000 young Swiss soldiers to become united with Napoleon against Russia. The hasty retreat was ended by the bitter cold of Berezina. Only 300 Swiss soldiers returned home. Thank G4od that today’s situation in Switzerland is not a question of life or death.

Topics:

Marc Meyer considers the following as important: equity, Featured, Featured SNB, Marc Meyer, newsletter, SNB, Thomas Jordan

This could be interesting, too:

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

investrends.ch writes Die Zurückhaltung der SNB wird mehrheitlich begrüsst

Marc Meyer argues that the Swiss National Bank must build up reserves, but this does not mean “foreign exchange reserves”, but “Swiss Franc reserves”. According to the constitution these reserves are owners’ equity denominated in Swiss Franc and some gold. Thomas Jordan’s famous paper “Does the SNB need equity” tries to overturn the constitution suggesting that the constitution accepts FX investments as “reserves”. Russia builds up foreign reserves with national resources, with equity, the SNB, however, with more and more Swiss Franc debt.Effectively Meyer seems to be right: The euro lost 6% per year on average since 2008, but SNB’s yield on investment is under 1.5%. This implies that debt (or FX losses) rise far more quickly than foreign assets can yield.

This post originally appeared on Insideparadeplatz in German, it was written in 2013, far before the end of the euro peg.

Swiss imperial ambitions killed at the BerezinaOver 200 years ago, there was a widespread opinion that Switzerland should compete with the other European nations. This idea attracted 8,000 young Swiss soldiers to become united with Napoleon against Russia. The hasty retreat was ended by the bitter cold of Berezina. Only 300 Swiss soldiers returned home.

Thank G4od that today’s situation in Switzerland is not a question of life or death. However there is great concern about the Swiss economy and its survival. The risk stems from the exorbitant indirect debt of the Swiss National Bank (SNB) towards foreign countries.

Thank G4od that today’s situation in Switzerland is not a question of life or death. However there is great concern about the Swiss economy and its survival. The risk stems from the exorbitant indirect debt of the Swiss National Bank (SNB) towards foreign countries.

Our Swiss National Bank thinks that she should be one of the big players. In his speech at the Economic Society of Berne, the head of the SNB, Thomas Jordan, compared the SNB balance sheet of the balance sheets of the great central banks. The balance sheets of the central banks have become bigger with the aim of fighting the financial crisis – so did the SNB. Jordan overlooks, however: Both the Fed and the ECB invest their assets in their own currency area. The SNB, however, invested almost exclusively abroad.

This is an unhedged currency risk, that can break our necks. In addition, the entire SNB value added is done abroad rather than in Switzerland – at the expense of Switzerland. Instead of boosting our economy, the SNB boosts foreign economies.

The press titled: The “reserves” the SNB were among the largest in the world and “China model for the SNB“. As for currency reserves we are only slightly behind Russia and will overtake Russia soon! “This could full us with proud” – titled the Finanz und Wirtschaft with an imperialistic tone.

To make comparisons with Russia is dangerous – especially if you underestimate the Russian economy. A crucial difference to Russia is the following: We overlook a simple fact: Russia finances its foreign exchange with equity (sale of natural gas, oil, etc.). The SNB, however, with debt – debt for each of us Swiss.

Confusion among SNB terms

Confusion among SNB terms

In my recently published article “Bürkliplatz – massive threat to Paradeplatz” I showed that the SNB terms of “currency reserves” and “foreign exchange assets” have been confused.

Under the Federal Constitution our National Bank must build up “currency reserves”, aka owner’s equity. The term “currency” always refers to the local currency – not in Forex (“German Devisen”) which are “foreign currency”.

Article 99, paragraph 3 of the Federal Constitution clearly states :

“The Swiss National Bank shall create sufficient monetary reserves from its profits; a portion of these reserves is held in gold. ”

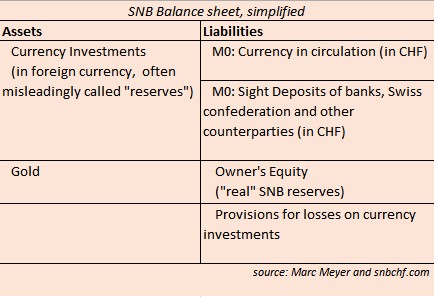

The SNB thus has to build up sufficient reserves, in the form of the equity account called “owner’s equity” denominated in Swiss franc, in our local currency. Reserves are and remain “equity” on the liabilities side, they are never on the assets side.

The accounting records regarding this SNB self-financing that forms the prescribed “reserve” or “foreign reserve assets” is as follows:Income statement / equity

When we speak of “reserves”, the so-called “currency reserves”, this account is a liability account or a capital account for the SNB.

The SNB is not happy with this constitutional mandate, the mandate that she is required to build up reserves or equity. So they refuse the constitutional mandate. For example, the provisions for losses at the end of 2014 were by not able to cover the 50 billion CHF losses in the first half of 2015. But they go even further: Chairman Jordan wants to obtain the right to go into negative equity [Jordan: Does the SNB need equity?]

But this contradicts the Constitution.

SNB chairman attempts to overturn the Constitution

Where are the reserves? Swiss National Bank Jordan with his hat game

Therefore, the SNB chairman attempted to overturn the Federal Constitution. He claims that “currency reserves”, are not a capital account on the liabilities side of SNB’s balance sheet, but they are foreign currency investments on the asset side: “… currency reserves on the asset side of our balance sheet …” (Jordan, ibid, page 4)In the Annual Report, the term “reserves” but nowhere on the asset side of the SNB’s balance sheet occurs. With a sleight-of-hand, Jordan simply twisted the accounts and therefore the constitutional order. He claims that the Swiss constitution wants the SNB to invest in foreign currency. This is not true. The SNB should build up reserves, equity.

The term “provisions for currency reserves” comes from the liability side of the SNB’s balance sheet and represents owner’s equity. The account name is wrong anyway, because provisions are effectively based on foreign capital, not owner’s capital. This shows how lax the Swiss National Bank is controlled. Only the constitution decides. And that one mandates the SNB to accumulate equity. Had the constitutional article issued a mandate to invest in foreign currency, so the second sentence of Article 99 paragraph 3 would be:

Error!

“… a part of these reserves is held in gold and foreign currency assets”.But exactly this is not the case:

The Constitution states:

Important!

“… a portion of these reserves is held in gold.”Had “currency reserves” and “foreign currency investments” been the same, they would have to be partially invested in gold. “Foreign currency investments” can but – by definition – are not yet recognized as “Gold”. In addition, the gold is denominated in Swiss francs. The attempt by the SNB to overturn the Swiss constitutional text, by recording the account “reserves” on the asset side, is a non-starter.

The constitution prohibits negative equityThe Federal Constitution does not allow that the SNB has negative equity. Therefore, it is not tolerable that our SNB chairman travels around Switzerland, claiming that the SNB’s equity should be negative.

Only common sense shows that negative equity for the SNB would be devastating. In this case, the loans from the commercial banks to the SNB would no longer be covered and would have to be depreciated over (Swiss Law OR 960, paragraph 2). This would lead to horrendous losses at commercial banks – and to their bankruptcy.

Instead of the SNB, the commerical banks will need to deposit their balance. This can never be the purpose of our National Bank. Jordan however insists and sayed: “… they [the SNB] is not obliged … in negative equity … … to declare its bankruptcy …” (Jordan, ibid page 8/9).

Jordan insisted on his presentation again, the SNB could simply go in negative equity printing more banknotes. The SNB could never be “illiquid”. This justification will be in vain: Prints the SNB bills, so the ratio of equity to total assets falls more than ever.

Reason: banknotes are not equity of the SNB, as Jordan sayed [lecture to the Statistical Economic Society, Basel], but debt. The printing of banknotes does not improve the total owners’ capital ratio, but deteriorates it further.

Jordan claimed in Basel: “The central bank can fulfill all payment obligations at all times because they can provide the needed liquidity itself.”In Bern he repeated: “Because the SNB can create unlimited francs thanks to the monetary monopoly, it can fully cover its liabilities.”

But if it prints SNB banknotes, so his liabilities are not reduced, but increased.

Imagine, I owe 120 francs to a colleague and I possess only 100 francs. Then I cannot say that he should give me another 20 francs of credit, and with that the debt is paid back. Likewise, the SNB does not pay back their debts to the banks, when it goes more into debt with them. Debt can be settled only with wealth – not with additional debt.

When the SNB obtains from commercial banks 120 billion francs of credit (either through banks’ sight deposits at the SNB or by issuing banknotes) and invests this capital in euros at the rate of 1.20, so it receives 100 billion euros. If the price of 1: 1, so the SNB receives only 100 billion francs back – it simply loses 20 billion francs. The SNB cannot demand additional loans from the commercial banks.

It must learn: Printing money is always increasing debt.

The SNB should sell the foreign currency “reserves” before it is too lateThe SNB will be forced to retreat, bitter financial losses for us Swiss will be the result. A hasty, disorderly retreat in such huge dimensions will tear our country into financial disaster. The SNB should now start immediately with an orderly retreat from the Berezina, stop any exchange rate interventions, and sell the so-called “reserves” in foreign currency, before it is too late.