Overview: Sight deposits are currently the by far most important means of financing for SNB currency purchases, for interventions. Sight deposits are assets for commercial banks, the Swiss confederation and other counterparties that deposit money at the SNB, but for the SNB they are liabilities, debt.Sight deposits are always denominated in CHF. The SNB finances itself with Swiss Francs. With a rising CHF the debt relative to assets gets bigger, because the assets lose their value. As consequence the central bank may lose its Owner’s Equity that may lead to a bankruptcy or a recapitalization by the Swiss state. The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. With this weekly delivery it gives an far earlier indication of SNB interventions than the relatively late releases of balance sheet or IMF data. Currency in circulation (bank notes and coins) is the second financing method, it represents the typical “money printing” of central bank debt. Nowadays this “bank notes printing” is far less important than the electronic printing of debt called “sight deposits”. Printing is the popular word for unsterilised central bank interventions that – at least for monetarists – paves the way for price inflation.

Topics:

George Dorgan considers the following as important: currency reserves, Featured, Featured SNB, intervention, monetary data, negative interest, newsletter, Reserves, sight deposits, SNB

This could be interesting, too:

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

Overview:

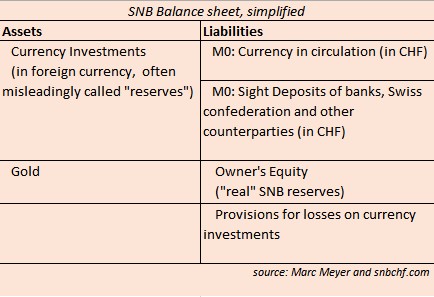

Sight deposits are currently the by far most important means of financing for SNB currency purchases, for interventions. Sight deposits are assets for commercial banks, the Swiss confederation and other counterparties that deposit money at the SNB, but for the SNB they are liabilities, debt.

Sight deposits are always denominated in CHF. The SNB finances itself with Swiss Francs. With a rising CHF the debt relative to assets gets bigger, because the assets lose their value. As consequence the central bank may lose its Owner’s Equity that may lead to a bankruptcy or a recapitalization by the Swiss state.

The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. With this weekly delivery it gives an far earlier indication of SNB interventions than the relatively late releases of balance sheet or IMF data.

The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. With this weekly delivery it gives an far earlier indication of SNB interventions than the relatively late releases of balance sheet or IMF data.

Currency in circulation (bank notes and coins) is the second financing method, it represents the typical “money printing” of central bank debt. Nowadays this “bank notes printing” is far less important than the electronic printing of debt called “sight deposits”. Printing is the popular word for unsterilised central bank interventions that – at least for monetarists – paves the way for price inflation.

Further definitions:

Sight Deposits of Swiss banks: They are part of M0, the monetary base:

With the money multiplier effect, money on Swiss banks have a higher influence on Swiss lending and inflation. Therefore the two categories are separated. For monetarists, a big rise in Swiss sight deposits would be a bigger issue than the increase of the second item, which is:

“Other Sight Deposits” of other counter-parties with an account at the SNB.

Inside the monetary data release these include loans from the Swiss confederation and federal authorities like the state pension fund (In German “AHV”). Other counter parties are also insurances, private pension funds, settlement agencies, investment companies, foreign banks, foreign central banks and institutions. These other sight deposits are not part of M0, because they are not able to “multiple money” with loans to the public (no money multiplier effect).

Since December, sight deposits above a certain threshold are “punished” with negative rates.

Weekly SNB Intervention Watch: Sight Deposits

| Date (+ link to source) |

avg. EUR/CHF during period | avg. EUR/USD during period | Events | NEW: Speculative CFTC Position CHF (vs. USD) | Delta sight deposits which is actually SNB intervention |

Total Sight Deposits | Sight Deposits @SNB from Swiss banks |

"Other Sight Deposits" @SNB from Non-Swiss cpties |

|---|---|---|---|---|---|---|---|---|

| September 07, 2015 | 1.0850 | 1.1157 | ECB threatens more QE | -8503x125k | 0 | 463.9 bln. | 395.0 bln. | 68.9 bln. |

| End August 2015 | 1.08 | 1.1250 | China crisis is negative for CHF and pos. for USD (see more) | -12597x125k | +3 bln. per month |

463.9 bln. | 396.0 bln. | 67.9 bln. |

| July 17, 2015 | 1.0426 | 1.0904 | Deal with Greece achieved | +3100x125k (CHF long) |

+0.8 bln. per week |

460.9 bln. | 396.8 bln. | 64 bln. |

| End June | 1.0400 | 1.1100 | Greek Referendum | +6900x125k | +3.4 bln. per month |

457.9 bln. | 391.1 bln. | 66.7 bln. |

| End May 2015 | 1.0405 | 1.1160 | Ascent of EUR/USD with rising German inflation | +8300x125k | +5.5 bln. per month |

454.5 bln. | 380.5 bln. | 73.5 bln. |

| End April 2015 | 1.03 | 1.09 | Weak US GDP let Euro and CHF rise. | +1300x125k | +6 bln. per month |

449 bln. | 384 bln. | 65 bln. |

| End March,2015 | 1.0602 | 1.0831 | Euro falls thanks to Greek and Draghi fool game (GR= 1.5% of EU GDP) | +706x125k | 0 | 443 bln. | 379.3 bln. | 64 bln. |

| End Feb, 2015 | 1.0617 | 1.1353 | Greeks continue fooling Germany | -5085x125k (CHF short) |

0 | 443 bln. | 383.6 bln. | 59.7 bln. |

| Jan 30, 2015 | 1.04 | 1.1340 | Greek crisis again: Run to safety continues | -7373x125k | 14.8 bln. | 443 bln. | 383.3 bln. | 59.7 bln. |

| Jan 23, 2015 | 0.99 | 1.1340 | First week after end of peg | -9809x125k | 26.2 bln. | 428.2 bln. | 365.5 bln. | 62.7 bln. |

| Jan 16,2015 | 0.9988 | 1.1578 | End of EUR/CHF peg | -26444x125k (before end peg) |

13.1 bln. | 402 bln. | 339.6 bln. | 62.4 bln. |

| Jan 9,2015 | 1.2009 | 1.18 | ECB QE Onset, Brent: 47$ | -24171x125k | 2.4 bln. | 388.9 bln. | 329 bln. | 59.7 bln. |

| End Dec,2014 | 1.2020 | 1.2099 | Rouble crisis, Brent: 54$ | -16545x125k | 16.5 bln. | 386.5 bln. | 327.7 bln. | 58.8 bln. |

| End Nov, 2014 | 1.2026 | 1.2436 | Gold referendum,Brent:69$ | -23424x125k | 3.6 bln. | 370.6 bln. | 319 bln. | 51.4 bln. |

| End Oct, 2014 | 1.2028 | 1.2525 | Brent: 84$ | -20283x125k | 0 | 367 bln. | 310 bln. | 56.4 bln. |

| End Sep, 2014 | 1.2115 | 1.2632 | Brent:91$ | -12557x125k | 0 | 368 bln. | 310 bln. | 58 bln. |

| August, 2014 | 1.2060 | 1.3128 | Brent: 101$ | -13039x125k | 0 | 367 bln. | 310 bln. | 57 bln. |

| July 2014 | 1.2150 | 1.2832 | ECB QE Talk taking effect on markets | -11764x125k | 0 | 368 bln. | 310 bln. | 58 bln. |

| June, 2014 | 1.2158 | 1.3596 | First ECB easing | -6813x125k (CHF spec.pos turns neg.) |

0 | 368 bln. | 301 bln. | 67 bln. |

| May, 2014 | 1.2192 | 1.3642 | +13703x125k | 0 | 367 bln. | 304 bln. | 63 bln. | |

| End Q1, 2014 | 1.2227 | 1.3703 | Ukraine crisis | +14819x125k | 0 | 368 bln. | 316 bln. | 52 bln. |

| End Q4, 2013 | 1.2303 | 1.3588 | US recovery despite gov. shut-down | +10889x125k | 0 | 364 bln. | 319 bln. | 45 bln. |

| Previous Record High | 1.2047 | 1.2927 | Nov2012:-3367x.. June2013:-28972x |

256 bln. CHF (2012/03 to 2013/12) | 373 bln. (Nov 2012) |

321 bln. (June 2013) |

||

| March 16, 2012 | 1.2040 | 1.3300 | Temporary low in sight deposits | -19812x125k | -4 bln. (SNB selling Euros) | 217 bln. | 159 bln. | 58 bln. |

| Dec, 2011 | 1.2040 | 1.2948 | Markets perceive higher floor thread | -10978x125k | -26 bln . (SNB selling Euros) | 221 bln. | 180 bln. | 41 bln. |

| Sept 16, 2011 (first record) | 1.2155 | 1.2940 | After establishment of 1.20 floor | +5400x125k (CHF long despite floor) |

58.4 bln. (sept 2011) | 247.4 bln. | 206 bln. | 42 bln. |

| August 2011 | 1.18 | 1.4379 | US Downgrade, ECB intervention | +9342x125k | 159 bln. (Aug 2011) | 189 bln. | 164 bln. | 25 bln. |

| July 2011 | 1.12 | 1.4396 | SNB absorbs liquidity with SNB bills | +7877x125k | -71 bln . (SNB sterilizes via SNB bills) | 30 bln. (Thirty) |

||

| May/June 2010 | 1.40 | 1.2306 | SNB abandons interventions | -12810x125k | 24 bln. | 101 bln. | ||

| May 02 2009 | 1.5164 | 1.41 | First high during fin. crisis | -4922x125k | 77 bln. | |||

| Remarks

Italic print: Recent data estimated based on SNB balance |

Italic print: Recent data estimated based on SNB balance |

Italic print: Recent data estimated based on SNB balance |

Full list of Swiss institutions with sight deposits |

Italic print: Recent data estimated based on SNB balance sheet of October 2014 |

Headlines and Comments

The following headlines are added each week. They reflect the movement in the table above.

September 7:

No change of sight deposits this week, hence no SNB intervention. The speculative position against CHF has fallen again, hence some traders are buying CHF. Strangely EUR/CHF continues its ascent on September 7, despite the ECB threat with more QE.

Week to August 29th:

Shortly before January 15th, 2015, the speculative position was at it highest. Remember that all such carry trades – a strong speculative position that counters real money, collapse one day. In our view, the carry trade should continue until EUR/CHF reaches 1.10 or 1.15. The carry trade could run 3 to 5 years, before it should collapse again to EUR/CHF 0.90. Time for the SNB to collect some dividends and coupons to avoid a bankruptcy.

July 15th to August, 15th: Sight deposits have risen by 2.5 bln. in the course of one month. But a big speculative position is building up against CHF. Sight deposits do not capture these movements because they are not portfolio investments for the balance of payments. They happen at FX brokers. But long-term investors still like Swiss stocks.

July 13th: Another 2.1 bln CHF of interventions, a deal with Greece is not yet achieved. Inflows mostly came from local banks They seem not to fear negative rates. This delta in sight deposits, is probably punished by negative rates. But the SNB seems to be convinced to keep EUR/CHF over 1.04, without considering that many exporters (like pharma and chemicals) take advantage of the stronger dollar.

July 6th: Surprisingly only a small intervention of 1.4 bln. CHF during the Greek referendum week. Reasons might be that the European recovery still avoids inflation. See more in the two phases of CHF appreciation.

June 29th: Greek referendum announced and talks on Greek ended. According to Forexlive.com, the SNB has intervened. For us, this must have been at the lower area of 1.0312 in Asian trade, but not at 1.04.

June: The pace of SNB intervention is slowing. Sight deposits rise by 0.5 billion francs per week.

April and May: Sight deposits rise by 1.5 billion CHF per week, hence the SNB seems to intervene with a pace of 1.5 billion francs weekly. Recently the SNB increased the loans with the Swiss confederation.

Between Feb 21 and April 3: No major change, no SNB interventions

The biweekly bigger IMF data release will contain infos about money supply, in particular M0, next issue is on May 14th.

The last one, the one for March, is the following: