The risks implied by the Fed’s tightening cycle and the new Chinese monetary regime, among other things, will favour funding currencies over carry currencies in the next twelve months. Instead of looking at single currencies, it is sometimes interesting to look at broader themes to have a better understanding of how a certain group of currencies might behave. Among the best-known themes or strategies are carry trades, which are based on the principle of systematically buying high-interest-rate currencies and selling low-interest-rate currencies. Carry trade strategies Carry trade strategies identify low-yielding currencies to sell to fund the purchase of high-yielding currencies. As a result, currencies with high interest rates tend to be called carry currencies whereas low-interest-rate currencies are usually labelled funding currencies. The performance in FX carry strategies comes from two distinct components: the spot or price return and the yield return, which stems from being long and short yielding assets. When investing in a carry trade strategy, investors are looking to maximise the yield return so that it would not be wiped out by unfavourable spot returns.

Topics:

Luc Luyet considers the following as important: Carry Trade, currencies, ECB, Macroview, SNB

This could be interesting, too:

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

investrends.ch writes Wechsel an der VR-Spitze von Julius Bär

investrends.ch writes WEF 2025: SNB schliesst Negativzinsen nicht aus

investrends.ch writes SNB mit Rekordgewinn – Bund und Kantone freuen sich

The risks implied by the Fed’s tightening cycle and the new Chinese monetary regime, among other things, will favour funding currencies over carry currencies in the next twelve months.

Instead of looking at single currencies, it is sometimes interesting to look at broader themes to have a better understanding of how a certain group of currencies might behave. Among the best-known themes or strategies are carry trades, which are based on the principle of systematically buying high-interest-rate currencies and selling low-interest-rate currencies.

Carry trade strategies

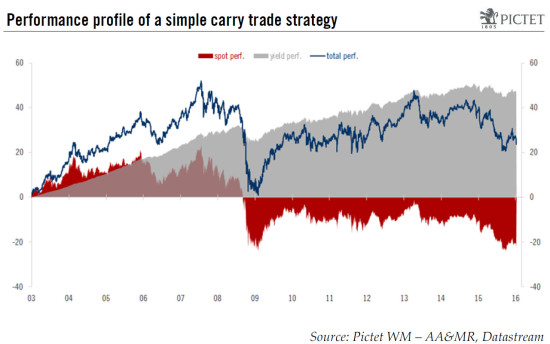

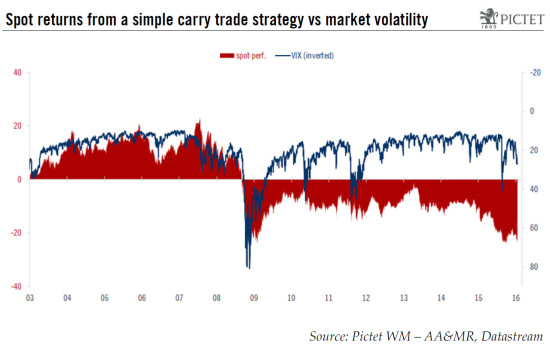

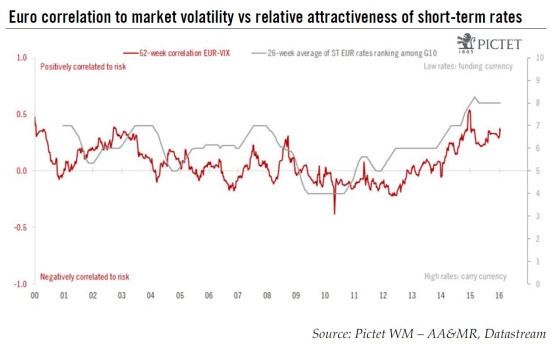

Carry trade strategies identify low-yielding currencies to sell to fund the purchase of high-yielding currencies. As a result, currencies with high interest rates tend to be called carry currencies whereas low-interest-rate currencies are usually labelled funding currencies. The performance in FX carry strategies comes from two distinct components: the spot or price return and the yield return, which stems from being long and short yielding assets. When investing in a carry trade strategy, investors are looking to maximise the yield return so that it would not be wiped out by unfavourable spot returns. Indeed, by creating a simple strategy among G10 currencies, based on buying the three currencies with the highest 3-month interest rates while selling the three currencies with the lowest 3-month interest rates and rebalancing the positions every three months, we can observe that the main driver of the performance stems from the rate differential, whereas the spot return can basically be considered as random (see chart above). In other words, for the carry trade strategy to be profitable, the volatility of the spot returns should be low so that it cannot completely erase the gains made from the positive yield differential. As a result, a low FX volatility environment increases the odds of a successful strategy. As FX volatility tends to be significantly correlated to market volatility (see chart above), investors should consider buying carry currencies in benign-risk-appetite environments. Overall, a risk-on environment tends to push investors towards riskier strategies, whereas investors tend to reduce their risky positions when risk aversion is high. As a result, a risk-on environment favours appreciation of high-yielding currencies and depreciation of low-yielding currencies, as carry trades are favoured. In contrast, high-yielding currencies tend to depreciate and low-yielding currencies tend to appreciate when the risk aversion pushes investors to unwind their risky positions (see chart below). The more leverage is involved, the more severe the unwinding will be. In other words, market volatility has a significant but different impact on carry currencies and funding currencies.

Funding currencies vs “safe haven” currencies

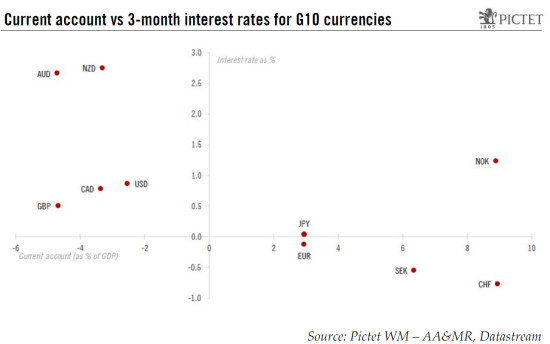

Funding currencies are not the only currencies to be favoured in times of heightened market volatility; indeed, “safe haven” currencies also appreciate when risk aversion is high. However, while the key features of funding currencies is their low interest rates, the key feature of “safe haven” currencies is being regarded as safe by investors in time of crisis. In other words, when risk aversion is high, funding currencies appreciate because carry trades are unwound by speculators, while “safe haven” currencies appreciate as investors want to place their money in a currency area considered as (relatively) safe. Thus, funding currencies tend to be always negatively correlated to risk appetite, whereas a “safe haven” currency should be negatively correlated to risk appetite only in times of crisis. Unfortunately, singling out “safe haven” currencies is not straightforward, as they are often used as funding currencies. Indeed, “safe haven” currencies tend to have low interest rates given their relative risk-free profile. On the other hand, funding currencies are not necessarily “safe haven currencies”, as low rates do not make a currency area “safe”. In that regard, indicators for the country’s risk and for the external sustainability, such as the net foreign assets position or the current account, need to be healthy. A relationship can be found between the current account and the level of interest rate, as the current account is the difference between savings and investments. A positive current account implies that savings are higher than investments, whereas a negative current account means that investments are higher than savings. In this latter case, the need for foreign savings favours higher interest rates to attract those external funds. With the exception of Norway, the data tend to confirm this link (see chart below).

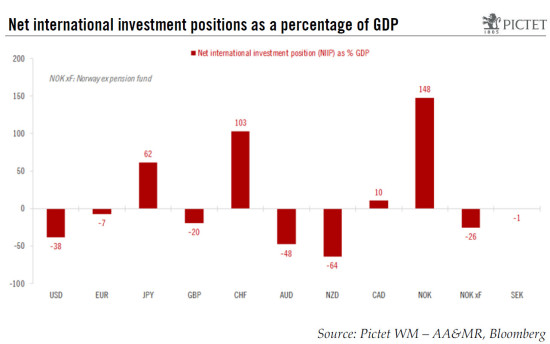

However, the constraint of positive net foreign assets (or a net international investment position) is a significant determinant of safe haven status and is more discriminant than the current account (see chart above). Through that lens, only Switzerland and Japan score well. By taking into account other factors like the public debt to GDP ratio and the liquidity of foreign exchange markets, the Swiss franc can clearly be labelled as a “safe haven” currency. Because of its massive public debt to GDP ratio, it is difficult to designate the Japanese market as “safe”. Finally, the US dollar does not score well in most of our criteria, but most of the world’s monetary systems have been tied to the US dollar. As a result, it is the world’s most liquid and most widely used currency and is almost universally accepted as a means of payment, which ultimately makes it very safe.

Significant threats to risk appetite in 2016

The level of interest rates enables us to identify the AUD and NZD as carry currencies and the EUR (see chart below), JPY, SEK and CHF as potential funding currencies. If we had a good idea of the risk profile in 2016, we could make a fairly sound guess as to which currency group will outperform the other. Unfortunately, to estimate risk appetite is just as difficult as, or even more difficult than, forecasting exchange rate movements. Still, the brand-new Fed tightening cycle after the 2004-2006 tightening cycle, the risks implied by the Chinese economy and its policy, the muted global growth outlook and the record high level of debt in emerging markets do not point to a strong and robust risk appetite. As a result, market volatility in 2016 should, overall, add support to funding currencies and weigh on carry currencies. However, the cautious Fed, the asset-buying programme in the euro area and in Japan, and the large FX reserves of the People’s Bank of China should prevent the expected bouts of market volatility from turning into a broader crisis, where investors will flee to safety. In that regard, the weak fundamentals of the Swiss franc should not be trumped by its “safe haven” status. Furthermore, the use of the Swiss franc as a funding currency is likely to continue to suffer from the aftermath of the SNB’s surprise change in monetary policy in January 2015. Similarly, the US dollar is unlikely to benefit much from its “safe haven” status. However, given its persistent appreciation and the Fed’s tightening cycle, it should remain supported by potential outflows from emerging markets. Indeed, since the 2008 financial crisis, companies in emerging markets have been borrowing USD and converting them into local currencies as part of a massive carry trade.

The Swedish krona is attractive

To sum up then, funding currencies should perform better than carry currencies. It is now interesting therefore to look at other factors to identify which funding currency looks more attractive. Divergence in monetary policies has been, and should remain, a key driver in FX performance. On that front, all funding currencies, except the US dollar, are being dragged down by the dovish monetary policies of their central banks. Indeed, given the low inflation outlook, driven in part by the low oil prices, the Bank of Japan and the European Central Bank (ECB) may have to add further monetary stimuli. Meanwhile, the Swiss National Bank and the Riksbank are expected to continue to link their monetary policies to those of the ECB. Long-term valuations also have an impact on currencies, especially when they reach extreme levels. The Japanese yen and the Swedish krona are extremely undervalued, at -27.0% and -25.5% against the US dollar respectively, according to the purchasing power parity based on consumer price inflation. On the other hand, the Swiss franc is significantly overvalued (+13.3%) against the greenback. As a result, taking valuation into consideration, the yen and the krona appear to be more attractive than the US dollar, the euro and the franc. Given that Sweden, with its growth outlook, seems more likely to generate sustained inflation pressures than Japan, the Swedish krona looks more attractive than the Japanese yen. Overall, the Swedish krona and the US dollar look like attractive funding currencies for 2016.