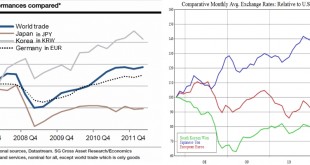

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.As opposed to the Swiss National Bank, the Japanese only talk, they do not fight. 2016 Japanese interventions thread Once the Fed finally reduced rate expections, the USD/JPY depreciated from 120 to 108 in a single quarter. (via Reuters and investing.com) Gains for stock markets and a warning of the chances of...

Read More »Blockchains in Banking (Commercial and Central)

The Economist reports about initiatives by commercial and central banks that aim at adopting the blockchain technology. For commercial banks, distributed ledgers promise various advantages—but they also cause problems: Instead of having to keep track of their assets in separate databases, as financial firms do now, they can share just one. Trades can be settled almost instantly, without the need for lots of intermediaries. As a result, less capital is tied up during a transaction, reducing...

Read More »SNB Foreign Currency Reserves

Rising. Source: SNB. The series “in EUR” is based on the author’s calculations. Note: The exchange rate floor vis-a-vis the Euro was in place from 6 September 2011 until 15 January 2015.

Read More »I Would Like to Withdraw A Couple Billion Swiss Francs: Legal Aspects

On his blog, Urs Birchler offers different perspectives on the question whether the Swiss National Bank (SNB) is obliged to pay out banks’ reserves in cash. One view: Reserves are legal tender. The SNB therefore is not obliged to exchange reserves against cash. Another view: According to the law, the SNB is required to provide sufficient cash. Moreover, reserves and cash were meant to be perfect substitutes. Yet another view: Lawmakers would have written a different law had they known that...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

First week of February: Speculators are closing down their short positions on the euro– both against the dollar and against CHF. The carry trade is breaking down into a reverse carry trade. This leads to a strengthening of the euro versus CHF. Given that US data was better than expected, the speculative USD against CHF position should further augment. It was at 4600 contracts versus CHF.No SNB interventions: Sight deposits decreased slightly by 0.2 billion CHF, this implies that the SNB is...

Read More »Latest SNB Intervention Update: Weekly Sight Deposits

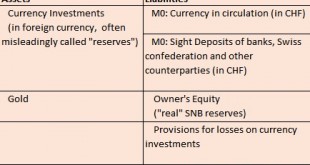

Overview: Sight deposits are currently the by far most important means of financing for SNB currency purchases, for interventions. Sight deposits are assets for commercial banks, the Swiss confederation and other counterparties that deposit money at the SNB, but for the SNB they are liabilities, debt.Sight deposits are always denominated in CHF. The SNB finances itself with Swiss Francs. With a rising CHF the debt relative to assets gets bigger, because the assets lose their value. As...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

We regularly publish the SNB asset structure by currency, rating & duration and the investment strategy. They shall be a template for the tactical asset allocation along these dimensions for other conservative asset managers – CHF holdings certainly excluded because the SNB nearly exclusively buys foreign assets. The SNB balance sheet looks as follows: In this post we will concentrate on the assets side, investment strategy and composition of “FX reserves”.See more on liabilities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org