CEPR Discussion Paper 13065, July 2018. PDF. (Personal copy.) I offer a macroeconomic perspective on the “Reserves for All” (RFA) proposal to let the general public use electronic central bank money. After distinguishing RFA from cryptocurrencies and relating the proposal to discussions about narrow banking and the abolition of cash I propose an equivalence result according to which a marginal substitution of outside for inside money does not affect macroeconomic outcomes. I identify key...

Read More »“Für elektronisches Zentralbankgeld (In Favor of Central Bank Digital Currency),” NZZ, 2018

NZZ, March 15, 2018. PDF. CBDC is not the same as krypto currencies. Easy arguments against CBDC are misleading. Switzerland should not dismiss CBDC too quickly. (The title of the article is misleading, it is not mine. I argued for openness in the discussion rather than for adoption.)

Read More »Desirable Features of Central Bank Issued Digital Currency

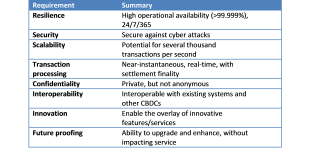

On bankunderground, Simon Scorer reminds us that a central bank issued digital currency (CBDC) need not operate on a distributed ledger platform. The two do not have much to do with each other. Scorer suggests a series of technical requirements for a CBDC: And he concludes that a distributed ledger does not meet all requirements. It’s unlikely that all of the above attributes could be perfectly met with today’s technology; you may need to make compromises between features – e.g. the...

Read More »“Kunden sollten zwischen Sichtguthaben und elektronischem Notenbankgeld wählen können (Let People Choose Between Deposits and Reserves),” NZZ, 2017

NZZ, August 17, 2017. HTML, PDF. The Vollgeld initiative may point to a problem but it does not propose a viable solution. Even with Vollgeld, the time consistency friction with its Too-Big-To-Fail implication would persist. A more flexible, liberal approach appears more promising. It would give the general public a choice between holding deposits and reserves. Financial institutions and central banks around the world are pushing in that direction.

Read More »RTGS Open To Non-Bank Payment Service Providers

The Bank of England has announced plans to open its central-bank-money settlement system (RTGS) to non-bank payment service providers. This, it hopes, will promote competition, innovation, and financial stability by creating more diverse payment arrangements.

Read More »A Right to Electronic Central Bank Money?

On his blog, Tony Yates raises the question whether the general public has a right to use central bank issued electronic money? Because of inclusion considerations? Or because providing cash and reserves is a central government function?

Read More »“Die Vollgeld-Initiative und eine Alternative (The Swiss Sovereign Money Initiative, and an Alternative),” SNB, 2017

In: Thomas Moser, Carlos Lenz, Marcel Savioz and Dirk Niepelt, editorial committee, Monetary Economic Issues Today, Festschrift in Honour of Ernst Baltensperger, Swiss National Bank/Orell Füssli, Zürich, June 2017. PDF of draft. The sovereign money initiative (Vollgeldinitiative) seeks to gain greater control over the money and credit supply, to increase financial stability and to achieve a fairer distribution of seigniorage income. The initiative’s suggested approach – a ban on active...

Read More »Fintech Regulation in Switzerland: Open Questions

In the NZZ, Jürg Müller reports about the developing regulatory framework for fintechs in Switzerland. A proposal by the federal finance department drew—reasonable—criticism by various lobbies and industry associations, including the CFA Society Switzerland. Die CFA Society Switzerland will das systemrelevante Bankensystem von anderen Finanzdienstleistern trennen. Dafür sei eine präzisere Bankendefinition nötig, als sie heute vorgenommen werde. Nur Banken sollen demnach dem Bankengesetz...

Read More »Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

Headlines Week April 03, 2017 We were arguing in the previous months, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. The tendency of point 3 had been interrupted when the ECB appeared to be less dovish. FX Last week:...

Read More »Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

Headlines Week March 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Llst weeks: The EUR/CHF suddenly appreciated with the ECB...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org