Headlines Week November, 25 2016 We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts – i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up U.S. wages. According to Lars Christensen Trumpeconomics is also about monetary stimulus: Trump...

Read More »Weekly Sight Deposits: Investors hedge against Trump’s inflationary policy with Swiss Franc.

Headlines Week November 18, 2016 We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts – i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up wages. According to Lars Christensen Trumpeconomics is also about monetary stimulus: Trump would...

Read More »SNB Sight Deposits November 7: No interventions, EUR/CHF under 1.08 with political jitters

Headlines Week November 04, 2016: No interventions, EUR/CHF under 1.08 with political jitters Sight Deposits: show that the SNB has not intervened to sustain the euro, that dipped under EUR/CHF 1.08. We considered the 1.08 as line in sand for the SNB. FX: The odds of Trump are rising. This causes fear and demand for Swiss Franc. The EUR/CHF fell to 1.0750. Euro/Swiss Franc FX Cross Rate, November 07(see more posts...

Read More »How Does the Blockchain Transform Central Banking?

The blockchain technology opens up new possibilities for financial market participants. It allows to get rid of middle men and thus, to save cost, speed up clearing and settlement (possibly lowering capital requirements), protect privacy, avoid operational risks and improve the bargaining position of customers. Internet based technologies have rendered it cheap to collect information and to network. This lies at the foundation of business models in the “sharing economy.” It also lets...

Read More »Banking on the Blockchain

In the NZZ, Axel Lehmann offers his views on the prospects of blockchain technologies in banking. Lehmann is Group Chief Operating Officer of UBS Group AG. New possibilities: Higher efficiency; lower cost; more robustness and simpler processes; real-time clearing; no need for intermediaries; information exchange without risk of interference automated “smart contracts;” automated wealth management; more control over transactions; better data protection; improved possibilities for macro...

Read More »Should the Fed Reduce the Size of its Balance Sheet?

On his blog, Ben Bernanke discusses the merits of the Fed’s strategy to slowly reduce the size of its balance sheet to pre crisis levels. Bernanke suggests that this strategy should be reconsidered: First, the large balance sheet provides lots of safe and liquid assets for financial markets. This might strengthen financial stability. (DN: In my view, there are also reasons to expect the opposite.) Second, a larger balance sheet can help improve the workings of the monetary transmission...

Read More »Reserves For Everyone

On a new website, Aleksander Berentsen rejects the Swiss Vollgeld initiative. As an alternative, he suggests the Swiss National Bank should offer transaction accounts for everybody, in line with proposals I have made earlier (see here (2016), here (2015), here (2015)). In the Handelszeitung (here and here), Simon Schmid reports.

Read More »Swiss Sovereign Money Initiative: Reserves For Everyone

On a new website, Aleksander Berentsen rejects the Swiss Vollgeld initiative. As an alternative, he suggests the Swiss National Bank should offer transaction accounts for everybody, in line with proposals I have made earlier (see here (2016), here (2015), here (2015)). In the Handelszeitung (here and here), Simon Schmid reports....

Read More »“Elektronisches Notenbankgeld ja, Vollgeld nein (Reserves for All, But no Sovereign Money),” NZZ, 2016

Neue Zürcher Zeitung, June 16, 2016. PDF, HTML. Ökonomenstimme, June 17, 2016. HTML. Vollgeld seems attractive because it decouples the supply of money from intermediation. By enabling everyone to use legal tender for electronic payments, electronic base money would satisfy a need. Vollgeld would prevent bank runs, at least partly; render deposit insurance unnecessary and reduce moral hazard; could help stabilize the credit cycle; and would redistribute seignorage to the central bank. But...

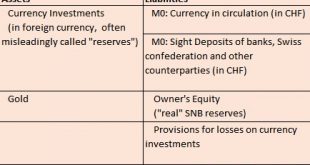

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

The Q1/2016 update on the SNB investment strategy and its assets. The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.The SNB balance sheet looks as follows: In this post we will...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org