Swiss Franc The Euro has fallen by 0.08% at 1.1372 EUR/CHF and USD/CHF, May 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Contrary to hopes and expectations, the US made good on the presidential tweet and raised the tariff on around 0 bln of Chinese goods from 10% to 25%. Trump indicated that the process that will levy a 25% tariff on the remaining Chinese imports has begun. Also contrary to expectations, Chinese officials did not detail their response, though it is expected to be forthcoming. However, as we noted, this is not always how China plays its hand. Sometimes, it skips the American-style big announcement and simply takes action, as it has with

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Featured, Germany Trade Balance, newsletter, RBA, SPX, trade, U.K. Gross Domestic Product (QoQ), U.K. industrial production, U.S. Consumer Price index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

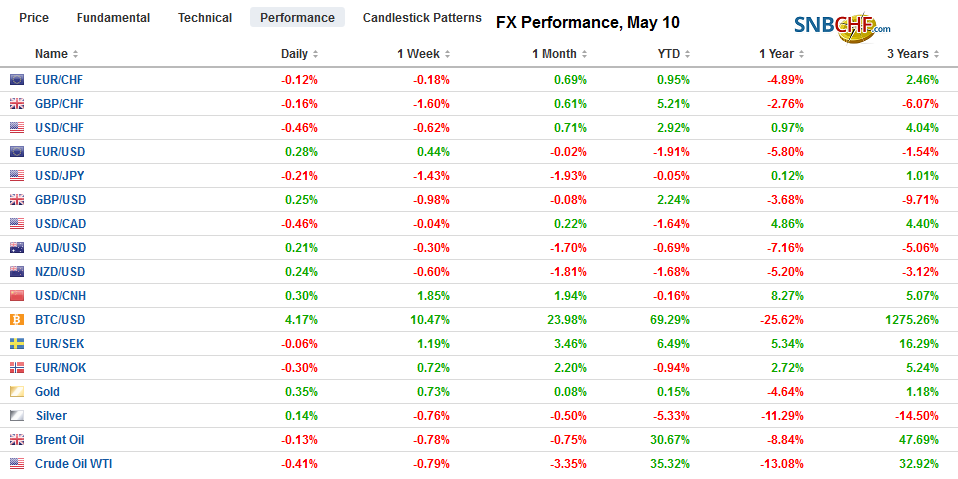

Swiss FrancThe Euro has fallen by 0.08% at 1.1372 |

EUR/CHF and USD/CHF, May 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Contrary to hopes and expectations, the US made good on the presidential tweet and raised the tariff on around $200 bln of Chinese goods from 10% to 25%. Trump indicated that the process that will levy a 25% tariff on the remaining Chinese imports has begun. Also contrary to expectations, Chinese officials did not detail their response, though it is expected to be forthcoming. However, as we noted, this is not always how China plays its hand. Sometimes, it skips the American-style big announcement and simply takes action, as it has with Canada recently and Japan in the past, for example. Meanwhile, state fund buying of Chinese shares appears to have sparked the reversal higher of Chinese stocks, and the recovery has carried into Europe as well. This week’s steep losses are being pared. Bond yields are softer in Europe, while the US 10-year yield, which briefly dipped below the three-month bill yield for the first time since March, is little changed at 2.44%, off seven basis points on the week. The three-month bill yield is 2.41%. The US dollar is mostly softer, though the yen and sterling are a little heavy. Most emerging market currencies, including the battered Turkish lira, are finishing the week on a firmer tone. |

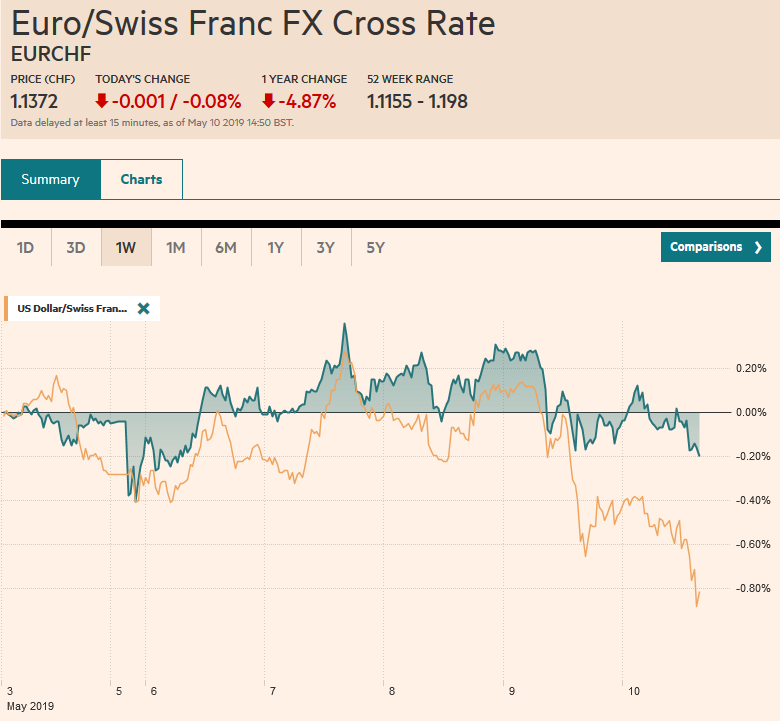

FX Performance, May 10 |

Asia Pacific

The US-China trade talks resume today. The general indication is that there is not much progress that can be accomplished at this level of negotiations and the head of both countries is needed to break the impasse. Many observers argue that the approach of past US administrations has not brought China to heel and therefore the tariff war is the only alternative. We find this to be a false dilemma and have long argued that a multilateral approach boosts the chance for success. There is also a sense that even if China were to adopt all the policies the US wants, the rivalry would only intensify.

Defying economic logic, Japan reported both weaker than expected cash wages and stronger than expected consumption. Labor cash earnings fell 1.9% year-over-year in March. Economists surveyed by Bloomberg expected a 0.5% decline (median) after a revised 0.7% decline in February (initially -0.8%). It is the third consecutive decline and is the biggest drop in a decade. On the other hand, household spending accelerated to 2.1% from 1.7% (year-over-year). Economists had projected slow consumption. It was the strongest gain since last August. While some increase in consumption is possible ahead of the sales tax increase (October), it seems a bit early to look for it.

In the monetary policy statement, the Reserve Bank of Australia slashed growth forecasts (to 1.75% in the year to June from 2.5%). However, its reluctance to cut rates may be linked to its view that the economy will re-accelerate. It reduced its outlook for consumption and investment but continues to count on the robust labor market for the economic resilience it continues to project. Meanwhile, in an unusual move, at least a couple of Australian banks have pressed forward and announced cuts in mortgage rates. The RBA meets next on June 4, but the derivatives markets suggest better prospects for a cut at the July 2 meeting.

Today is the first time this week that the dollar is holding above the previous session’s low against the yen. It has yet to rise above the previous session’s high this week. Yesterday’s range was roughly JPY109.50 to JPY110.10. There are two expiring options that in play: JPY109.75 for about $475 mln and JPY110.00 for around $525 mln. A higher close today would snap a five-day dollar slide. The Australian dollar has traded in a 20-tick range on either side of $0.7000. If it is unable to close above the high already recorded, it will be the fourth consecutive weekly losses for the Aussie. The greenback fell less than 0.2% against the Chinese yuan today, but it was sufficient to end its six-day rally. The dollar rose about 1.2% against the yuan this week, the most since last June.

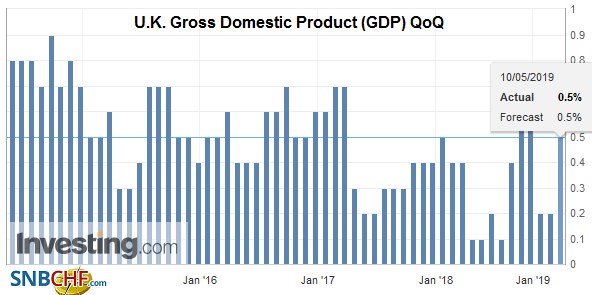

EuropeThe UK reported growth accelerated in Q1 to 0.5% from a 0.2% pace in Q4 18 even as the economy stagnated in March. Consumption (+0.7% quarter-over-quarter up from 0.3% in Q4) and gross fixed capital formation (2.1% vs. -0.6%) were the drivers. |

U.K. Gross Domestic Product (GDP) QoQ, Q1 2019(see more posts on U.K. Gross Domestic Product (QoQ), ) Source: investing.com - Click to enlarge |

| Imports surged as companies and households took precautionary measures ahead Brexit. The softness of March monthly data warns of the lack of momentum coming into Q2. Some April employment data will be released next week, but Brexit continues to command the focus. |

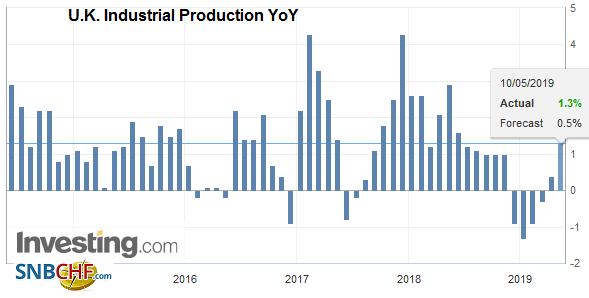

U.K. Industrial Production YoY, March 2019(see more posts on U.K. Industrial Production YoY, ) Source: investing.com - Click to enlarge |

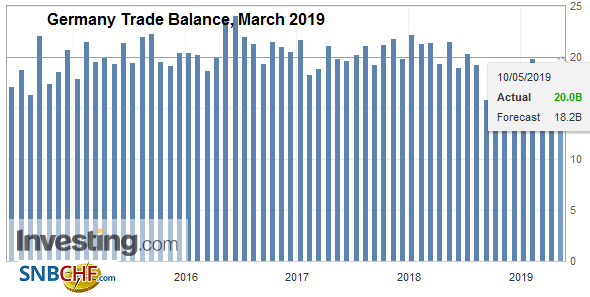

| Germany will report Q1 GDP next week and today’s trade figures will fuel some optimism despite the weakness in survey data. Many observers may complain about Germany’s large trade surplus, but the unexpected increase in March exports will likely be seen as a constructive development. Exports jumped 1.5% on the month. The median guestimate in the Bloomberg survey was for a decline of 0.4% after a 1.2% decline in February. German imports rose 0.4%, in line with expectations. Imports fell by 1.6% in February. France reported March industrial production figures (-0.9% driven by a 1.0% drop in manufacturing output), as did Italy (0.9% drop in March industrial output) alongside retail sales (-0.3% vs. forecasts for a 0.1% gain). However, with Q1 GDP already reported and being halfway through Q2, the data was of fleeting interest. |

Germany Trade Balance, March 2019(see more posts on Germany Trade Balance, ) Source: investing.com - Click to enlarge |

The euro closed above its 20-day moving average yesterday for the first time since April 22 and reach a six-day high near $1.1250. Of the last 11 sessions beginning with the stronger than expected US Q1 GDP on April 26, the euro has risen in eight, if today’s gains are sustained. Today could be the first session since April 22 that the euro has remained above $1.12. Sterling is struggling to sustain upticks and is hovering around $1.30. It is off roughly 1.2% for the week, its largest loss since the end of March. There is a GBP225 mln option at $1.30 that will be cut today, which may hold some interest. A softer US dollar could see sterling test the $1.3040 area, but there is little enthusiasm.

United States

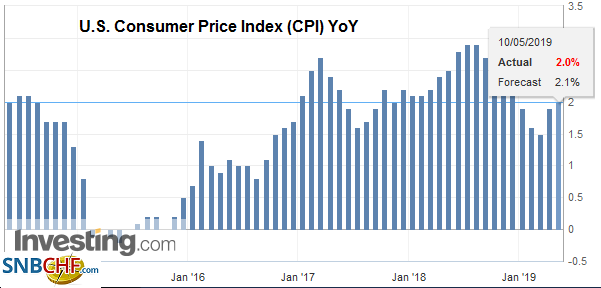

While the trade talks resume, the US reports April CPI. Both the headline and core rates are expected to tick up to 2.1%. The response is likely to be stronger on a downside miss than an upside surprise. Powell and some other Fed officials have indicated that the recent softness in inflation was transitory. Recall that the headline rate had risen to 2.9% last summer before falling to 1.5%-1.6% at the start of the year. The issue here is not the secular decline but the recent softness. The other important point is that despite the repeated claims to the contrary, the Federal Reserve’s inflation target of 2% applies to the headline PCE deflator and not the core rate. |

U.S. Consumer Price Index (CPI) YoY, April 2019(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

Canada reports April employment data. Canada lost jobs in March (-7.2k) for the first time in seven months but is forecast to have grown around 11.5k jobs in April. The market often seems to respond to the headline more than the mix between full and part-time positions. The hourly wage rate for permanent workers is also reported. It had bottomed at the end last year below 1.5%. In March it was 2.3%, and it is expected to have maintained that pace in April. Mexico reports March industrial production and manufacturing data. It is expected to be soft, but with prices still firm, the central bank is unlikely to cut rates at next week’s meeting.

The US dollar briefly poked above CAD1.35 yesterday, but it quickly returned into the CAD1.34-CAD1.35 range that has dominated recently. Initial support is seen near CAD1.3430, but the range is likely to be respected. The US dollar spiked above MXN19.30 for the first time in a month. The first level of support is pegged around MXN19.15 and then MXN19.10. Levered accounts have done well in Mexican cetes (bills) and are unlikely to give up that cash register, making them buyers of peso into weakness. We note that the S&P 500 came close to filling the gap created by the higher opening on April 1, which underpinned out technical bullish outlook. Before the gap was closed, the S&P 500 recovered to fill the gap that was created by yesterday’s sharply lower opening. Today’s performance will shape next week’s technical tone. A close above 2880 would be constructive and above 2900 would likely embolden those who fear missing out.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Featured,Germany Trade Balance,newsletter,RBA,SPX,Trade,U.K. Gross Domestic Product (QoQ),U.K. Industrial Production,U.S. Consumer Price Index