Politicians have destroyed more than 13 million jobs this year in a deluge of edicts aimed to fight the covid-19 pandemic. More than two hundred thousand Americans still died from the coronavirus, but the anticovid government crackdowns probably did far more damage than the virus. The covid crisis has also shown how easy it is for politicians to fan fears to seize nearly absolute power. In March, Donald Trump proclaimed that “we are at war with an invisible enemy.”...

Read More »FX Daily, October 15: Markets Shake and Dollar Goes Bid

Swiss Franc The Euro has stable by 0.00% to 1.0733 EUR/CHF and USD/CHF, October 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A combination of the surging virus, threatening the slow recovery that was already losing momentum, the lack of new stimulus in the US, and market positioning is seeing risk unwind in a big way today. Equities are selling off. Led by a 2% drop in Hong Kong, Asia Pacific equities...

Read More »Swiss Producer and Import Price Index in September 2020: -3.1 percent YoY, +0.1 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »Coronavirus: record number of new cases reported in Switzerland

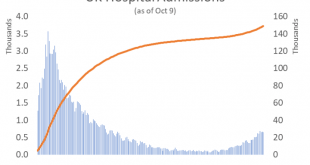

© Xantana | Dreamstime.com On 14 October 2020, the Federal Office of Public Health (FOPH) reported 2,823 new cases of SARS-CoV-2 infection over 24 hours, a record number. In addition, FOPH reported 57 new Covid-19 hospital admissions and a further 8 deaths. When the FOPH receives test data it assigns each reported positive test to the day when the test was conducted. Because of reporting delays, most positive cases reported on any given day will be allocated to days...

Read More »Swiss government expects 2020 GDP to shrink less than feared

Parts of the Swiss economy that depend on global demand, such as international tourism, still face a tough time Keystone Swiss economic output will shrink by 3.8% this year, a less bad coronavirus-triggered slump than previously expected, the State Secretariat for Economic Affairs (SECO) said on Monday. The latest SECO forecast was an improvement from its June outlook, when it said it expected Swiss gross domestic product (GDP) would fall by 6.2% this year, the worst...

Read More »Covid and the Escalation of Medical Tyranny

Covid has exposed how easy it is for government to weaponize healthcare. How long will the doctor-patient relationship remain sacred? This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack. Original Article: “Covid and the Escalation of Medical Tyranny“. You Might Also Like A Review of Stephanie Kelton’s The Deficit Myth The good news is that Stephanie Kelton has...

Read More »Dollar Bounce Remains Modest as Headwinds Build

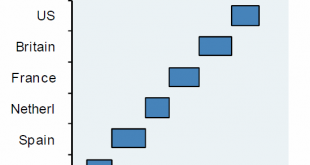

The dollar is making a modest comeback; stimulus talks have hit a dead end; we get more US inflation readings for September Brexit talks continue ahead of the EU summit Thursday and Friday; a new bill by the UK government could change the investment landscape in the country The EU recovery fund has hit some speed bumps; the Netherlands is the latest country to impose stricter measures; eurozone IP came in slightly lower than expected China reported strong money and...

Read More »Precious Metals Nowhere Near Cycle Highs – Brace for Gains!

In today’s video GoldCore’s Mark O’Byrne is interviewed by the Wealth Research Group, discussing the start of a new bull run for gold and silver and what we can expect. Some of the areas Mark touches on today include… What investors are currently buying The importance of owning physical gold Comparing golds performance with previous highs Investors motivations for purchasing gold What people are fearing; the size of the national debt, inflation or deflation?...

Read More »FX Daily, October 14: UK Blinks on Threat to Walk Away on Eve of EU Summit

Swiss Franc The Euro has fallen by 0.15% to 1.0729 EUR/CHF and USD/CHF, October 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Turn around Tuesday saw the dollar bounce, particularly against the Australian dollar and European currencies, among the majors. Sterling pared earlier losses on reports that the UK would not walk away from the talks just yet, while the euro remains on its back foot. Emerging market...

Read More »Techonology firm Ruag International to cut more jobs

Ruag has numerous production sites across Switzerland, notably a plant at Emmen near Lucerne that produces elements for space rockets. Keystone/Urs Flüeler The Swiss aerospace and armament company, Ruag, says it will shed up to 150 jobs by the end of next year due to the coronavirus crisis. A 30% drop in sales of aircraft structures over the past seven months and the restructuring of the company are the main reason for the job cuts notably in IT, finance and human...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org