Given the overt hostility that progressives have toward private enterprise in the first place, politicians will take shutdown-caused shortages and empty shelves as “proof” that private enterprise has failed. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack. Original Article: “The Second Act Will Be Worse Than the First: Lockdowns Are Not the Answer“. You Might Also Like...

Read More »Dollar Bleeding Stanched as Markets Search for Direction

Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today UK jobs data came in decidedly downbeat even though the furlough scheme has not yet ended; BOE Governor Bailey said that the bank is not yet ready to implement negative rates Japan will...

Read More »Why These Gold Standardites Are Wrong, 13 October

On Friday, the price of silver went up from $24.25 to $25.20, or +4%. Let’s look at the graph of the price and basis (i.e. abundance) action. For the first part of the day, the action is from speculators, for the most part. Then around the time that the US west coast comes online, we see a continued rise in price but a drop in basis back to where we started. Folks, this is what buying of physical metal looks like: prices rises by about 30 cents accompanied by a drop...

Read More »Third Year of Blogging – The Poor Swiss is 3 years old!

(Disclosure: Some of the links below may be affiliate links) The Poor Swiss blog just turned three years old. It is difficult to believe it has already been three years since I started this blog. I have done a lot of things on this blog in the last year. Some of these things paid off. Some did not. But I think the blog is in a much better place right now than one year ago, which is always a good sign. I hope you agree with me! This article is a retrospective of this...

Read More »FX Daily, October 13: Markets Look for Fresh Incentives

Swiss Franc The Euro has fallen by 0.08% to 1.073 EUR/CHF and USD/CHF, October 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 and NASDAQ gapped higher for the third consecutive session and continued to advance. The benchmarks reached their best level since early September. Hong Kong markets were closed due to a storm, but the MSCI Asia Pacific gained for the seventh consecutive session. Most...

Read More »Forecast: 2020 economic slump less serious than feared

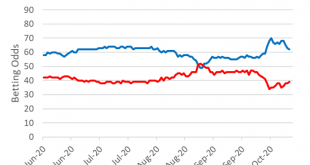

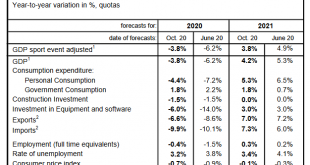

The Expert Group is expecting GDP adjusted for sporting events to fall by 3.8 % in 2020 and unemployment to average 3.2 % over the year as a whole. Prospects for 2020 are therefore less negative than feared in the middle of the year. The momentum is likely to weaken as time goes on. Due to the relaxation of the health policy measures, the Swiss economy started to swiftly make up lost ground at the end of April, with both consumerand investment demandex-ceeding...

Read More »Our Simulacrum Economy

In the hyper-real casino, everyone has access to the terrors of losing, but only a few know the joys of the rigged games that guarantee a few big winners by design. Readers once routinely chastised me for over-using simulacrum to describe our economy and society. The problem is this word perfectly describes the hollowed-out, rigged economy and social order we inhabit and so synonyms don’t quite cut it: it’s not the same as simulation or imitation or counterfeit. My...

Read More »Swiss National Bank intervenes heavily to weaken Swiss franc

© Michael Müller | Dreamstime.com Official data recently released by the Swiss National Bank (SNB) show it sold 51.5 billion Swiss francs while acquiring US dollar and euro-denominated assets in a bid to weaken the franc over the first quarter of 2020. The data followed comments by SNB President Thomas Jordan signalling that even larger interventions may be on the cards in the future. Switzerland’s long-running battle with its overvalued currency has drawn criticism...

Read More »Coronavirus: more than 4,000 new cases over 3 days in Switzerland

© Patrik Slezák | Dreamstime.com On 12 October 2020, the Federal Office of Public Health (FOPH) reported 4,068 new cases of SARS-CoV-2 infection over 72 hours. The latest 3-day infection figure is 2.6 times the number over the same period a week ago. Switzerland’s 7-day rolling average daily new infection number has jumped from 469 to 1,215 in a week. In addition, the rate of positivity – the percentage of tests coming back positive – continues to rise. The latest...

Read More »The NRA Would Be Wise to Leave New York ASAP

The NRA would be wise to vote with its feet. Millions of Americans have already escaped the high taxes and freedom-destroying blue state regimes by doing the same. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack. Original Article: “The NRA Would Be Wise to Leave New York ASAP“. You Might Also Like Money-Supply Growth Hits New High For Third Month In a Row In...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org