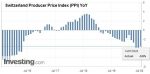

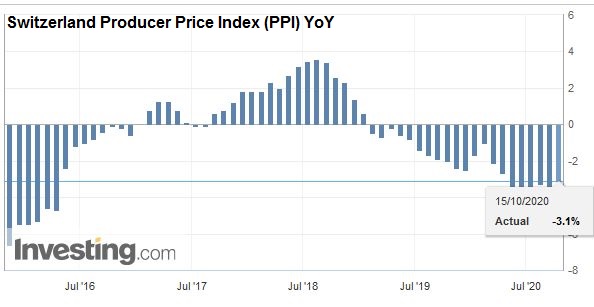

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued? 15.10.2020 – The Producer and Import Price Index rose in September 2020 by 0.1% compared with the previous month, reaching 98.0 points

Topics:

George Dorgan considers the following as important: 2) Swiss and European Macro, 2.) Swiss Statistics - Press Releases, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued?

| 15.10.2020 – The Producer and Import Price Index rose in September 2020 by 0.1% compared with the previous month, reaching 98.0 points (December 2015 = 100). The rise is due in particular to higher prices for scrap as well as for basic metals and semi-finished metal products. Compared with September 2019, the price level of the whole range of domestic and imported products fell by 3.1%. These are the results of the Federal Statistical Office (FSO).

In particular, higher prices for scrap were responsible for the increase in the producer price index compared with the previous month. Raw milk and fresh vegetables also became more expensive. The import price index registered lower prices compared with August 2020, particularly for petroleum and natural gas. Prices also fell for diesel, leather and travel goods, heating oil and passenger cars. In contrast, higher prices were observed for non-ferrous metals and products made therefrom, gasoline and wearing apparel. |

Switzerland Producer Price Index (PPI) YoY, September 2020(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge |

Download press release: Producer and Import Price Index increased by 0.1% in September 2020

Tags: Featured,newsletter