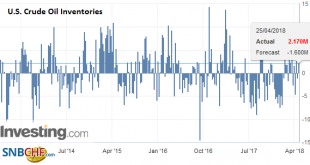

Oil prices have recovered more than 50% of the decline since the mid-September peak. The next retracement objectives are found near $82 a barrel for Brent and $76.5 for WTI basis the continuation futures contract. The immediate consideration is that supplies have tightened. OPEC compliance to its agreement has exceeded targets, and Venezuelan output has been halved over the past two years to levels not seen in a more...

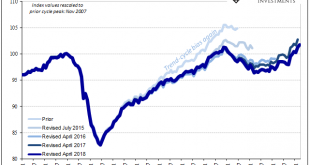

Read More »Why The Last One Still Matters (IP Revisions)

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

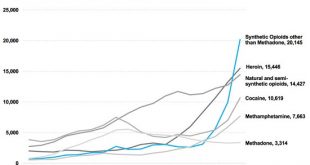

Read More »Our Strange Attraction to Self-Destructive Behaviors, Choices and Incentives

Self-destruction isn’t a bug, it’s a feature of our socio-economic system. The gravitational pull of self-destructive behaviors, choices and incentives is scale-invariant, meaning that we can discern the strange attraction to self-destruction in the entire scale of human experience, from individuals to families to groups to entire societies. The proliferation of self-destructive behaviors, choices and incentives in our...

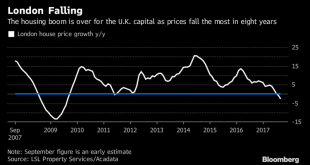

Read More »London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– London house prices fell by 3.2% in the first quarter – Halifax – Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or...

Read More »Getting High on Bubbles

Turn on, Tune in, Drop out Back in the drug-soaked, if not halcyon, days known at the sexual and drug revolution—the 1960’s—many people were on a quest for the “perfect trip”, and the “perfect hit of acid” (the drug lysergic acid diethylamide, LSD). Dr. Albert Hoffman and his famous bicycle ride through Basel after he ingested a few drops of LSD-25 by mistake. The photograph in the middle was taken at the Woodstock...

Read More »Swiss Trade Balance Q1 2018: The positive trend continues

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Swiss finance minister sees ‘clearly improved’ ties with US

G20 finance ministers and central bank governors attending the 2018 World Bank Group/IMF Spring Meetings in Washington on April 20, 2018 (Keystone) - Click to enlarge Relations between Switzerland and the United States have improved under the Trump administration, Finance Minister Ueli Maurer told Swiss public radio, SRF, on Saturday. Maurer is heading a Swiss delegationexternal link, together with Economics...

Read More »Great Graphic: Aussie Tests Trendline

It is not that the Australian dollar is the weakest currency this month. Its 0.4% decline puts it among the better performers against the US dollar. However, it has fallen to a new low for the year today. The losses have carried to a trendline drawn off of the early 2016 low near $0.6800. The trendline has been drawn on this Great Graphic composed on Bloomberg. It is found today near $0.7625 and rises by about seven...

Read More »Emerging Market Preview: Week Ahead

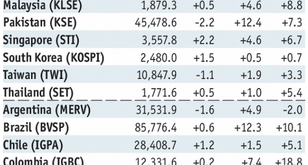

Stock Markets EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous. Stock Markets Emerging Markets, April 18 - Click to enlarge...

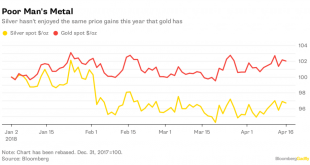

Read More »Silver Bullion Remains Good Value On Positive Supply And Demand Factors

– Silver bullion remains good value on positive supply and demand factors– Industrial demand set to continue to climb from 2017, into 2018 and beyond– Speculators are bearish on silver as net short positions in silver futures reach record– Investment demand sees silver ETF holdings at eight-month high of 665.4 million ozs– 2017 saw fifth consecutive annual physical deficit in scrap silver, of 26 moz– Global silver mine...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org