The cantons of Neuchâtel (14.7%) and Geneva (14.6%) have the highest percentages of taxpayers owing money, according to the newspaper SonntagsBlick. © Siriporn Kaenseeya | Dreamstime.com - Click to enlarge Fribourg (12.6%), Bern (9.5%) and Luzern (6.5%) complete the top-five. Vaud (5.9%), Basel-City (5.5%) and Zurich (2.4%) are further down. Aargau (2.0%) and Uri (1.0%) sit at the bottom with fewest with oustanding tax...

Read More »The Science of Japanification

The term itself gives it away. They called it quantitative easing for a specific reason. Both words mean to convey substantial concepts. The first part, quantitative, was used because it sounds deliberate, even scientific. It implies a program where great care and study was employed to come up with the exact right amount. It’s downright formulaic, where you intend that by doing X you can predictably create Y. The...

Read More »‘New buyer found’ for ailing Monetas blockchain firm

Monetas founder Johann Gevers told investors he has found a replacement buying after an earlier deal fell through. (Nik Hunger) - Click to enlarge Troubled Swiss blockchain payments firm Monetas has found a new mystery buyer to pull it out of the mire, swissinfo.ch has learned. The company has run into major problems in the last few months, including enforced bankruptcy proceedings and the acrimonious...

Read More »SNB loses 6.8 billion in Q1/2018

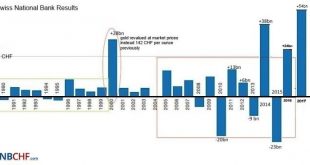

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »Switzerland spent CHF 11.4 billion on environmental protection in 2016

Neuchâtel, 26 April 2018 (FSO) – In 2016, 11.4 billion francs were spent on the environment, equivalent to 1.7% of gross domestic product (GDP). Since 2008, environmental expenditure has increased by 5%. Two thirds were spent on wastewater and waste management. Overall, expenditure in these two areas decreased by 5%, while it increased by 34% in the other environmental sectors. These initial estimates are based on the...

Read More »Swiss travel and watch firms named best places to work

Swiss International Air Lines has been ranked as the most attractive employer in a survey on the 150 largest companies in Switzerland. Zurich Airport came in second, followed by watchmaker Patek Philippe. The survey, published by Dutch recruitment agency Randstadexternal link on Thursday, asked 4,800 people aged 18-65 where they would like to work. The study took 16 criteria into account, including work environment,...

Read More »FX Daily, April 27: Dollar Puts Finishing Touches on Best Week Since November 2016

Swiss Franc The Euro has fallen by 0.08% to 1.1958 CHF. EUR/CHF and USD/CHF, April 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s recent gains have been extended, and it is having one of its best weeks since November 2016. The Dollar Index is up 1.7% for the week, as US session is about to start. Though it took this week’s gains to change market’s...

Read More »Bi-Weekly Economic Review: Interest Rates Make Their Move

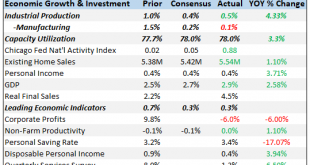

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears. The economic news over the last two weeks does not appear to...

Read More »From Fake Boom to Real Bust

Paradise in LA LA Land More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf. Normally, judgment would be passed on a Thursday, but we are making an exception. - Click to enlarge For example, here in the land of...

Read More »SNB reports a profit of CHF 47.6 billion for Q1 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org