At the end of every quarter, the IMF publishes the most authoritative reserve data with a three-month lag. On Good Friday, the IMF published Q4 17 reserve holdings. A recent article on Bloomberg played up an economist’s forecast that euro reserves would increase by $500 bln over the next couple of years. A review of the reserve data may help us evaluate such a claim, which if true, could have important implications for...

Read More »The important role of official statistics in a world of fact, fiction and everything in between

- Click to enlarge Neuchâtel, 4 April 2018 (FSO) – Facts provide the foundation for political and social dialogue. But what happens when instead of facts, purposely spread untruths begin to dominate that dialogue? And what can be done about it, or better still, what can be done to stop it? Possible answers can be found at the conference entitled “Truth in numbers – the role of data in a world of fact, fiction and...

Read More »FX Daily, April 10: XI’s Day, but Not So Good for Putin

Swiss Franc The Euro has risen by 0.25% to 1.1807 CHF. EUR/CHF and USD/CHF, April 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump’s lawyer’s office, house and hotel were the subject of search warrants. A...

Read More »No Revolution Just Yet – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Irredeemably Yours… Yuan Stops Rallying at the Wrong Moment The so-called petro-yuan was to revolutionize the world of irredeemable fiat paper currencies. Well, since its launch on March 26 — it has gone down. It was to be an enabler for oil companies who were desperate to sell oil for gold, but could not do so until the...

Read More »Why Systems Fail

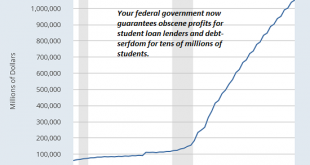

Since failing systems are incapable of structural reform, collapse is the only way forward. Systems fail for a wide range of reasons, but I’d like to focus on two that are easy to understand but hard to pin down. Federal Government, 2005 - 2018 - Click to enlarge 1. Systems are accretions of structures and modifications laid down over time.Each layer adds complexity which is viewed at the time as a solution....

Read More »US Jobs Data Optics Disappoint, but Signal Unchanged

The US jobs growth slowed in March more than expected, but the details of the report suggest investors and policymakers will look through it. The poor weather seemed to have played a role. Construction jobs fell (15k) for the first time since last July, and the hours worked by production employees and non-supervisory worker slipped. United States The 103k net new jobs were the least since last September when storms...

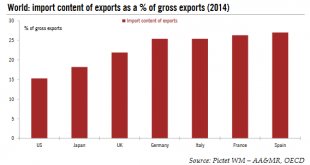

Read More »Europe has a lot to lose from trade wars

Any estimate of the economic costs of protectionist measures, let alone trade wars, is subject to uncertainty given the complexity of global supply chains. A common assumption is that new tariffs on exports will produce small direct effects on GDP growth but more significant indirect effects in the event of escalating trade conflicts, including on domestic investment. Europe looks particularly vulnerable to such...

Read More »Jamie Dimon Warns Of Potential ‘Market Panic’

Jamie Dimon Warns Of Potential ‘Market Panic’ – JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’ – In annual letter to shareholders Dimon warns of increased inflation and interest rates – Concerned QE unwinding could cause chaos as ‘markets will get more volatile’ – Hard to look at the last 20 years in America “and not think that it has been getting increasingly worse.” – Positive about US economy over next...

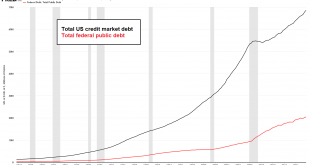

Read More »The Dollar Cancer and the Gold Cure

The Long Run is Here The dollar is failing. Millions of people can see at least some of the major signs, such as the collapse of interest rates, record high number of people not counted in the workforce, and debt rising from already-unpayable levels at an accelerating rate. US Total Credit Market Debt, 1968 - 2018Total US credit market debt has hit a new high of $68.6 trillion at the end of 2017. - Click to enlarge...

Read More »Great Graphic: Has the Dollar Bottomed Against the Yen?

The US dollar appears to be carving a low against the yen. After a significant fall, investor ought to be sensitive to bottoming patterns. The first tell was the key reversal on March 26. In this case, the key reversal was when the dollar made a new low for the move (~JPY104.55) and then rallied to close above the previous session high. The second tell was the divergence with the technical indicators. The divergence is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org