Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX. Stock Markets Emerging Markets, May 30 Source: economist.com - Click to enlarge Indonesia Indonesia reports May CPI Monday, which is expected to rise...

Read More »Vollgeld – Eine umfassende Analyse

Am 10. Juni stimmen wir in der Schweiz auf nationaler Ebene über die Vollgeld-Initiative ab. Diese widmet sich einer der wohl komplexesten und zugleich wesentlichsten Thematiken unserer Gesellschaft: unserem Finanzsystem. Die Idee des Vollgeldes geht weit über die Initiative in der Schweiz hinaus und ist heute in erster Linie Bestandteil der «Modern Monetary Theory». Ihren Ursprung lässt sich in das 19. Jahrhundert...

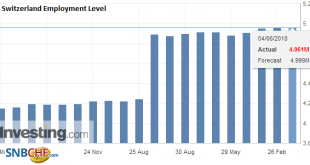

Read More »Employment barometer in the Q1 2018: Fastest growth in employment in industry for 10 years

Neuchâtel, 4 June 2018 (FSO) – In the 1st quarter 2018, total employment (number of jobs) rose by 1.6% in comparison with the same quarter a year earlier (+0.6% with previous quarter, +1.7% in full-time equivalents). The Swiss economy counted 77 000 more jobs and 11 000 more vacancies than in the corresponding quarter of the previous year. There was also an increase in the employment outlook indicator (+2.0%) and...

Read More »House Prices Down in Verbier but Up in Some other Swiss resorts

A recent report published by UBS shows real estate price changes in european mountain resorts. ©-Tatiana-Vasilieva-_-Dreamstime.com_ - Click to enlarge Over the last year, Verbier (-3.2%) and Crans Montana (-3.0%) experienced the largest price declines, while Saas Fee (+14.3%) and St. Moritz (+7.4%) climbed the most. Prices rises in the Jungfrau region (+4.8%) Gstaad (+1.5%), Flims/Laax (+2.8%), Andermatt (+1.5%),...

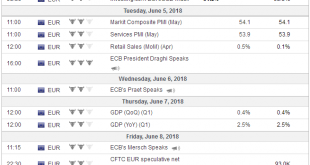

Read More »FX Weekly Preview: Macro Matters Now, Just Not the Data

The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new...

Read More »Bi-Weekly Economic Review – VIDEO

[embedded content] Interview with Joe Calhoun about BiWeekly Economic Review 01/06/2018. Related posts: The Currency of PMI’s Why The Last One Still Matters (IP Revisions) The Dismal Boom Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil What About 2.62 percent? More Pieces of Impossible Not Do We Need One, But Do We Need...

Read More »Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later Guest post by Dominic Frisby of Money Week This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…...

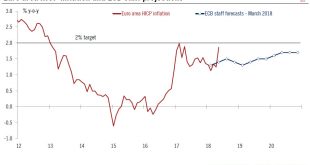

Read More »Euro area inflation close to ECB target in May

Euro Area HICP Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%). This sharp rebound in inflation will provide the ECB with a critical input for its looming decision on...

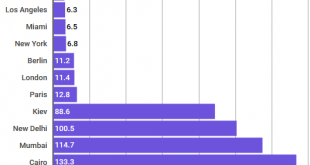

Read More »Pay in Zurich and Geneva highest in the world

A survey of the cost of living in 77 cities, by UBS, ranks Zurich (1st) and Geneva (2nd) as the most expensive. But while these cities are the most expensive, their workers are also the highest paid. In Zurich, less than five days pay affords an iPhone X. In Geneva, the same device requires less than six days of labour. Los Angeles (6.3 days) and Miami (6.5 days) complete the top four. At the other end of the ranking, a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org