The KOF Economic Barometer for May fell by 3.3 points to a new standing of exactly 100 points. The last time the Barometer had a similar standing was in December 2015. The current value of 100 points to an average development of the Swiss economy in the coming months. In May, the KOF Economic Barometer fell by 3.3 points to 100 points from revised 103.3 in April (first publication in April: 105.3). Within a...

Read More »Crowdfunding Platforms Boom in Switzerland

This crowd backed a winner: Bernese football fans gather outside parliament on May 20 after their team, Young Boys, won the Swiss league (Keystone) Swiss crowdfunding platforms dealt with CHF375 million ($377 million) in 2017, almost three times as much as the previous year. Some 160,000 people supported a crowdfunding project. Over the past eight years, more than half a billion francs have been collected via the...

Read More »FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

Swiss Franc The Euro rise by 0.38% to 1.1479 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday’s lows. While the...

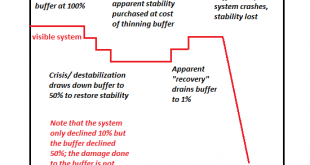

Read More »How Systems Collapse

This is how systems collapse: faith in the visible surface of abundance reigns supreme, and the fragility of the buffers goes unnoticed. I often discuss systems and systemic collapse, and I’ve drawn up a little diagram to illustrate a key dynamic in systemic collapse. The key concepts here are stability and buffers. Though complex systems are never static, but they can be stable: that is, they ebb and flow within...

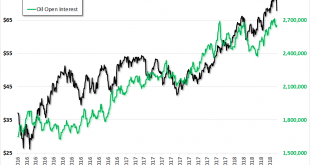

Read More »Wild Speculation in Crude Oil – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Crude Oil Market Structure – Extremes in Speculative Net Long Positions On May 28, markets were closed so this Report is coming out a day later than normal. The price of gold rose nine bucks, and the price of silver 4 pennies. With little action here, we thought we would write 1,000 words’ worth about oil. Here is a chart...

Read More »Le bilan de la BNS, Une arme de destruction massive

Chers amis lecteurs, voici le drame de la Suisse. Il s’appelle « Politique monétaire non conventionnelle« . Une arme de destruction massive que personne n’ose approcher, ni même aborder! Elle consiste en l’art de se faire un bilan sans bases réelles et avec en contreparties de l’endettement! Le directoire de la BNS a réussi l’exploit de se fabriquer de toutes pièces des réserves monétaires en devises étrangères de...

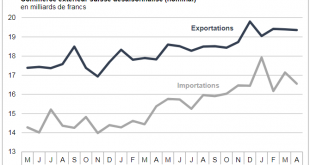

Read More »Swiss Trade Balance April 2018: Foreign Trade Caps at a High Level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Switzerland second hardest working nation in Europe

© Makasanaphoto | Dreamstime.com Recent statistics show that the average full-time employee in Switzerland worked 42.6 hours a week. This is slightly less than an average Icelander (42.9) – the longest working – but 13% longer than the average in leisurely France (37.4), the european nation putting in the fewest hours. Switzerland also came second on a broader measure: average hours worked per week by everyone 15 or...

Read More »What Happened Monday?

Italian politics dominated Monday’s activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections. The euro reversed course by midday in Asia, several hours before European markets opened. The move accelerated and by midday in Europe, with London markets on holiday as well as...

Read More »America 2018: Dicier by the Day

Scrape all this putrid excrescence off and we’re left with a non-fantasy reality: everything is getting dicier by the day. If we look beneath the cheery chatter of the financial media and the tiresomely repetitive Russian collusion narrative (that’s unraveling as the Ministry of Propaganda’s machinations are exposed), we find that America in 2018 is dicier by the day. The more you know about the actual functioning of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org