A Purely Technical Market Long time readers may recall that we regard Bitcoin and other liquid big cap cryptocurrencies as secondary media of exchange from a monetary theory perspective for the time being. The wave of speculative demand that has propelled them to astonishing heights was triggered by market participants realizing that they have the potential to become money. The process of achieving more widespread...

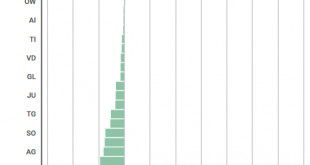

Read More »The price of solidarity – Switzerland’s inter-cantonal payments for 2019

In Switzerland, much in life revolves around the canton. Cantons have their own health, social and education systems, parliaments and tax rates. Federal government, based in Bern, is a layer that sits over the top, bringing the cantons together as Switzerland. For some cantons, nationhood has a cost. For others it means extra money. Every year, based on a collection of complicated formulae, the federal government...

Read More »There Isn’t Supposed To Be The Two Directions of IP

US Industrial Production dipped in May 2018. It was the first monthly drop since January. Year-over-year, IP was up just 3.5% from May 2017, down from 3.6% in each of prior three months. The reason for the soft spot was that American industry is being pulled in different directions by the two most important sectors: crude oil and autos. In the middle is the middling performance of manufacturing especially for consumer...

Read More »FX Daily, June 19: America First Clashes With Made in China 2025

Swiss Franc The Euro has fallen by 0.60% to 1.1495 CHF. EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The escalation of trade tensions between the world’s two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady...

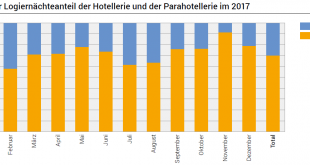

Read More »Tourist accommodation in 2017: supplementary accommodation recorded growth in overnight stays of close to 7 percent

Neuchâtel, 18 June 2018 (FSO) – In 2017, supplementary accommodation posted a total of 15.9 million overnight stays, i.e. an increase of 6.9% compared with 2016. With 10.8 million units, Swiss visitors represented more than two-thirds of demand (68.3%), i.e. a rise of 7.0%. Foreign visitors registered a 6.6% increase with 5.0 million units. Among this clientele, European visitors generated the most overnight stays with...

Read More »Rail workers stand against proposed cuts

Swiss Federal Railways workers releasing balloons and demands in Zurich. Some 1,400 rail workers took to the streets across the country on Monday to protest a package of cuts and reforms planned by the Swiss Federal Railways. The demonstrations, called for by the Union for public transport workers (SEV), were spread across several Swiss cities: Geneva, Lausanne, Olten, Bern, and Zurich, where the largest event brought...

Read More »Emerging Markets: Week Ahead Preview

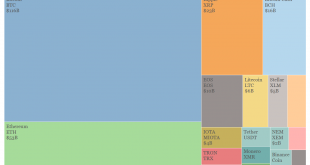

Stock Markets EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term. Stock Markets Emerging Markets, June 13 - Click to enlarge Singapore Singapore reports May...

Read More »Lift-Off Not (Yet) – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Wrong-Way Event. Last week we said something that turned out to be prescient: This is not an environment for a Lift Off Event. An unfortunate technical mishap interrupted the latest moon-flight of the gold rocket. Fear not true believers, a few positive tracks were left behind. [PT] Fundamental Developments The price of...

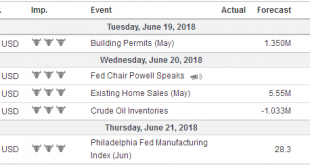

Read More »FX Weekly Preview Warning: Treacherous Week Ahead

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data. There are three major disruptive forces the make for a challenging investment climate just the same: the US policy mix, trade tensions, and immigration. The mix of tighter monetary...

Read More »Emerging Markets: What Changed

Summary US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned. Chile central bank signaled...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org