Summary US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned. Chile central bank signaled that the policy rate is likely to rise before year-end. Stock Markets In the EM equity space as measured by MSCI, Mexico (+0.9), India (+0.6%), and UAE (+0.3%) have outperformed this week, while Peru (-3.8%), Brazil (-3.6%), and Philippines (-3.0%) have underperformed. To put this in better context, MSCI

Topics:

Win Thin considers the following as important: 5) Global Macro, Argentina, Bulgaria, Chile, Egypt, emerging markets, Featured, Hungary, newsletter, Pakistan, United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

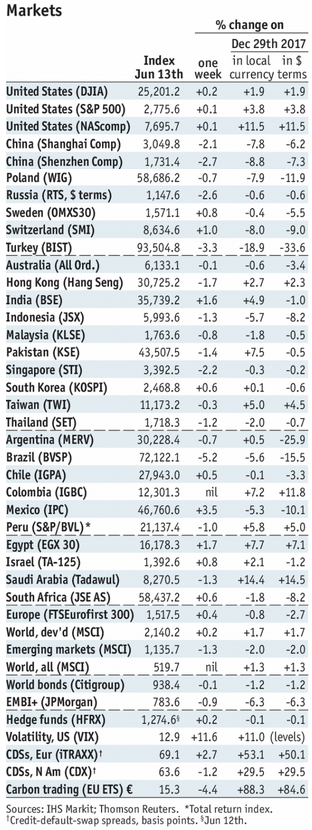

Stock MarketsIn the EM equity space as measured by MSCI, Mexico (+0.9), India (+0.6%), and UAE (+0.3%) have outperformed this week, while Peru (-3.8%), Brazil (-3.6%), and Philippines (-3.0%) have underperformed. To put this in better context, MSCI EM fell -2.1% this week while MSCI DM fell -0.3%. In the EM local currency bond space, India (10-year yield -6 bp), Poland (-5 bp), and China (-4 bp) have outperformed this week, while Turkey (10-year yield +115 bp), Brazil (+67 bp), and Hungary (+26 bp) have underperformed. To put this in better context, the 10-year UST yield fell 2 bp to 2.90%. In the EM FX space, MYR (+0.1% vs. USD), CZK (+0.1% vs. EUR), and EGP (flat vs. USD) have outperformed this week, while ARS (-9.7% vs. USD), TRY (-5.6% vs. USD), and ZAR (-3.2% vs. USD) have underperformed. To put this in better context, MSCI EM FX fell -1.0% this week. |

Stock Markets Emerging Markets, June 13 |

United StatesUS-China trade tensions are rising. The US announced 25% tariffs on $50 bln worth of Chinese imports, and China said it would retaliate with “equal scale, equal intensity” on imports from the US. President Trump then doubled (tripled?) down and pledged additional tariffs if China follows through on its retaliation threats. According to the USTR, the first $34 bln stage will take effect July 6, with another $16 bln to be announced later. PakistanPakistan devalued the rupee for a third time since December. The backdrop has worsened, and there is growing speculation of an IMF program. Finance Minister Akhtar said that Pakistan faces “some very daunting challenges” but added that the interim government won’t approach the IMF. She added that the decision whether to approach the IMF for aid will have to be taken by the new government after the election July 25. BulgariaBulgaria will seek to join the European banking union and ERM-2 simultaneously. Both the ECB and the EU expressed a desire for Bulgaria to improve its governance before adopting the euro. Previously, Bulgaria wanted to first join ERM-2 and then join the banking union later. HungaryThe National Bank of Hungary appears to have tilted more hawkish. Deputy Governor Nagy said the bank is prepared to tighten monetary conditions if the weak forint endangers its inflation target. Before, the bank had shown little concern with the exchange rate. EgyptNewly elected Egyptian President El-Sisi shuffled his cabinet. New Prime Minister Moustafa Madbouly replaced his Finance, Defense and Interior Ministers and signals a new focus on boosting the economy and fighting terrorism. New Finance Minister Mohamed Maait replaces Amr El-Garhy. President El-Sisi appointed some of his closest military advisers to the new cabinet. Lieutenant General Mohamed Zaky is now Defense Minister, while General Mahmoud Tawfiq is now Interior Minister. ArgentinaArgentina has a new central bank chief after Federico Sturzenegger resigned. Finance Minister Luis Caputo will take over. Treasury Minister Nicolas Dujovne will lead a united Ministry of Finance and Treasury. Also, the central bank said Mariano Flores Vidal (General Manager), Demian Reidel (Second Vice President), and Andres Neumeyer (Chief Economist) have also resigned. ChileChile central bank signaled that the policy rate is likely to rise before year-end. It also raised its inflation forecast for this year to 2.8% from 2.3% previously. More importantly, the bank said inflation would return to the 3% sooner than forecast due to higher oil prices. It added that its base scenario is for interest rates to follow market expectations in the short-term, which indicates a 25 bp hike by year-end. |

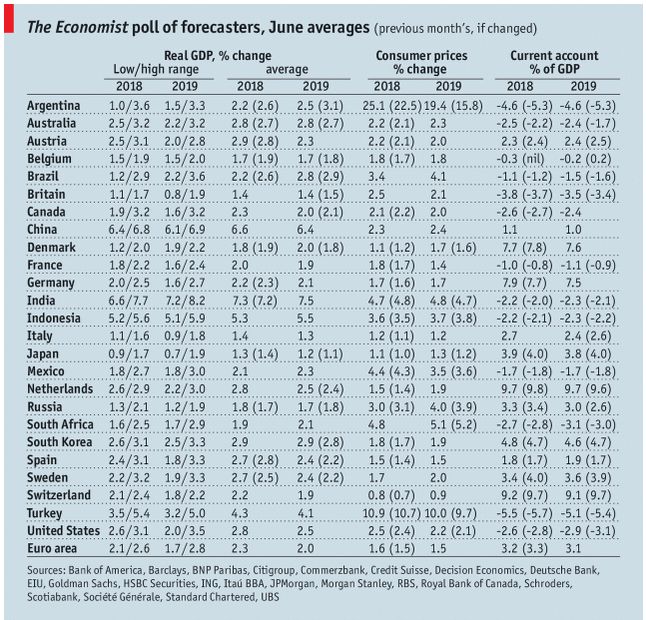

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2018 Source: economist.com - Click to enlarge |

Tags: Argentina,Bulgaria,Chile,Egypt,Emerging Markets,Featured,Hungary,newsletter,Pakistan,United States