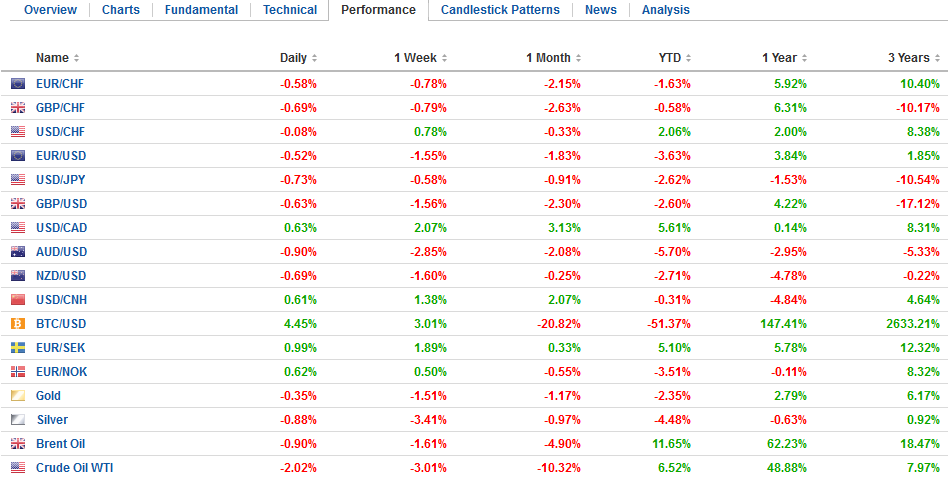

Swiss Franc The Euro has fallen by 0.60% to 1.1495 CHF. EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The escalation of trade tensions between the world’s two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady as it too is benefiting from the unwinding of risk trades. The main impetus comes from the Trump Administration, which in response to China’s retaliation for the 25% tariff on bln of Chinese goods for intellectual property rights violations, has announced that it will put an additional 10% on 0

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, Daily FX, EUR, Featured, GBP, JPY, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

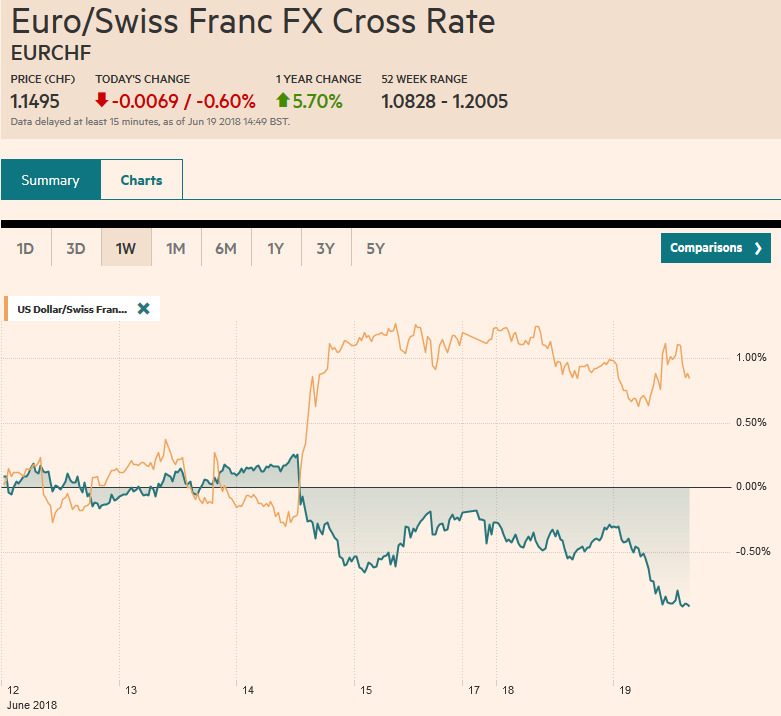

Swiss FrancThe Euro has fallen by 0.60% to 1.1495 CHF. |

EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe escalation of trade tensions between the world’s two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady as it too is benefiting from the unwinding of risk trades. The main impetus comes from the Trump Administration, which in response to China’s retaliation for the 25% tariff on $50 bln of Chinese goods for intellectual property rights violations, has announced that it will put an additional 10% on $200 bln of Chinese goods. Moreover, it threatens that if Beijing retaliates it will slap a tariff on another $200 bln of Chinese goods. China goods imports from the US amount to around $130 bln. China cannot play a tit-for-tat strategy unless it doubles and triples up on tariffs for existing goods. While it is already doing this, there seems to be some limit. The inability of China to match the escalation by the US invites an asymmetrical response. That means if China cannot win in this space that it will look for another place to express its displeasure with the US action. There are numerous areas in which the US seeks China’s cooperation, such as North Korea, Iran, terrorism, and the South China Sea. The US is not invincible. The initial round of tariffs would seem to hit mostly non-Chinese supply chains, but as the US increases the range of goods with tariffs, consumer goods will also likely see tariffs. |

FX Performance, June 19 |

However, the asymmetries are evident. Many Chinese companies are dependent on US components. This is one of the lessons from ZTE. Note that the defense spending bills that passed the US Senate yesterday by 85-10 contain a section that unwinds the ZTE deal that the White House engineered. The bill must now be passed by the House of Representatives. In addition, the US Treasury is expected to unveil new restrictions on Chinese investment in the US by the end of the month.

The escalating trade tension sucked the oxygen from other potential drivers. Fortunately, there is a light economic calendar. The ECB conference in Sintra has seen Draghi reiterate what he said last week. Powell, Kuroda, and Lowe are scheduled to speak tomorrow. The eurozone’s April current account surplus narrowed, while construction output rose. The US reports May housing starts and permits, but this these tend not move the market in the best of times.

For many investors, today is about damage control. The MSCI Asia Pacific Index fell 1.6% on its fifth consecutive loss. It fell to a marginal new low for the year. China’s markets re-opened after yesterday’s holiday with a 3.8% drop in Shanghai and a 5.8% drop in Shenzhen. The index of China’s shares that trade in Hong Kong shed 3.2%. Japan’s Nikkei fell 1.8%. A double top near 23000 warns of potential toward 21000.

The MSCI Emerging Market Index is off nearly 2%, the most in this five-day swoon, and is trading at levels not seen since last October. The push below 1100 is a worrisome technical development. The 1052 area corresponds to a 38.2% retracement of the rally since early 2016. The 50% retracement is seen near 982. The combination of tighter US monetary policy and the prospects were increased trade tensions weigh on a particularly vulnerable asset class, and idiosyncratic challenges make for a challenging period.

European shares are also being sold. The Dow Jones Stoxx 600 is off 0.8%. It is the third consecutive day of losses. The benchmark made a new two-month lows. The 383 area corresponded with a 50% retracement of the recovery off the March lows. The 61.8% retracement is found near 378.

The risk-off mood is helping to lift core bonds. Yields in the US, UK, and German 10-year benchmarks are off 4-5 bp. That puts the US yield below 2.87%, a three-week low. The low from late May was seen near 2.76%. In Europe, Italy remains the laggard. Its 10year bond yield is about one basis point higher, and the two-year yield is five basis points firmer.

The euro initially extended the recovery seen yesterday and made it to $1.1645 before the trade news broke. It was subsequently sold through yesterday’s lows, setting up a potential outside day. Last week’s low near $1.1545 has been taken out, and the next target is the late-May low near $1.1510. The $1.1450 area marks the 50% retracement of the euro’s rally that began in early 2017. The 61.8% retracement is just below $1.12.

Sterling has been push through the late May low of $1.3200 to trade at new lows for the year. The double top pattern we have been tracking projects into the $1.30-$1.31 area. The 50% retracement of sterling’s recovery from the flash crash (Bloomberg records the low at $1.1840) is found near $1.3100. The 61.8% retracement is $1.28. The government lost a vote in the House of Lords yesterday, and this will make for a challenging House of Commons session tomorrow.

The dollar is being sold through a three-week uptrend against the yen. The trendline is found near JPY109.85. Last week, the greenback was knocking on JPY111.00. Initial support now is pegged near JPY109.50, where a $354 mln option expires today. A break of JPY109.50 signals a likely test on the JPY109.20 low seen on June 8 and June 11. A convincing violation could spur dollar losses toward JPY108.

The Canadian dollar is trading at new lows for the year. Early June 2017, the US dollar was trading near CAD1.35 before the Bank of Canada signaled that is was prepared to raise rates. Above CAD1.3265, and the greenback is poised to test CAD1.3350. The Australian dollar is also at new lows for the year. There is support seen near $0.7335-$0.7750, though over the medium-term, we look for a break of $0.7000. Lastly, we note that dollar is moving higher against the Chinese yuan for the third session and near CNY6.48, the greenback is at its best level since mid-January.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,$TLT,Daily FX,Featured,newsletter