In Switzerland, much in life revolves around the canton. Cantons have their own health, social and education systems, parliaments and tax rates. Federal government, based in Bern, is a layer that sits over the top, bringing the cantons together as Switzerland. For some cantons, nationhood has a cost. For others it means extra money. Every year, based on a collection of complicated formulae, the federal government calculates how much certain cantons must pay other cantons, a kind of solidarity transfer. Today, the inter-cantonal transfers for 2019 were published. At the same time, the Federal government puts money into the transfer pot – in 2019 it will put in 3.4 billion francs, by far the largest contribution.

Topics:

Investec considers the following as important: 3) Swiss Markets and News, Canton tax Switzerland, Editor's Choice, Featured, newsletter, Personal finance, Tax Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

In Switzerland, much in life revolves around the canton. Cantons have their own health, social and education systems, parliaments and tax rates.

Federal government, based in Bern, is a layer that sits over the top, bringing the cantons together as Switzerland.

For some cantons, nationhood has a cost. For others it means extra money. Every year, based on a collection of complicated formulae, the federal government calculates how much certain cantons must pay other cantons, a kind of solidarity transfer.

Today, the inter-cantonal transfers for 2019 were published.

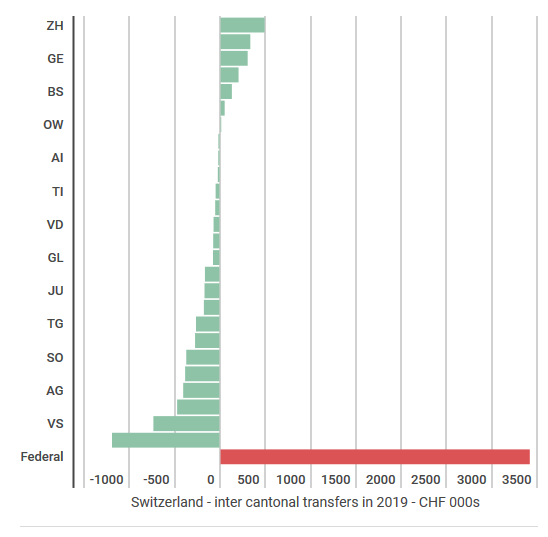

| At the same time, the Federal government puts money into the transfer pot – in 2019 it will put in 3.4 billion francs, by far the largest contribution. |

Switzerland - inter cantonal transfers in 2019 - CHF 000s |

| The big payers in 2019 will be Zurich (487 million), Zug (329), Geneva (300), Schwyz (299) and Basel-City (125). And the largest recipients will be Bern (1,187 million), Valais (730), St. Gallen (468) and Aargau (400) – see chart above.

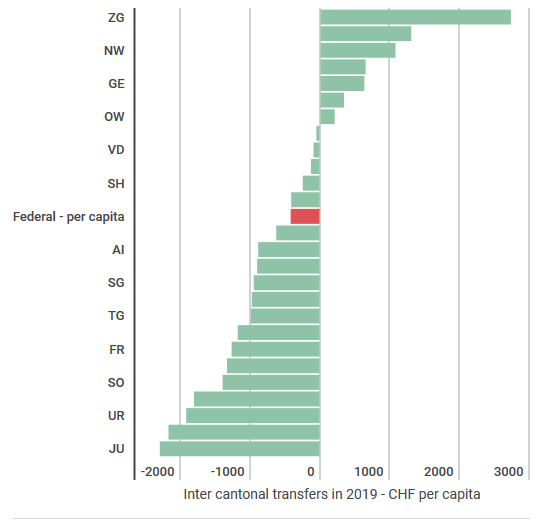

On a per capita basis, taxpayers in Zug (-2,727 francs) will contribute the most and the residents of Jura (+2,288 francs) will benefit the most – see chart above. 2019 payments are similar to those for 2018. |

Inter cantonal transfers in 2019 - CHF per capita |

Tags: Canton tax Switzerland,Editor's Choice,Featured,newsletter,Personal finance,Tax Switzerland