juin 27, 2018 par LHK Bitcoin : les causes de la chute historique sous la barre des 6 000$. 2 articles de Adrien Pittore/ Entreprise news Bitcoin Horrific CrashesLes soldes ne commencent que mercredi. Et pourtant, la valeur du Bitcoin, plus généralement des cryptomonnaies, a accusé un sacré coup de rabais jeudi 21 juin. Alors qu’il était plutôt bien stabilisé, le cours du Bitcoin s’attaquait à la barre symbolique...

Read More »London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy) London house prices still 50% above 2007 bubble peak (see chart) Brexit and weak consumer confidence to blame say experts Little sign that U.K. property “weakness” is likely to change London property bubble appears to be bursting Editors Note: The London property bubble appears to be in the early stages of bursting. House prices are falling with reports of falls of as...

Read More »Geneva set to vote on world’s highest minimum wage

In May 2014, Switzerland voted against a minimum wage of CHF 22 an hour. At some point voters in the canton of Geneva will get to vote on a similar initiative, which would apply only in the canton. Similar to the federal vote, which was rejected by 76.3% of Swiss voters, the plan calls for a minimum hourly wage of CHF 23 ($US 23.40). Based on a 40-hour week, this works out at around CHF 4,000 per month. Vote organisers...

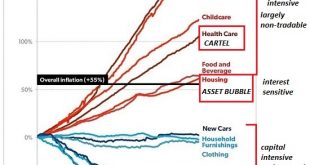

Read More »Make Capital Cheap and Labor Costly, and Guess What Happens?

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital. If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap. It becomes ludicrously...

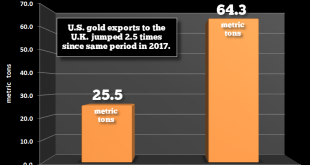

Read More »Gold Exports To London From U.S. Surge 152 percent In 2018

Gold Exports To London From U.S. Surge 152% In 2018 – U.S. gold exports to UK (primarily) London jumped over 150% from 25.5 metric tons to 64.3 mt in the first four months of 2018 (yoy)– Largest countries receiving U.S. gold exports are China/ Hong Kong, Switzerland and the UK – U.S. gold exports to London (UK) alone nearly as much as total U.S. gold production – Gold flowing from weak hands in West to strong hands in...

Read More »FX Daily, June 27: Renminbi Slide Continues and Oil Extends Surge

Swiss Franc The Euro has risen by 0.07% to 1.1542 CHF. EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi....

Read More »EU Unemployment Rule change could cost Switzerland dearly

Currently, across EU and EFTA countries, unemployment benefits are paid by the country of residence. Last week, the EU announced plans to make the country of employment pay unemployment benefits instead. ©-Meryll-_-Dreamstime.com-1 - Click to enlarge This change could be costly for Swiss cantons with large numbers of cross-border workers, workers who live in the EU but work in Switzerland. In March 2018, there were...

Read More »Buying more time

Switzerland: monetary policy At its quarterly monetary policy assessment last week, the Swiss National Bank (SNB) kept unchanged the target range for the three-month Libor at between -1.25% and -0.25% and the interest rate on sight deposits at a record low of -0.75%. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained...

Read More »The Wealth Effect, Report 24 Jun 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Last week, we discussed Social Security, a Ponzi scheme that is inevitably approaching its default. That leads us to another point in our broader discussion of capital destruction. Let’s illustrate with an example. The Fraudulent Promise Suppose Eric works for wages. He is 50 years old. His house is paid off, he has no...

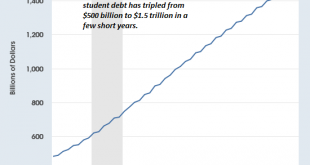

Read More »Dear High School Graduates: the Status Quo “Solutions” Enrich the Few at Your Expense

You deserve a realistic account of the economy you’re joining. Dear high school graduates: please glance at these charts before buying into the conventional life-course being promoted by the status quo. Here’s the summary: the status quo is pressuring you to accept its “solutions”: borrow mega-bucks to attend college, then buy a decaying bungalow or hastily constructed stucco box for $800,000 in a “desirable” city, pay...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org