Summary:

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital.

If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap. It becomes ludicrously easy to borrow money to buy whatever cheap capital can buy: stock buybacks, robots, automation tools, interest-sensitive assets such as housing, competitors or potential competitors, high-yield emerging-market bonds, and so on.

What happens when cartels take control of core domestic industries such as

Topics:

Charles Hugh Smith considers the following as important:

5) Global Macro,

Featured,

newsletter,

The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital.

If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap. It becomes ludicrously easy to borrow money to buy whatever cheap capital can buy: stock buybacks, robots, automation tools, interest-sensitive assets such as housing, competitors or potential competitors, high-yield emerging-market bonds, and so on.

What happens when cartels take control of core domestic industries such as banking, defense, higher education and healthcare? Costs soar because competition has been throttled via regulatory capture, and these domestic sectors are largely non-tradable, meaning they can’t be offshored and have little meaningful exposure to globalization.

Labor-intensive cartels such as these can pass on their rising costs for labor, resources and profiteering. Do you really think assistant deans could be pulling down $250,000 annual salaries in higher education if there was any global or domestic competition?

As for healthcare, I’ve often noted that healthcare/sickcare will bankrupt the nation all by itself. When a cartel such as healthcare / sickcare can force higher prices on employers and employees, the cost of labor throughout the economy rises.

As I’ve indicated on the chart, labor-intensive cartels in non-tradable sectors–higher education, defense/national security, healthcare and banking– can pass on their rising labor costs to their captive customers.

Central bank policies of super-low interest rates and abundant credit for big players and financiers have made capital cheap. Given a choice between cheap-to-finance robots and software, and ever-more costly labor, what’s the rational choice for employers facing unrelenting margin pressure from rising costs for virtually everything–from taxes and junk fees to resources, rent, regulatory compliance and other inputs?

It’s obvious, isn’t it? The rational move is use cheap capital to replace labor as fast as possible. If capital was costly and difficult to borrow, the decision wouldn’t be so easy.

| Cheap capital makes buying political influence easier, too. And with enough political influence, cartels can protect themselves from competition and transparent pricing.

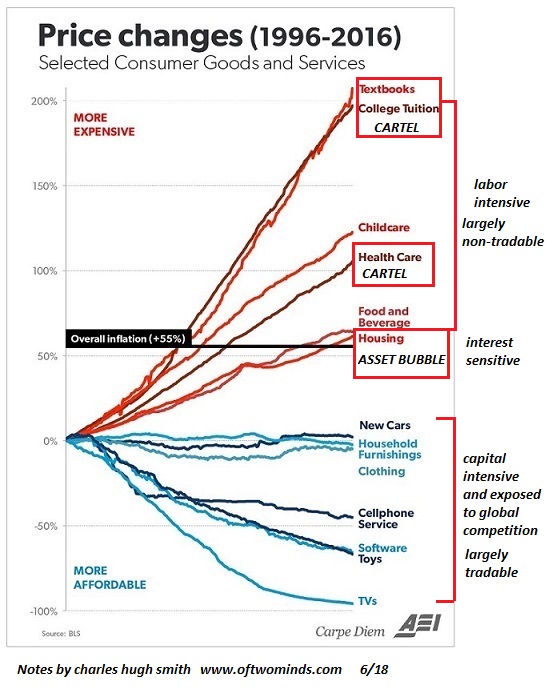

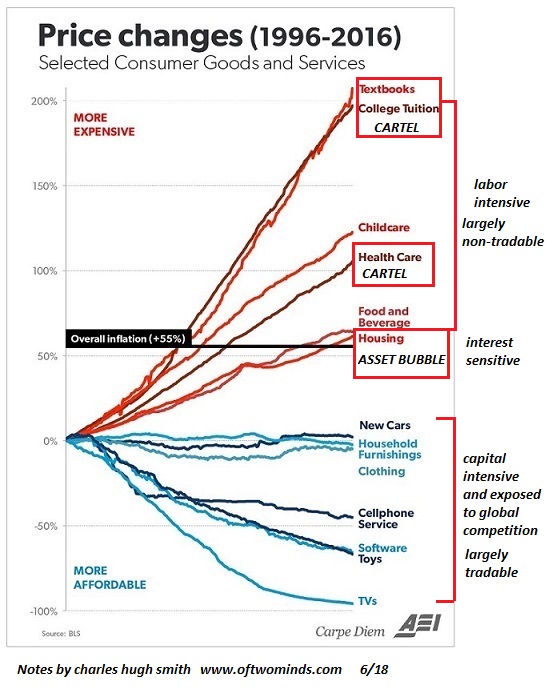

I’ve marked up this chart of price changes to break out the three basic categories:

1. Labor-intensive sectors that are largely non-tradable (domestic) and dominated by cartels that can push their higher labor costs onto their customers.

2. Interest-sensitive sectors such as housing that jack up prices as cheap capital pushes valuations into bubble territory.

3. Tradable sectors exposed to global competition and capital-intensive technology such as robotics and automation. |

Price Changes, 1996 - 2016 - Click to enlarge |

What happens when capital is cheap, labor is costly and cartels dominate the labor-intensive non-tradable domestic sectors? Labor costs in the protected sectors soar, pushing prices higher throughout the economy, pushing employers to replace costly labor with cheap capital-intensive technology.

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital. So assistant deans, hospital managers, top-tier bankers and under-secretaries of defense are doing just fine while the Unprotected are experiencing rising costs of living and stagnating wages and employment.

How’s the economy doing? It depends on which class you’re in. The Protected Class is doing just fine, the class with access to cheap credit and participation in asset bubbles has never had it so good, while the Unprotected Class faces a bleak future of lower real wages, rising costs of living and a social mobility ladder with few rungs left.

My new book is Money and Work Unchained. For more, please visit the

book's website.

Tags:

Featured,

newsletter