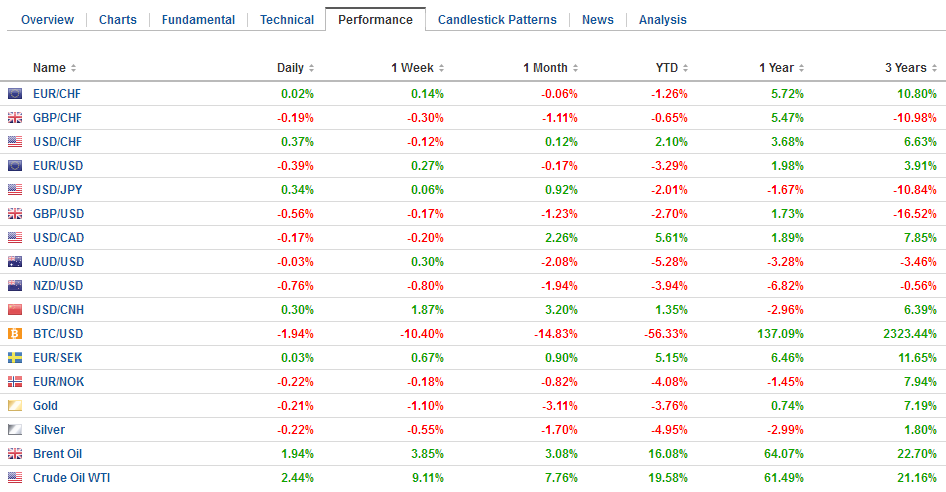

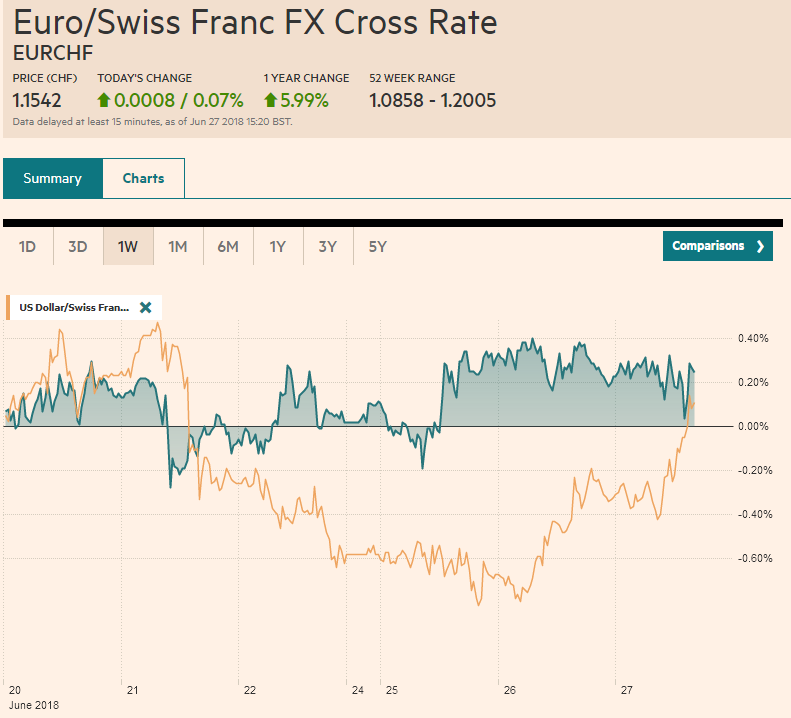

Swiss Franc The Euro has risen by 0.07% to 1.1542 CHF. EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi. The decline is the sharpest since the 2015 devaluation. The onshore yuan fell for its eighth session of the past ten, while the offshore yuan has declined in all ten sessions. Over this run, the onshore yuan is off 3.1%, while the offshore yuan is off 3.3%. The PBOC leaned against the yuan’s weakness

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, EUR, EUR/CHF and USD/CHF, Featured, GBP, newsletter, SPY, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.07% to 1.1542 CHF. |

EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi. The decline is the sharpest since the 2015 devaluation. The onshore yuan fell for its eighth session of the past ten, while the offshore yuan has declined in all ten sessions. Over this run, the onshore yuan is off 3.1%, while the offshore yuan is off 3.3%. The PBOC leaned against the yuan’s weakness in three ways: First, the reference rate (fix) for was for a weaker US dollar (than Tuesday’s onshore close). Second, it drained liquidity. Third, reports suggest that parties that often act on behalf of officials, or are perceived as such, were buying yuan today. The market was not impressed, and the dollar finished the onshore session above CNY6.61. Last week’s low was near CNY6.4280. The Shanghai Composite fell 1.1%. Equities in the region fell, with the MSCI Asia Pacific Index off about 0.6%. The US equity gains offered little consolation. Although US equities stabilized after Monday’s slide, the Dow Industrials closed again below the 200-day moving average and the S&P 500 merely consolidated at the lower end of Monday’s range. European equities are also under pressure. The Dow Jones Stoxx 600 is off 0.6%, with all of the industry sectors lower but energy. There are two developments that may suggest the market sentiment may not be as bearish the yuan as the continued slide may suggest. First, the fact that the implied one-month vol is above the longer-dated vol (e.g., one year) is consistent with a short-term squeeze rather than a structural shift. Contacts report strong options activity today. Second, the spread between the one-month and 12-month NDF is not suggesting a bearish outlook for the yuan. |

FX Performance, June 27 |

Charts circulating of the yuan and with a data point inserted to show when the US announced the tariffs on Chinese goods for intellectual property violations are misleading. There have been other relevant developments, like the easing monetary policy by reducing the quality of collateral needed for MLF borrowing and by easing the reserve requirement. The 0.5% cut in RRR frees up roughly $100 bln. China also reported weaker than expected economic data, including May retail sales, industrial output, and investment.

The yuan outperformed earlier this year, while the dollar was appreciating against most emerging market currencies and recovering against most of the major currencies as well. Many observers suspect that China is devaluing the yuan as part of the response to the US tariff threats. While it is possible, we think it is unlikely, especially at this juncture. Chinese officials want to avoid the vicious cycle of currency weakness, stock market slide, accelerating capital flows.

It is well recognized that the US economic strength, helped in the short-run by a large fiscal stimulant, is in a position to absorb a trade hit, which economist expect to be relatively small. China economic challenges are may be more acute as the deleveraging efforts and slowing economy, under highly indebt conditions, and weakening property prices, limited the room to maneuver.

Reports suggest that Chinese officials will tone down their Made in China 2025 rhetoric, apparently and belatedly recognizing how that antagonizes the US. Meanwhile, it appears that Trump is siding with Mnuchin over Navarro in the restrictions on investment and technology transfers. Recall Mnuchin tried to downplay the confrontation with China suggesting that the Treasury’s announcement, expected later this week, will not single out China. Navarro argued for a narrower China focus.

Meanwhile, the other main issue is oil. Brent rose to almost $77 a barrel today, extending yesterday’s 2.1% advance by nearly 1% before some profit-taking was seen. WTI for August delivery surged 3.6% yesterday and edged toward $71. Reports that the US had increased pressure on other countries to cease all buying of Iranian oil by early November or incur US wrath helped fuel the rally. News that Saudi Arabia was committing to record output next month (~11 mln barrels a day) was not seen as sufficient to overcome the loss of output elsewhere and the limited capacity of most oil producers. Also, Saudi Arabia typically boosts oil output in the summer for domestic consumption (air conditioning).

The US dollar is firm against the major currencies but the Japanese yen. The euro extended yesterday’s pullback. It has found a bid ahead of $1.1615, the 50% retracement mark of the run-up sparked by the hawkish hold by the BOE last week. As the quarter draws to a close, we note large option expirations Today there are options at $1.1625 (3.3 bln euros), $1.1650 (1.6 bln euros), $1.1675 (666 mln euros), and $1.1690 (2 bln euros).

The dollar’s momentum against the yen faded near JPY110.20. Support was found near JPY109.70. There are large option expirations here too, with strikes at JPY109.60 ($1 bln), JPY110 ($1.3 bln), and JPY110.30 (~$400 mln). Sterling found good bids below $1.3200 in early European turnover. Nearby resistance is pegged around $1.3340.

The New Zealand dollar is the weakest of the majors, with a 0.6% decline ahead of the RBNZ meeting outcome, known shortly after the US markets close today. The RBNZ is widely expected to leave rates on hold, show no urgency to raise rates, and is likely to note that the Kiwi is still over-valued, though it has recorded new eight-month lows today. The Australian and Canadian dollars are in narrow ranges near this year’s lows.

The US reports the advanced look at goods trade for May. The growth differentials warn that the US trade deficit is likely to deteriorate not only in May but on a trend basis, despite the protectionist efforts. Economists generally recognize the contradiction between US fiscal stimulus and efforts to reduce the US trade imbalance. The US also reports the preliminary look at May durable goods orders. The cut in corporate taxes was supposed to help fuel capital investment. However, evidence remains elusive, and if a decline in durable goods orders is reported as expected, it would be the first back-to-back decline in two years.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,EUR/CHF and USD/CHF,Featured,newsletter,SPY