Swiss Franc The Euro has fallen by 0.08% to 1.1539 CHF. EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets have stabilized today after yesterday’s rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China’s retaliatory tariffs on the US is still ten days off. The immediate...

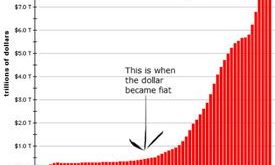

Read More »Sound Money Needed Now More Than Ever

The sound money movement reemerged on the national political scene a decade ago. In 2008, the financial crisis brought in a fresh wave of U.S. gold and silver investors. Ron Paul and the Tea Party advocated for limiting government and ending the Federal Reserve system. Sound money advocates made real inroads in recruiting Americans to their cause based on evidence that the nation is headed for bankruptcy. The...

Read More »Nearly 1 in 20 in Switzerland are millionaires, according wealth to report

© Andrii Chernykh | Dreamstime.com The 2017, a wealth report, published by Capgemini, shows there were 389,000 US$ millionaires in Switzerland, around 4.5% of the population, or close to 1 in 20. If children under the age of 15 are excluded, Switzerland’s millionaire percentage rises to 7.3%. In addition, these figures include only investable wealth, which does not include the value of family homes. If this wealth was...

Read More »Manipulation of Gold and Silver Is “Undeniable”

Manipulation of Gold and Silver by Bullion Banks Is “Undeniable” by David Brady via ZeroHedge Manipulation in precious metals is undeniable Now so chronic that it is obvious and therefore predictable Central banks around the world are repatriating their gold from the U.S. in preparation for some major event to come I want to be long … “when that event occurs” Silver Change - Click to enlarge As a former...

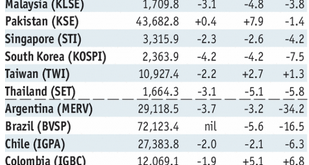

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL. Stock Markets Emerging Markets, June 20 - Click to enlarge Indonesia Indonesia reports May trade Monday....

Read More »Strikes mooted over construction retirement age

Tools downed temporarily at a construction site earlier this year, there is a mood for strikes, unions say Unions on Friday threatened warning strikes for the building sector this autumn if the current retirement age of 60 for construction workers is dropped. At a press conference on Friday, Switzerland’s biggest trade union Uniaexternal link, and the union Synaexternal link called for early retirement, as well as more...

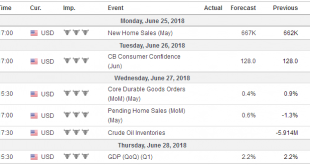

Read More »FX Weekly Preview: Trade Tensions and EU Summit Highlight Q2’s Last Week

We argue there are three major disruptive forces that are shaping the investment climate: the US policy mix in relative and absolute terms, the escalation of trade tensions, and immigration. In the week ahead, trade issues may eclipse the US policy mix, and immigration will compete with the economic and financial agenda at the European heads of state summit at the end of the week. China The People’s Bank of China made...

Read More »Emerging Markets: What Changed

Summary Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody’s cut the outlook on Pakistan’s B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index Brazil’s government its split on the inflation target for...

Read More »‘Cryptocurrencies too primitive for national money’: SNB director

Cryptocurrencies, such as bitcoin, have been criticised by the Bank for International Settlements for having a series of perceived technical flaws (Keystone) Cryptocurrencies and the blockchain technology they run on are currently far too primitive for the Swiss central bank to consider issuing a digital franc, says board director Thomas Moser. Moser’s comments on Thursday reflected the previously stated stance taken by...

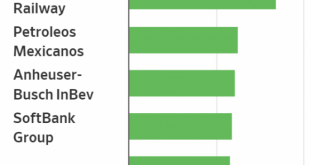

Read More »Merger Mania and the Kings of Debt

Another Early Warning Siren Goes Off Our friend Jonathan Tepper of research house Variant Perception (check out their blog to see some of their excellent work) recently pointed out to us that the volume of mergers and acquisitions has increased rather noticeably lately. Some color on this was provided in an article published by Reuters in late May, “Global M&A hits record $2 trillion in the year to date”, which...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org