The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »The Next Financial Crisis Is Right on Schedule (2019)

Neither small business nor the bottom 90% of households can afford this “best economy ever.” After 10 years of unprecedented goosing, some of the real economy is finally overheating: costs are heating up, unemployment is at historic lows, small business optimism is high, and so on–all classic indicators that the top of this cycle is in. Financial assets have been goosed to record highs in the everything bubble.Buy the...

Read More »Is the tide turning for social media platforms in Switzerland?

In a ranking of 170 media brands, Facebook had the lowest credibility. The Swiss appear to be switching off from social media, according to a survey, which suggests that the image of Facebook and Twitter have taken a hit. Some 55% of the Swiss population used social media in 2017, down 4% compared with a year earlier, a media brand study for the consultancy firm Publicomexternal link revealed. The report, published on...

Read More »FX Daily, September 12: Dollar Chops in Narrow Ranges

Swiss Franc The Euro has fallen by 0.03% at 1.1277 EUR/CHF and USD/CHF, September 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar has been confined to about 10 pips on either side of JPY111.55. There are $1.13 bln of options struck between JPY111.50 and JPY111.65 that expire today. Dollar support extends to JPY111.20-JPY111.30. It has not traded above JPY112.00...

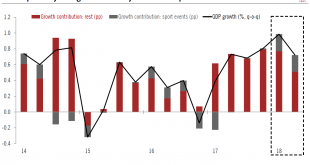

Read More »Switzerland Q2 growth numbers are impressive, but details are mixed

The latest headline Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ (SECO) quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2 (2.9% q-o-q annualised, 3.4% y-o-y), slightly above our 0.6% projection and consensus (0.5% q-o-q). This was the fifth consecutive quarter with an above average rate. Q1 GDP growth was significantly revised up to 1.0% q-o-q (from 0.6%). Thus,...

Read More »Great Graphic: Did the CRB Bottom?

The CRB index has been trending lower since late May. It fell nearly 10% to retrace 50% of the rally come June 2017. This Great Graphic shows the 4 1/2 month trendline. It had been violated in late August but fell back under it at the end of last week. On Monday, it gapped higher, above the trendline. Today it filled the gap and rallied to new session highs. A move above 192.00 would likely confirm a bottom of some...

Read More »Rep. Alex Mooney: Bring Back Gold!

This article originally appeared here. Washington has been quite the circus lately. Bret Kavanaugh’s appearance in front of the Senate Judiciary Committee prompted dozens of interruptions from Democrats and numerous protests from leftists. During Twitter CEO Jack Dorsey’s testimony to the House Commerce Committee, journalist Laura Loomer demanded to be verified on the social media platform, and Representative Billy Long...

Read More »FX Daily, September 11: Dollar May Prove Resilient if it is Turn Around Tuesday

Swiss Franc The Euro has fallen by 0.17% at 1.1282 EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro and sterling extended their recovery from the US hourly earnings lows seen before the weekend. However, the move stalled in the European morning, after the UK reported better than expected earnings itself. Sterling approached the 61.8%...

Read More »Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York. Their application was denied. They have sued....

Read More »Cool Video: What Earth Really Looks Like

Here is the challenge: Representing a three-dimensional object in two-dimensions. It is impossible to do without distortions. Those distortions can reflect cultural biases as well as the function of the map, such as for navigation purposes. The Mercator Projection, which generates the map that may be most familiar, dates back to the 16th century. It projects the image on to a cylinder, where parallels of latitude are as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org