The US dollar is beginning the new week on a soft note, as China threatens not to accept the invitation for trade talks in Washington if the US imposes new tariffs on $200 bln of its goods, which the Wall Street Journal reports could come as early as today. Meanwhile, the MSCI Emerging Markets Index is giving back half of the 2.5% rally seen in the second half of last week. The Turkish lira is leading the emerging...

Read More »BNS. Peuple suisse, tu peux trembler pour ton épargne et ta retraite! LHK

Les forcenés de la printing press: le plus forcené ce n’est pas celui que l’on croit, non c’est la Banque Nationale Suisse! Le financement du bilan de la BNS se fait en grande partie par les liquidités des banques cantonales et les Raiffeisen. Va-t-elle nous rendre un jour nos économies? LHK - Click to enlarge Total du bilan par rapport à la taille du GDP. Total Balance Sheet in Relation to the Size of the GDPLes...

Read More »Over 7,000 farms get lower subsidies due to irregularities

Aerial view of a farm near Appenzell in eastern Switzerland (Keystone) The federal authorities last year cut direct subsidies paid to 16% of all Swiss farms due to irregularities often due to animal protection and welfare issues. In all, 7,145 farms, or 16% of the total, received lower payments, the SonntagsZeitung wrote on Sunday. The report was based on figures that have yet to be published by the Federal Office for...

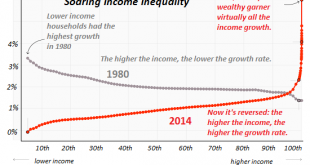

Read More »Massive Deficit Spending Greenlights Waste, Fraud, Profiteering and Dysfunction

America’s problem isn’t a lack of deficit spending/consumption. America’s problems are profoundly structural. The nice thing about free to me money from any source is the recipients don’t have to change anything. Free money is the ultimate free-pass from consequence and adaptation: instead of having to make difficult trade-offs or suffer the consequences of profligacy, the recipients of free money are saved: they can...

Read More »Never Mind the Bollocks, Here’s the Avocado Toast, Report 16 Sep 2018

For about ten bucks a month, Netflix will give you all the movies you can watch, plus tons of TV show series and other programs, such as one-off science documentaries. They don’t offer all movies, merely more than you can watch. Oh, and there are no commercials. They don’t just give you old BBC reruns, which you know they can get for a pittance. Netflix is spending money (well Federal Reserve Notes) producing its own...

Read More »Der Nationalbank sind die Hände gebunden

Das latente Aufwertungsrisiko des Frankens beschränkt ihren Handlungsspielraum: SNB in Bern. (Foto: Keystone/Gaetan Bally) - Click to enlarge EZB-Präsident Mario Draghi konstatierte letzte Woche zufrieden, dass die aktuellen Turbulenzen in einzelnen Staaten auch dort bleiben und nicht andere Länder anstecken. Seine Kollegen in der Nationalbank, die diese Woche ihren geldpolitischen Entscheid fällen, dürften das etwas...

Read More »Credit Suisse found lacking in fight against money laundering

Not up to scratch, says FINMA of CS’s efforts to run a clean operation (© KEYSTONE / WALTER BIERI) Swiss bank Credit Suisse has failed to meet its obligations to prevent money laundering, says Switzerland’s financial supervisory authority. According to FINMA, the Financial Market Supervisory Authorityexternal link, the misconduct is related to the alleged corruption cases around FIFA, world football’s governing body,...

Read More »FX Weekly Preview: Dollar Pullbacks Remain Shallow as Rate Differentials Widen

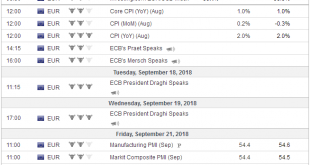

The trajectory of monetary policy in the US and Europe has been fairly clear. There is practically no doubt that the Fed will hike rates on September 26. Despite softer than expected PPI and CPI figures, the market has become more confident of another move in December. The Federal Reserve’s balance sheet unwind reaches its maximum velocity of $50 bln a month in Q4. Eurozone It is also understood that ECB will reduce...

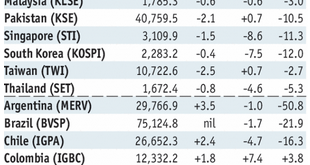

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the...

Read More »Some Swiss Rail ticket machines set to disappear

© Hai Huy Ton That | Dreamstime.com Ticket machines once replaced many of the people selling ticket from counters. Now the internet and mobile phones threatens ticket machines. As more and more people use dash past ticket machines with an electronic train ticket in their pocket, Swiss Rail is looking at phasing out some machines according to various newspapers including 20 Minutes. The 150 machines selling fewer than 20...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org