Mathias Ruch (foreground) explains his vision as co-founder and CEO of CVVC. A consortium of Swiss investors has launched a private equity vehicle that aims to collect up to $100 million with the long-term goal of getting 1,000 blockchain companies off the ground internationally every year. The Swiss company Crypto Valley Venture Capitalexternal link (CV VC) launched its initial “Genesis Hub” incubator in Zug, home to...

Read More »Portfolio Re-Balancing and the Dollar

Boosted by tax reform, deregulation, and strong earnings growth, US equities have motored ahead, leaving other benchmarks far behind. As the Great Graphic here shows, most of the other benchmarks are lower on the year. The S&P 500 (yellow line) is up 8.8% for the year before the new record highs seeing seen now, while the Dow Jones Stoxx 600 from Europe (purple line) is still off 1.7%. The MSCI Asia Pacific Index...

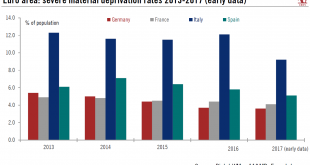

Read More »Italian material deprivation rates still the worst among large euro area economies

Latest poverty figures provide government with an argument for fiscal stumulus. Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase...

Read More »Le Conseil fédéral se moque des personnes âgées!

Le Conseil fédéral se distingue par 2 points tout compte fait complémentaires. Le premier est son soutien indéfectible à la politique expansionniste et ruineuse de la BNS, dont il a la responsabilité au plan constitutionnel. Celle-ci mobilise les richesses du pays, puis les convertit en monnaies étrangères, pour enfin les investir dans des actifs plus ou moins pourris, plus ou moins risqués, voire plus ou moins...

Read More »FX Daily, September 20: The Mixed Performance Makes it Difficult to Talk about The Dollar

Swiss Franc The Euro has fallen by 0.40% at 1.1244 EUR/CHF and USD/CHF, September 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro poked through $1.18 for the first time since the June ECB meeting. There is an option for about 740 mln euros that expires there today and another at $1.1775 for 890 mln euros. That June high was near $1.1850, which was a five-high. If...

Read More »Trump’s Backdoor Power Play to Rein In the Fed

“Just run the presses – print money.” That’s what President Donald Trump supposedly instructed his former chief economic adviser Gary Cohn to do in response to the budget deficit. The quote appears in Bob Woodward’s controversial book Fear: Trump in the White House. Trump disputes many of the anecdotes Woodward assembled. But regardless of whether the President used those exact words, they do reflect an “easy money”...

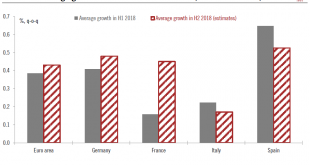

Read More »Contrasting Fortunes within the Euro Area

While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes. The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators...

Read More »Commodity Trading Consortium Launches Blockchain Platform

It is a highly complex process to get oil from the ground and into cars. (Copyright 2018 The Associated Press. All rights reserved.) A consortium of commodities traders, banks and the world’s largest goods inspection company have joined forces to launch a blockchain platform in Switzerland, which is intended to ease the administrative burden of shifting oil, grain and other products around the world. The Komgo venture...

Read More »Das Bad im Geldhaufen

Die Schweizerische Nationalbank hält die Schleusen im Kampf gegen die Frankenstärke weiterhin offen. Dies macht die Zentralbank indes zunehmend anfällig für politische Einflussnahme und Begehrlichkeiten. Als Carl Barks nach dem Zweiten Weltkrieg die Comicfigur Dagobert Duck erschuf, dachte er kaum an die Schweiz. Das Bild vom alten Knaben, der nur dann wirklich glücklich ist, wenn er ein Bad in seinen Golddukaten nehmen...

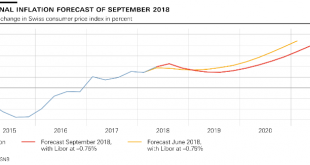

Read More »Monetary Policy Assessment of 20 September 2018

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org