For about ten bucks a month, Netflix will give you all the movies you can watch, plus tons of TV show series and other programs, such as one-off science documentaries. They don’t offer all movies, merely more than you can watch. Oh, and there are no commercials. They don’t just give you old BBC reruns, which you know they can get for a pittance. Netflix is spending money (well Federal Reserve Notes) producing its own original content. Did we mention that there are no commercials? How is this even possible? According to CNBC, Netflix is spending billion to produce 700 shows. Assuming all of its reported 118 million subscribers pay , their production budget eats up more than half a year of their total

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basic Reports, capital consumption, churn, dollar price, falling interest, Featured, gold basis, Gold co-basis, newsletter, Schumpeter, silver basis, Silver co-basis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

For about ten bucks a month, Netflix will give you all the movies you can watch, plus tons of TV show series and other programs, such as one-off science documentaries. They don’t offer all movies, merely more than you can watch. Oh, and there are no commercials.

They don’t just give you old BBC reruns, which you know they can get for a pittance. Netflix is spending money (well Federal Reserve Notes) producing its own original content.

Did we mention that there are no commercials? How is this even possible? According to CNBC, Netflix is spending $8 billion to produce 700 shows. Assuming all of its reported 118 million subscribers pay $10, their production budget eats up more than half a year of their total subscription fee revenue.

CNBC reports that Netflix is exploring the idea of putting ads in its shows. Unfortunately, a quarter of its subscribers say they would leave if that happens. The economics of free vs the economics of losing 25% of your customers in one wrong move. It’s the tiger or the tiger.

Netflix Devalued

In thinking about this, something struck us. Movies and TV shows have been devalued. We have come a long way (down) since the halcyon days of the 1970’s when Keith began watching TV. Back then, shows and movies were rare, and hence special. Today, the value to the marginal consumer is “don’t bother showing it to me, even for free, if there are to be ads.” (CNBC reports most of those who would drop Netflix over ads would not return even if the subscription price dropped.)

The reason is self-evident. There are so many movies, so many movie-like shows (e.g. Game of Thrones, and there is soon to be a series based on J.R.R. Tolkien’s The Silmarillion), that the typical consumer of video has more stuff available than he can hope to watch. And Netflix alone is producing 700 more every year. When Keith was a kid, he recalls many a weekend of “there’s nothing on TV”.

We think of the mechanism behind the law of supply and demand. It is the formation of the bid price and the offer price. The bid price is set by the competition among producers (and the offer comes from the competition among consumers). Producers of any product—in this case movies—take the bid price. Which, according to CNBC is so low, that it has reached zero. Including even ads. You can apparently charge ten bucks a month for access to the video smorgasbord, but the video-food had better be free.

This means that the competition among producers is so intense, that they are dumping so much video product onto the consumer bid, that they have pushed it all the way basically to zero. And they keep dumping more! 700 more just from Netflix alone.

With this thought under consideration, Keith was returning from dinner one evening and thinking about whatever happened to once-successful chain restaurants like Marie Calendars and Cocos (a Southwest franchise). Many stores have been closed, the ones still hanging on look tired and struggling. Of course, today increasing numbers of diners look for trendy concepts such as “farm to table”, vegan, and paleo.

It is not just movies, where marginal utility has fallen to just about zero. It’s happened in restaurants too.

We are not so interested in one firm, and we won’t offer the Nth + 1 analysis of NFLX (the marginal utility of stock analysis also falling rapidly to zero). We are interested in understanding the effects of monetary policy on all firms. In this endeavor, we would seem to be virtually alone. Who else asks the question: how does monetary policy cause the decline of once-hot restaurant properties and at the same time overstimulate overproduction of video content?

We have written many times that falling interest causes falling profit margins, most extensively in our Yield Purchasing Power series. Indeed, the theme is that one receives a smaller and smaller yield on all forms of capital.

Looking at a movie property or a restaurant gives another view of the same phenomenon. One is obliged to invest more, to get less. The falling interest rate does not dole out subsidized loans to the small to medium enterprise. Cocos, for example, has about 60 stores.

Capital Churn

It concentrates unimaginable capital into the hands of a very select few, the darlings of the investment world such as Netflix, Amazon, and Tesla. And those companies can keep their access only by executing on whatever story investors want to buy.

These companies are thereby afforded to produce and offer goods and services that would be impossible in a normal credit environment. Much to the downside of their would-be competitors, who are not given such largesse. They can, well… they can make movies for which there is no conceivable path to profit. We say this without an in-depth knowledge of Netflix’ business, just looking at the idea of a $10 admission fee to a buffet where it is possible to eat one movie a day easily, and still consume lots of TV shows and other content besides.

Even while Cocos and Marie Calendar’s were declining here in Arizona, Cheesecake Factory and Grand Lux Café were on the rise. Now even these newer concepts look dated, and the market is on to the next thing. We watched them build out a new Shake Shack store. At first, it was the trendy place to eat, and lunch and dinner saw lines out the door and around the corner, of people waiting to get in to get their burger and drink. Now the Shake Shack is like any other restaurant, walk up and order, take a seat and eat your fast food. The market is on to avocado toast, cauliflower rice, and house-made artisanal pickles. So invest a few million bucks in a restaurant to serve this fare, while it’s hot.

Joseph Schumpeter wrote about creative destruction, as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” However, he could not have envisioned the epic fall of interest rates that began three decades after his death.

So we must add a new idea. Capital churn is when perfectly good capital is rendered unprofitable, not by the innovation that occurs in a free market, but by the new malinvestment which renders the old investment submarginal.

Capital churn looks similar to creative destruction. But capital churn is a creature of the falling-rates monetary environment. Falling rates are an unnatural product, not of a free market, but of the use of irredeemable currency. They occur in the late stages, when the accumulated debt rises to the point where there is little demand for credit except on the downtick of interest rates. Perhaps by the movie producer or the next food trend. What do readers think of the idea of vegan steaks made of cauliflower and Portobello mushrooms, served over a bed of avocado-kale?

The gold standard is the antidote to this, as only gold stabilizes the interest rate.

Keith is working with Nevada, to help them issue a gold bond. He has put up a petition to show the state government that there is support for their move forward, and demand to buy it if they sell it. Please click here for the petition at Monetary Metals, especially if you would consider buying a gold bond. If you’d like to sign, but prefer not to give us your email address, please click here for the petition at Change.org.

Supply and Demand Fundamentals

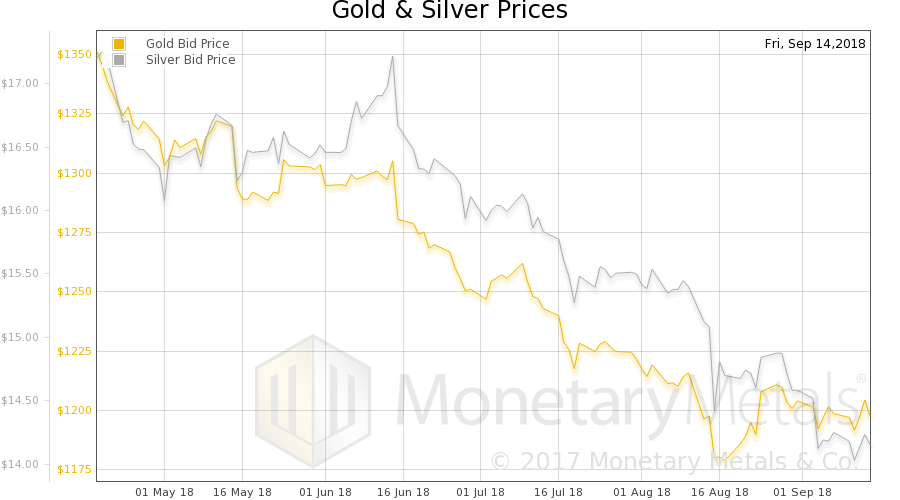

This price of gold fell three bucks, and the price of silver fell ten cents.

Perhaps because of the ongoing $150 price drop so far since April, we saw some doozy email subjects and article headlines this week. One notable one, from the man who confidently asserted we will have hyperinflation by the end of the year—in 2009—now says that the dollar is close to losing its reserve currency status. Clearly, if the dollar goes down then the price of gold (measured in these going-down dollars) will be up. For those that want profit$, that number again is 1-800-BUY-GOLD!

The debtors of the world can’t “replace” their dollar debts. What would this even mean? The creditors of the world can’t find any other irredeemable currency that comes remotely close in terms of liquidity. And that is aside from the issue that the system will fail first in the periphery, so it will be better to hold dollars than dollar-derivatives (e.g. pound and euro, much less toilet paper such as bolivar and lira).

Another popular theme is that stocks and bonds will have their comeuppance, when stocks crash and gold skyrockets. This is openly wishing other investors ill (as distinct from analysis of the debt problem or the Fed’s credit cycle). Does one party’s gain depend on others’ losses?

| We believe this is part of the reason why so many normal people want nothing to do with gold (the other being, prior to Monetary Metals, gold does not have a yield).

For our part, we try to say as often as we can that our dire prognosis for the monetary system or even our conclusion that rising assets is a process of capital consumption, is not blaming people for speculating. The Fed applies perverse incentives, and everyone is forced to make the best of those incentives, like it or not. Our condemnation is reserved for the apologists for irredeemable currency, central planning, socialized credit, and collectivized resources. The dollar will resume its fall (not measured in terms of its derivatives, but in terms of gold) all too soon. Indeed, the Monetary Metals calculated gold fundamental price had bottomed in late June at around $1,300, and started to rise in late August. Now, it looks like the silver fundamental price may be bottoming over $15.50. We will look at the supply and demand fundamentals of both metals. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It rose further, to another record high this week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

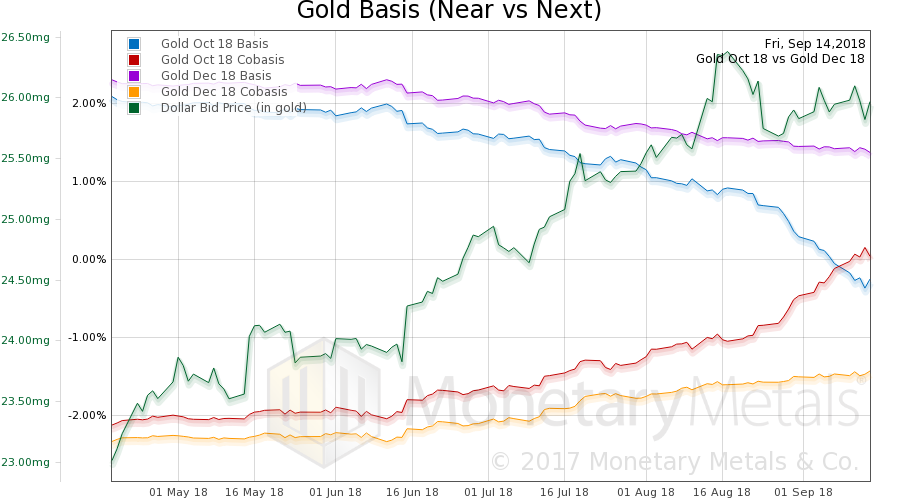

Gold Basis and Co-basisHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. We are showing the Oct and Dec basis, as the October contract is under selling pressure. The Dec contract shows a drop in basis (purple line, i.e. abundance) and rise in cobasis (yellow, scarcity). This week, the Monetary Metals Gold Fundamental Price rose two bucks to $1,373. |

Gold Basis and Co-basis(see more posts on dollar price, gold basis, Gold co-basis, ) |

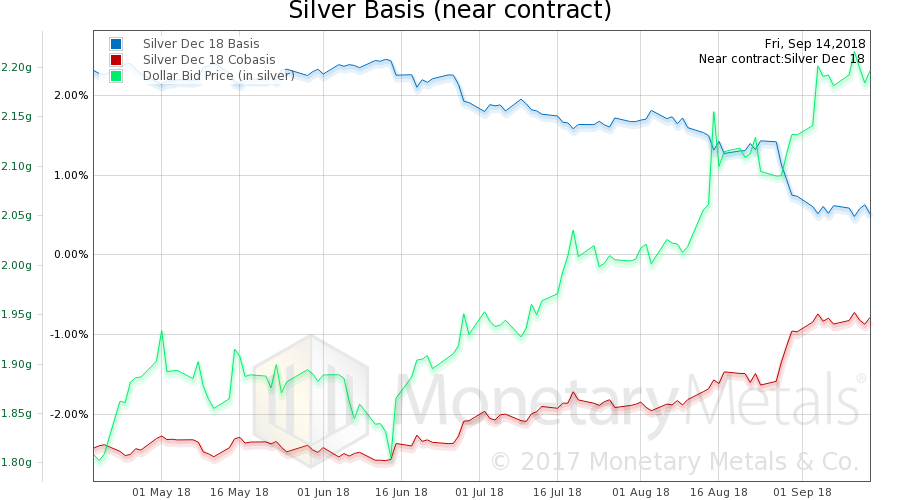

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. It’s the same story in silver, only the silver basis continuous is rising. The Monetary Metals Silver Fundamental Price fell $0.05, to $15.81. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2018 Monetary Metals

Tags: Basic Reports,capital consumption,churn,dollar price,falling interest,Featured,gold basis,Gold co-basis,newsletter,Schumpeter,silver basis,Silver co-basis