We expect the ECB to remain on hold at the 21 January meeting, but the combination of market stress, lower oil prices and renewed concerns about global growth is likely to force the Governing Council to consider easing policy again by the Spring. Two weeks into 2016, six weeks after easing policy at the December meeting, here we are again: the ECB is under pressure to do more. Investors continue to react to a number of related concerns, including the uninterrupted fall in oil prices, volatility in Chinese equity and currency markets, uncertainty over China’s growth and medium-term strategy, rising risks of credit events and, more generally, renewed concerns about global growth. Although we believe that US/global recession fears are overdone, those concerns are weighing on risk assets, which are having their weakest start of the year in decades. So what are the consequences for the ECB? We wouldn't expect too much from ECB president Mario Draghi on Thursday. The Governing Council will surely leave the door open to more easing if necessary, in light of recent developments. On the other hand, Draghi should emphasise the importance of the December package while insisting that monetary policy cannot be the only game in town to address weak aggregate demand.

Topics:

Frederik Ducrozet considers the following as important: Draghi, ECB, Macroview, Monetary Policy, QE

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

We expect the ECB to remain on hold at the 21 January meeting, but the combination of market stress, lower oil prices and renewed concerns about global growth is likely to force the Governing Council to consider easing policy again by the Spring.

Two weeks into 2016, six weeks after easing policy at the December meeting, here we are again: the ECB is under pressure to do more. Investors continue to react to a number of related concerns, including the uninterrupted fall in oil prices, volatility in Chinese equity and currency markets, uncertainty over China’s growth and medium-term strategy, rising risks of credit events and, more generally, renewed concerns about global growth. Although we believe that US/global recession fears are overdone, those concerns are weighing on risk assets, which are having their weakest start of the year in decades. So what are the consequences for the ECB?

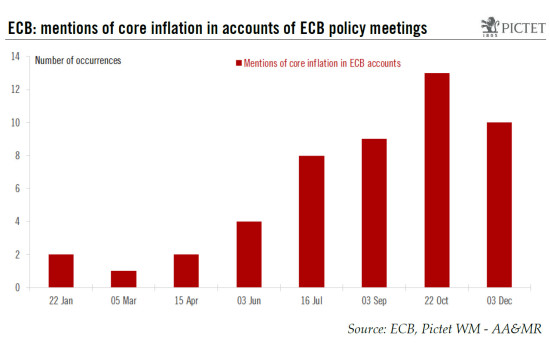

We wouldn't expect too much from ECB president Mario Draghi on Thursday. The Governing Council will surely leave the door open to more easing if necessary, in light of recent developments. On the other hand, Draghi should emphasise the importance of the December package while insisting that monetary policy cannot be the only game in town to address weak aggregate demand. Importantly, we expect the ECB to further increase its focus on underlying measures of inflation, as it did last year, trying not to overreact to weaker headline inflation prospects that are almost exclusively due to lower oil prices.

In the end, the likelihood of fresh ECB action has increased further, but delivery may not come until the Spring–March at the earliest, more likely June, depending on near-term market developments.

Even after the December package was delivered and some ECB hawks expressed their reservations, we expected the ECB to remain under pressure to ease in 2016 as a whole. Unless economic indicators improve rapidly (especially in China) and risk appetite makes a comeback, ECB easing will be a question of 'when' and 'how' rather than 'if'.

A question of timing and tools

It has become consensus that the ECB will wait and see how recent market developments affect business confidence, real economic developments and inflation expectations before responding to market stress. Investors see the Governing Council as divided and constrained by the lack of new instruments to ease policy. We agree with the former view, less so with the latter.

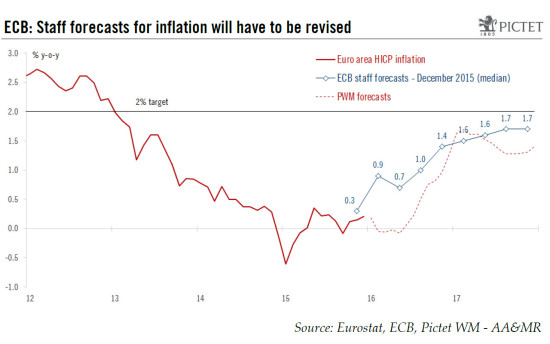

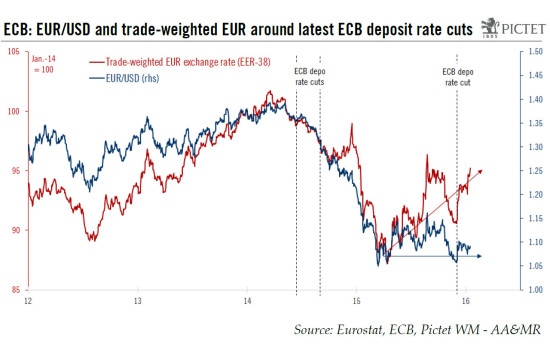

In terms of timing, the next important deadline is the March meeting, when the updated staff projections will be published along with the new projections for 2018. The collapse in oil prices will inevitability lead to a further downward revision to inflation forecasts, at least for 2016 (from 1% to between 0% and 0.4% in our view, depending on a hypothetical rebound in oil prices between now and the cut-off date around mid-February). The recent appreciation of the trade-weighted EUR will not help either.

That said, medium-term (2018) projections are likely to remain not too far from the 2% target, around 1.7-1.8%, and growth prospects have held up relatively well, calling for a calibrated response rather than a bazooka.

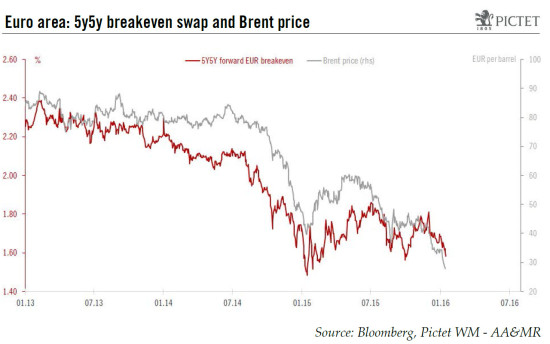

The biggest concern for ECB members at the moment comes from potential indirect effects from the collapse in oil prices in an environment of subdued aggregate demand. ECB Chief Economist Peter Praet recently noted that lower-for-longer commodities may have permanent effects, including via the expectations channel. Should these risks materialise, the ECB's response would have to be much more radical.

Either way, we expect the ECB to further increase its focus on underlying measures of inflation, in an attempt not to overreact to weaker headline inflation prospects that are almost exclusively due to lower oil prices.

In terms of tools, the ECB's reaction function looks less clear today than when Mario Draghi described it in Amsterdam in April 2014. We have the impression that once a consensus has been reached, the Governing Council is trying to minimise the risk of internal dissension when choosing its instruments, which may not necessarily be the most appropriate. Still, we stick with the view that any “unwarranted tightening” in financial conditions, including through a stronger trade-weighted currency should be addressed with a deposit rate cut. This option also happens to be the least controversial according to the accounts of the December meeting, after the Governing Council decided to cut the deposit rate by 'only' 10bp, to -0.30%.

“A cut in the deposit facility rate or 10 basis points was seen as unlikely to trigger material negative side effects and was also seen as having the advantage of leaving some room for further downward adjustments, should the need arise,” the accounts said. “However, the further cut into negative territory would need to be accompanied by close monitoring of the transmission to financial markets, banks and the overall economy.”

A further deterioration in the medium-term outlook for price stability, including the risk of inflation expectations 'dis-anchoring', should be addressed with an expansion of the QE programme, either in duration (beyond March 2017) or in terms of the monthly pace of purchases (from EUR60bn currently). The former would likely be seen as cosmetic easing by the market; only the latter would come as a significant move, in our view.

Draghi previously indicated that the Governing Council would review the technical aspects of the Asset Purchase Programme “during the Spring”. QE modalities have been adjusted before, including an increase in the issuer limits and a broadening of the universe of eligible securities to buy. The Governing Council could go a step farther if it were to increase the size of the programme more significantly in order to ensure smooth implementation. The range of options here goes from higher issue/issuers limits for highest-ranked bonds, to adding new securities such as corporate bonds, or even tolerating some deviation from the geographical breakdown of bond buying based on capital keys.

On balance, we think the ECB is likely to do more, and the 2 June meeting looks like the most likely timing to deliver another package. Our baseline scenario being fairly constructive for the global economy and the euro area, we expect the next ECB package to come as another incremental, calibrated response to weaker inflation prospects rather than a big bazooka. We will re-assess the likelihood of each option, including a rate cut and a QE expansion, following this week's policy meeting.