After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China. Three days in, news reached the Diamond that the Communists had closed down the affected region. Worse, on February 2, the company operating the tour disclosed to the captain that one passenger who had disembarked in Hong Kong tested positive for this novel coronavirus. The crew and passengers were told they had to immediately turn around and head back toward Tokyo. What followed was a nightmare.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Bank of Japan, currencies, economy, Featured, Federal Reserve/Monetary Policy, industrial production, Japan, Markets, newsletter, QE, QQE, Retail sales, Shinzo Abe

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China.

Three days in, news reached the Diamond that the Communists had closed down the affected region. Worse, on February 2, the company operating the tour disclosed to the captain that one passenger who had disembarked in Hong Kong tested positive for this novel coronavirus.

The crew and passengers were told they had to immediately turn around and head back toward Tokyo.

What followed was a nightmare. Since it was pretty much the only information the world had at the time about this disease, it played an outsized role in provoking often draconian responses. The numbers would end up projecting a situation beyond imagination, invoking the Spanish flu.

But those ended up being an unusual outlier, a case study only in what the most perfect conditions for the viral spread might unleash. It wasn’t representative, at all, for how the rest of the world would end up facing COVID-19. And it was nothing like what Japan would experience.

While Tokyo would fall under suspicion for the Diamond Princess sitting in its harbor under quarantine, as well as its close links to China, the Japanese government didn’t panic and never did impose a country-wide lockdown. Prime Minister Abe would issue restrictions, of course, but only asking that the Japanese people heed guidelines along with a healthy dose of common sense.

In the middle of May, the Abe government began to roll back those recommended restrictions with most of Japan already stirring back to life. As the AP reported:

Under the emergency, people were asked to stay at home and non-essential businesses were requested to close or reduce operations, but there was no enforcement. Since May 14, when the measures were lifted in most of Japan, more people have been leaving their homes and stores have begun reopening.

At the time, there had been 16,600 confirmed COVID cases, with 850 reported deaths associated with the disease.

|

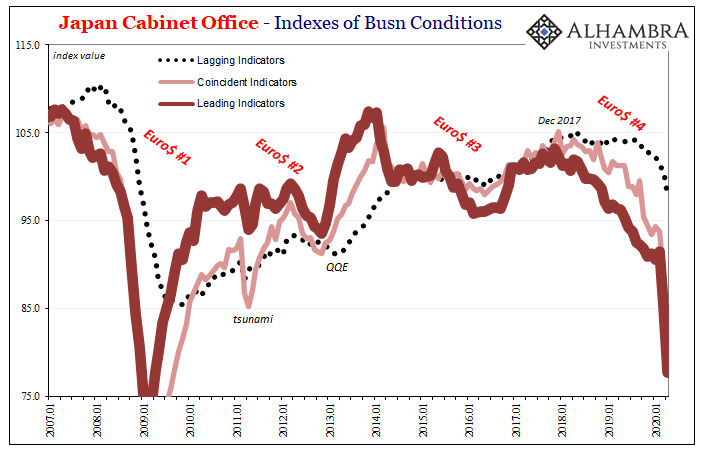

While good news, to be sure, these figures can’t be taken in isolation. The question which will really plague Japan, as across the rest of the world, one which I fear we all will be forced to wrestle with and debate endlessly for years: was it worth it? There is this information asymmetry to begin with; we will never know just how many deaths and health problems might have appeared had things gone differently, a lighter touch focused instead on the most vulnerable rather than blanket measures unnecessarily imposed upon those with little danger. On the other hand, though, we are starting to get a sense of what it cost. In Japan, where the death toll remains fewer than 1,000 out of a total population of more than 126 million, more and more it appears like the economic collapse will only get sorted out over years; certainly not months. And that’s according to the mainstream econometric models which in Japan place a surplus of effort into the QQE column (despite it having moved into its eighth year of existence). Japan may have come back during May 2020, its economy did not. |

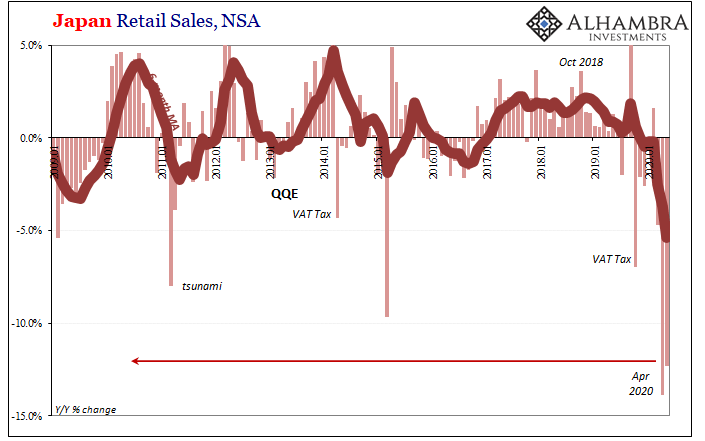

Japan Retail Sales, NSA 2009-2020(see more posts on Japan Retail Sales, ) |

| Retail sales, for one thing, had plummeted during April down by almost 14% year-over-year, a level of economic destruction the country hadn’t seen since the darkest days of its (first) Lost Decade in 1998’s Asian flu. While some were expecting a sizeable turnaround, it ended up being more like the US payroll report (which was only hyped because it had a plus sign in front, not because it realistically indicated a significant, meaningful rebound).

Ostensibly a positive number, too, the seasonally-adjusted figure measured just +2.1% from April’s deep trough. Unadjusted, retail sales were down more than 12% – the second double-digit decline in a row – in May’s estimates. |

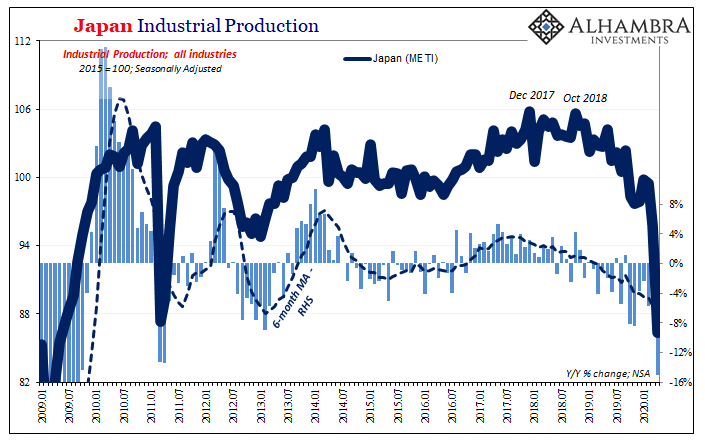

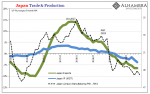

Japan Industrial Production, 2009-2020(see more posts on Japan Industrial Production, ) |

| Prime Minister Abe was quick to take credit for the first set of results, those of the pandemic; “We were able to bring the outbreak nearly under control in just a month and a half in a uniquely Japanese way.” In the long run, however, it is the second set which may doom his government.

The people in Japan have put up with two dozen QE’s including three different versions of QQE, and the lack of growth in the economy none of them could turn around. Imposing a deep recession, however, is a categorically different story. Already deeply pessimistic about an upside that may no longer exist, that doesn’t mean anyone will just accept a possibly deep downside with protracted negative pressures. Unlike in America, in Japan there was already unease over the state of the economy heading into 2020. While central bankers here declared it no more than a close call in 2019, those in Japan were already revving QQE back up because the global economy had pulled the Japanese economy into the significant minuses. And then this. Poll after poll conducted inside and outside the country has rated the Japanese government the worst – by its own citizens. And yet, Japan has hardly been hit compared with almost every other. Why the huge disparity? |

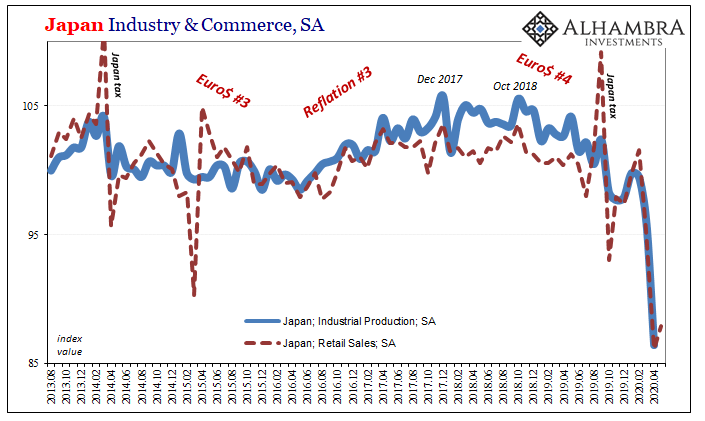

Japan Industry & Commerce, SA 2013-2020 |

But the way its leaders dealt with the crisis were rated poorest by citizens in all four fields — politics, business, community and media. The overall score, 16, was worst as well. Most often these write-ups go on to emphasize intangibles, or the lack of them being exhibited by officials; leadership or displaying public confidence. It obviously isn’t actual results, at least those so far as the pandemic is concerned, that is driving such widespread skepticism and frustration. Whatever the reason, where the economy is concerned the Japanese should be weeks if not months ahead of the rest of the world. Instead, the data continues to suggest the worst potential outcome – globally synchronized. The term globally synchronized growth, 2017’s key buzzword, may end up most relevant in its opposite place three years thereafter. A warning, perhaps, for even those nations currently enjoying higher approval ratings than Abe’s basement levels. Once the virus runs its course, what are the chances the economic disaster eclipses it in the long run conversation? A no-win situation from the beginning, still, when we look back after having completed what increasingly looks like the rough couple of years before all of us, which will end up still dominant over that future? |

Japan Cabinet Office, 2007-2020 |

Tags: Bank of Japan,currencies,economy,Featured,Federal Reserve/Monetary Policy,industrial production,Japan,Markets,newsletter,QE,QQE,Retail sales,Shinzo Abe