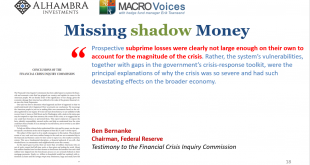

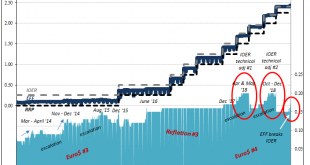

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing. What was going on in the shadows wasn’t...

Read More »Monthly Macro Chart Review: April 2019

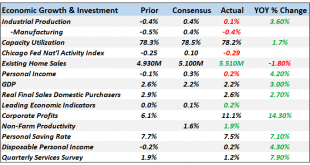

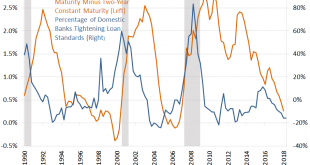

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed. On a more positive note, housing seems to have found its footing with lower rates and employment is still fairly robust....

Read More »External Demand, Global Means Global

The Reserve Bank of India (RBI) cut its benchmark money rate for the second straight meeting. Reducing its repo rate by 25 bps, down to 6%, the central bank once gripped by political turmoil has certainly shifted gears. Former Governor Urjit Patel was essentially removed (he resigned) in December after feuding with the federal government over his perceived hawkish stance. Shaktikanta Das, a career bureaucrat with...

Read More »Retail Sales In Bad Company, Decouple from Decoupling

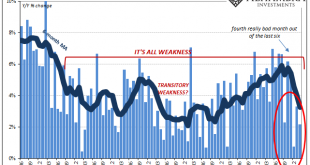

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks. There had been noises overseas, troubling indications that had gone on...

Read More »Phugoid Dollar Funding

On August 12, 1985, Japan Airways flight 123 left Tokyo’s Haneda Airport on its way to a scheduled arrival in Osaka. Twelve minutes into the flight, the aircraft, a Boeing 747, suffered catastrophic failure when an aft pressure bulkhead burst. The airplane had been improperly repaired from a tailstrike (the tail of the aircraft actually hitting the runway pavement) seven years earlier, and therefore wasn’t sufficiently...

Read More »Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting...

Read More »February 2019 PBOC/RMB Update

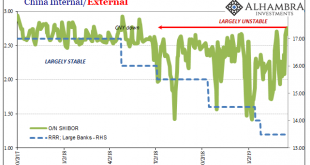

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions (here’s another). China...

Read More »Slump, Downturn, Recession; All Add Up To Sideways

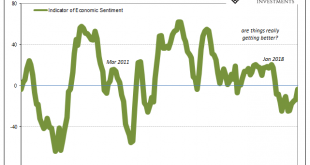

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6. That’s up from -24.7 back in October, though sentiment had likewise improved at one point last year, too. In July, the number...

Read More »The Real End of the Bond Market

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke). But as esoteric as all that may be, recent corporate statements leave much less doubt at least as to the primary effect....

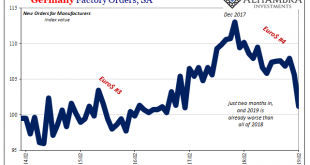

Read More »The World Economy’s Industrial Downswing

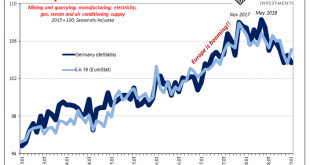

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it. Starting with Europe first, Germany’s deStatis had earlier reported factory orders and production levels in January 2019 while...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org