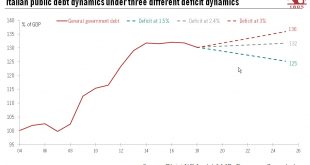

The populist government’s plans to increase the deficit could set it on a collision course with Brussels. We remain bearish Italian bonds and euro peripheral bonds in general. Leaders of Italy’s coalition government and the finance minister yesterday agreed on a 2.4% GDP deficit target. The new target is higher than our expectation of a deficit “above but close to 2.0%” in 2019. For us, the key issue is not so much the...

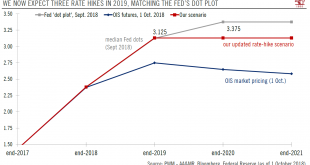

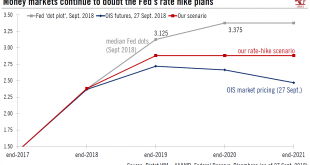

Read More »Taking the Fed’s dots at face value

We now expect the Fed to raise rates three times next year instead of two.The Federal Reserve (Fed) is subtly turning more hawkish, mostly due to its increased confidence in the US outlook. While the Fed’s ‘dot plot’ chart (which illustrates the central bank’s rate hike projections) was unchanged in September from June, we think the chart’s message that there will be three Fed rate hikes next year should be taken more seriously by the market.Consequently, we are revising up the number of...

Read More »Weekly View – Bad but not mad

The CIO office’s view of the week ahead.The Italian government’s budget deficit target of 2.4% for each of the next three years. It could have been worse: at one stage, the populist coalition’s spending plans looked like raising the deficit to 6%. But its actions set the stage for a clash with Brussels, while Italy’s credit rating could be downgraded in the coming weeks. For some time we have been underweight Italian bonds (as well as euro area peripheral bonds in general), a decision that...

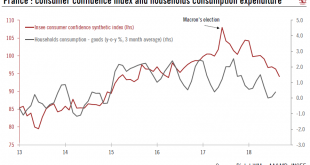

Read More »A bit too early to be worried about French consumers

Despite the recent fall in French consumer confidence, spending should pick up in the second half of the year. The French economy disappointed in the first half of this year. While there was a widespread ‘soft patch’ in the euro area, the source and size of the slowdown in France stands out. The real GDP growth rate fell by 0.5 points, much more than the rest of the euro area. Moreover, while the slowdown in the other...

Read More »Italy tests the EU’s tolerance

The populist government’s plans to increase the deficit could set it on a collision course with Brussels. We remain bearish Italian bonds and euro peripheral bonds in general.Leaders of Italy’s coalition government and the finance minister yesterday agreed on a 2.4% GDP deficit target. The new target is higher than our expectation of a deficit “above but close to 2.0%” in 2019. For us, the key issue is not so much the deficit figure in itself, but more the fact that the government plans the...

Read More »A bit too early to be worried about French consumers

Despite the recent fall in French consumer confidence, spending should pick up in the second half of the year.The French economy disappointed in the first half of this year. While there was a widespread ‘soft patch’ in the euro area, the source and size of the slowdown in France stands out. The real GDP growth rate fell by 0.5 points, much more than the rest of the euro area. Moreover, while the slowdown in the other countries was mainly due to net trade, in France weakening in household’s...

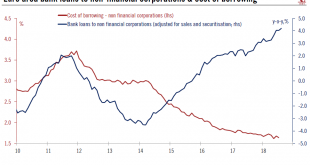

Read More »Credit Growth Remains Buoyant in the Euro Area

Financial conditions remain supportive and are not expected to tighten much in the coming months. Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months. Overall, domestic demand is likely to continue to be the main driver of growth in the euro area,...

Read More »Fed rate hikes well into 2019 may be on the cards

Fed sticks to routine of one hike per quarter, with growing chance of extra rate increase next year.As widely expected, the Fed hiked rates another 25bps on 26 September, continuing its routine of raising rates by 25bps each quarter.The Fed displayed optimism about US growth prospects. Chairman Powell said that the US was in a bright spot that was expected to last. This optimistic tone was echoed by a rise in the Fed’s GDP growth forecasts, including for next year – even as higher trade...

Read More »Credit growth remains buoyant in the euro area

Financial conditions remain supportive and are not expected to tighten much in the coming months.Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months.Overall, domestic demand is likely to continue to be the main driver of growth in the euro area, helping to mitigate external weakness. Strong job growth combined with...

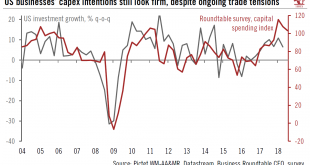

Read More »US corporates happy, and investing

The upswing in US capex defies negative trade headlines.The torrent of coverage about trade tensions hides an important positive development: US corporate investment is flourishing, and there are increasing signs this upswing in capital expenditure (capex) could persist. This could in turn mean that the US business cycle has further room to run, despite its advanced age, and that recession is still some way off.A survey we like to watch, particularly to gauge capex trends, is the quarterly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org