Fed sticks to routine of one hike per quarter, with growing chance of extra rate increase next year.As widely expected, the Fed hiked rates another 25bps on 26 September, continuing its routine of raising rates by 25bps each quarter.The Fed displayed optimism about US growth prospects. Chairman Powell said that the US was in a bright spot that was expected to last. This optimistic tone was echoed by a rise in the Fed’s GDP growth forecasts, including for next year – even as higher trade tariffs on Chinese imports kick in. Powell underplayed the impact of US-China trade tensions, hinting that he still they would end in a “fair trade” agreement at some point.Powell seemed voluntarily vague about the Fed’s tightening end point. However, recent signs point to the Fed adopting a more hawkish

Topics:

Thomas Costerg considers the following as important: Fed dot plot, Fed hawkishness, Fed rate rises, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Fed sticks to routine of one hike per quarter, with growing chance of extra rate increase next year.

As widely expected, the Fed hiked rates another 25bps on 26 September, continuing its routine of raising rates by 25bps each quarter.

The Fed displayed optimism about US growth prospects. Chairman Powell said that the US was in a bright spot that was expected to last. This optimistic tone was echoed by a rise in the Fed’s GDP growth forecasts, including for next year – even as higher trade tariffs on Chinese imports kick in. Powell underplayed the impact of US-China trade tensions, hinting that he still they would end in a “fair trade” agreement at some point.

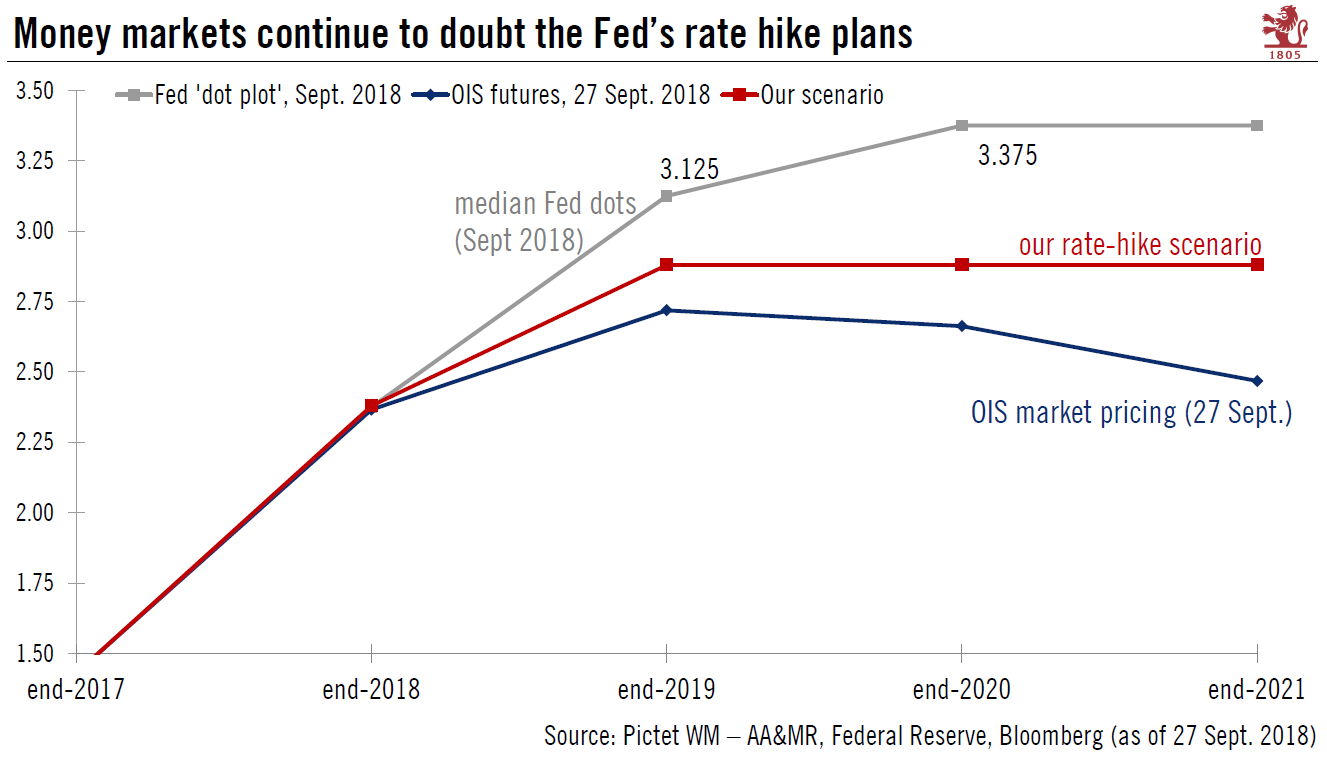

Powell seemed voluntarily vague about the Fed’s tightening end point. However, recent signs point to the Fed adopting a more hawkish stance. The Fed’s removal of the term “accommodative” from its press release, its 2019 median dot showing three expected additional rate hikes (with an additional one planned for 2020), and Powell’s attachment to a routine of one quarter-point hike per meeting, leave a strong feeling that Powell is set to hike rates until a significant disruption takes place. This disruption would either involve a sharp slowdown in US economic growth, or an equally sharp correction in financial markets.

Another rate hike in December looks very likely. We expect two additional rate hikes next year, but there is now a greater chance the Fed pushes through a third rate hike in 2019, in line with Fed officials’ ‘dot plot’ chart. That would mean a total number of three rate hikes in 2019 instead of the two expected in our central scenario, assuming that the Fed’s dot plot can be taken at face value.