The CIO office’s view of the week ahead.US equities declined roughly 7% over six days up to last Thursday. While the decline is in line with the median drawdown level since 2007, it was notable for its length, given the average drawdowns over the same time period lasted 40 days, rather than six. Most likely, investors were reacting to the higher risk environment created by rising bond yields. However, compared with February’s sell-off, there is less exuberance on the technical side....

Read More »Devil is in the details: Italian and French deficits are not quite comparable

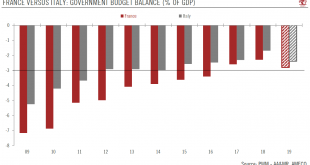

Italy’s structural weakness explain higher level of concern around its deficit target.Each EU member state is currently preparing 2019 budget plans for formal submission to the European Commission (EC) before mid-October. Among them, France and Italy’s budget plans have been raising eyebrows. Why is the EC concerned about Italy’s proposed 2.4% GDP deficit target for 2019 and not France’s target of 2.8%? Is Italy being treated unfairly by its European partners and by markets? Italy and France...

Read More »US inflation remains modest, but tariffs will soon make themselves felt

While we await the effect of import tariffs, inflation has still not taken off in the US. The Fed is unlikely to be swayed from its current rate tightening routine.Core consumer-price index (CPI) inflation rose a modest 0.12% month on month (m-o-m) in September, again undershooting market expectations, and the year-on-year (y-o-y) print stayed unchanged at 2.2% –a relatively benign outcome given the flourishing US economy and the tight labour market.Core inflation (excluding energy and food...

Read More »Innovation shock reshapes economic dynamics

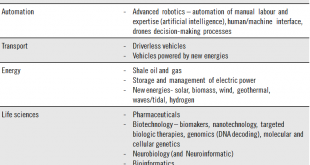

Head of Asset Allocation & Macro Research and Chief Strategist with Pictet Wealth Management, Christophe Donay shares his thoughts on the perennial relationship between innovation and economic growth.When analysing the current economic regime and assessing the potential for a shift in that regime, it is vital to take innovation into account. Demographic trends and productivity gains are commonly identified as the two main drivers of real economic growth. And innovation is a critical...

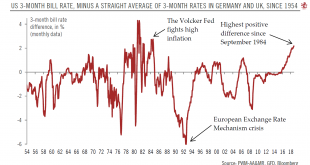

Read More »Fed rate decoupling

Monetary policy drift to continue.Fed likely to keep tightening while buoyed by a solid domestic backdrop Looking at the Federal Reserve (Fed) from the other side of the Atlantic, the question is really to what extent the Fed can continue to ‘decouple’ its monetary policy from other main global central banks, including those in Europe.The three-month Treasury bill rate in the US is at c.2.2%, while a straight average of the corresponding rate in Germany (c.-0.6%) and the UK (c.0.7%) is...

Read More »Squaring off over the Italian budget

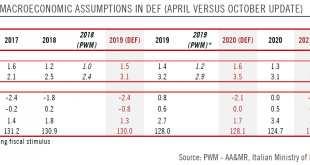

The Italian government’s budget plans set it on a collision course with the European Commission. The road to some kind of agreement is likely to be long and bumpy. The Italian government has confirmed its deficit target at 2.4% of GDP for 2019. This represents significant slippage from a previous budget deficit target of 0.8% in 2019. The deficit target has been set at 2.1% for 2020 and 1.8% for 202. But it is not the...

Read More »Squaring off over the Italian budget

The Italian government’s budget plans set it on a collision course with the European Commission. The road to some kind of agreement is likely to be long and bumpy.The Italian government has confirmed its deficit target at 2.4% of GDP for 2019. This represents significant slippage from a previous budget deficit target of 0.8% in 2019. The deficit target has been set at 2.1% for 2020 and 1.8% for 202. But it is not the headline deficit numbers that are a problem, but rather the details behind...

Read More »German September PMIs surprisingly weak

Blame the German automotive industry for the fall in manufacturing orders. Recent German soft and hard data in the manufacturing sector has been surprisingly weak. Data released today showed that the final manufacturing PMI fell to 53.7 in September, from 55.9 in August. Factory orders rose by 2.0% month-on-month (m-o-m) in August, having contracted for six out of the seven previous months. The increase in August...

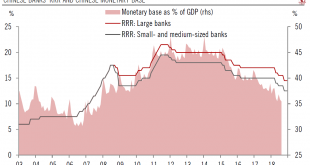

Read More »No massive monetary stimulus on the way from the PBoC

The latest cut in banks’ required reserve ratios seems likely to have been motivated by additional signs of slowdown in the Chinese economy, but may not herald a massive monetary stimulus.Over the weekend, the People’s Bank of China (PBoC) announced a cut of 100 basis points (bps) in banks’ required reserve ratio (RRR). This is the third RRR cut since April. The PBoC estimates that it will free up about Rmb 750 billion of net new liquidity in the banking system. According to the central...

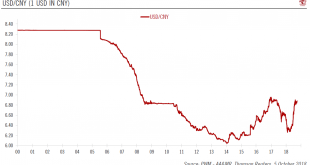

Read More »Renminbi nears a psychological threshold

The People’s Bank of China is unlikely to welcome further currency weakness.Having dropped more than 5% year to date, our scenario of weaker growth in China in 2019 (we expect GDP growth to decline to 6.1% from 6.6% in 2018) is likely to further weigh on the renminbi through the interest rate differential. The Chinese current account is unlikely to provide much relief, as it has moved into deficit in 2018. However, given that the renminbi is around 10% off its recent peak, a further sharp...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org