The populist government’s plans to increase the deficit could set it on a collision course with Brussels. We remain bearish Italian bonds and euro peripheral bonds in general.Leaders of Italy’s coalition government and the finance minister yesterday agreed on a 2.4% GDP deficit target. The new target is higher than our expectation of a deficit “above but close to 2.0%” in 2019. For us, the key issue is not so much the deficit figure in itself, but more the fact that the government plans the same 2.4% deficit for next three years (2019-21). Such deficit targets are unlikely to be welcomed by the European Commission.Currently, we have limited visibility on the assumptions used in the government’s projections for the budget deficit. Based on our own forecasts for Italian growth and rates, a

Topics:

Laureline Chatelain and Nadia Gharbi considers the following as important: Italian bond yields, Italian budget, Italian deficit, Italian ratings, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The populist government’s plans to increase the deficit could set it on a collision course with Brussels. We remain bearish Italian bonds and euro peripheral bonds in general.

Leaders of Italy’s coalition government and the finance minister yesterday agreed on a 2.4% GDP deficit target. The new target is higher than our expectation of a deficit “above but close to 2.0%” in 2019. For us, the key issue is not so much the deficit figure in itself, but more the fact that the government plans the same 2.4% deficit for next three years (2019-21). Such deficit targets are unlikely to be welcomed by the European Commission.

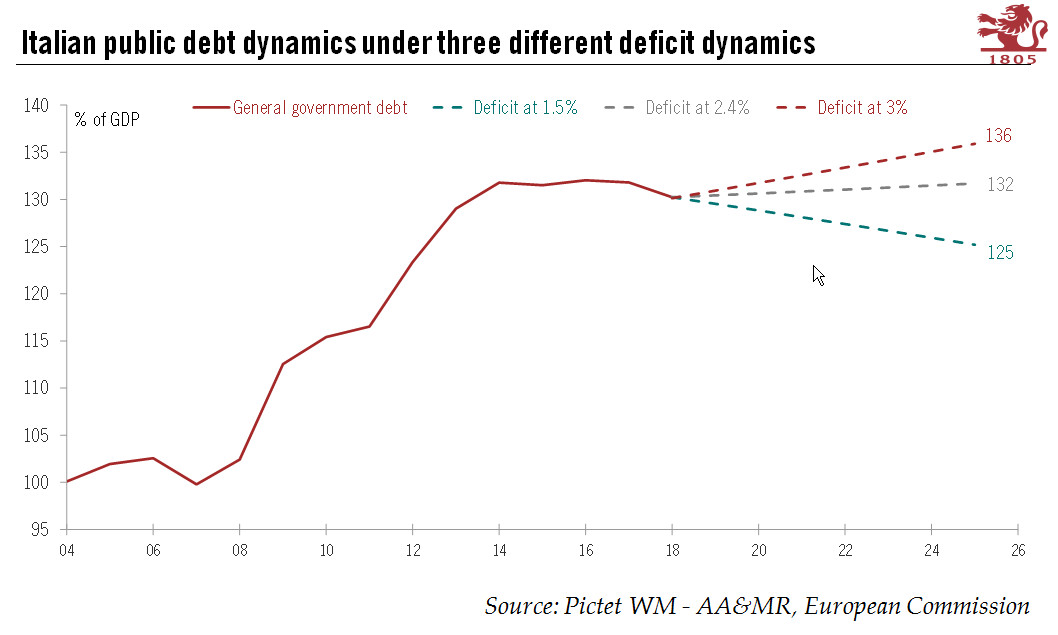

Currently, we have limited visibility on the assumptions used in the government’s projections for the budget deficit. Based on our own forecasts for Italian growth and rates, a 2.4% deficit will not lead to any decline in public debt. And even if the latest Italian budget plan does not breach the 3% of GDP ceiling set by the EU’s Stability and Growth Pact, it will still fall foul of EU rules.

Italy could first face warnings and possible sanctions from the European Commission after a lengthy period of consultation. If the EC finds that Italy is in non-compliance with EU rules, it could launch its Excessive Deficit Procedure and eventually fine Italy. Theoretically, Brussels could also suspend part or all of European Structural and Investment Fund commitments to Italy.

We therefore expect Moody’s and Fitch to announce a one-notch downgrade to Italy’s sovereign credit rating in October. The outlook they assign to their new ratings will be key: a negative outlook would increase the risk of a further downgrade. While we do not expect this to happen yet, a downgrade to sub-investment grade would have major consequences, as it would cause Italian sovereign bonds to be removed from major European bond indices.

At this stage, we are maintaining our bearish stance on euro area peripheral sovereign debt as we expect further volatility linked to Italy. Between confrontations with the EU, a likely ratings downgrade and prospects that economic growth will slow, the outlook for Italy’s sovereign debt remains muddy. Italian government’s assumptions for growth and average servicing cost are key to assessing Italian debt sustainability, how the European commission (EC) will react and whether or not rating agencies will take actions.