The CIO office’s view of the week ahead.Today’s kicking in of US tariffs on an extra USD200bn of Chinese imports, and China’s retaliation, marks a notable escalation in the trade war between the two countries. But markets prefer to look at the robust US economy, with strong M&A activity also helping (of which Comcast’s winning bid for Sky is just the latest manifestation). Markets seem to be betting that trade tensions will eventually cool. There is indeed a possibility that trade...

Read More »Business Indicators Present a Contrasting Picture of the Euro Area

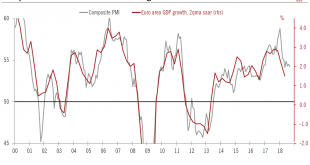

The services sector is proving resilient, but manufacturing disappoints. Euro area flash composite PMI dipped slightly to in September and came in slightly below consensus expectations. Activity in services picked up and weakened further in manufacturing, which continued its decline since the start of the year, falling to 53.3 in September from 54.6 in August. New export orders failed to grow for the first time since...

Read More »Cut to Swiss inflation forecast

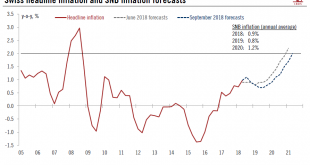

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation...

Read More »Italian material deprivation rates still the worst among large euro area economies

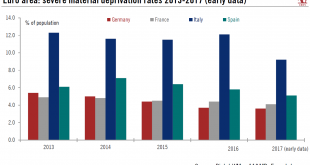

Latest poverty figures provide government with an argument for fiscal stumulus. Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase...

Read More »Kicking the tyres

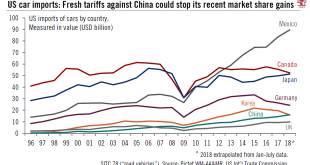

China’s ascent in the US car market could be stopped short by new tariffsUS President Donald Trump has shown a particularly strong interest in the US car industry – which carries both significant symbolic and political weight – and therefore in trade flows of foreign cars into the US. The recently negotiated trade agreement with Mexico is mostly about car manufacturing, particularly aimed at halting the ongoing displacement of US car production to Mexico. And Trump’s grievances against...

Read More »Business indicators present a contrasting picture of the euro area

The services sector is proving resilient, but manufacturing disappoints.Euro area flash composite PMI dipped slightly in September, coming in slightly below consensus expectations. Activity in services picked up and weakened further in manufacturing, which continued its decline since the start of the year, falling to 53.3 in September from 54.6 in August. New export orders failed to grow for the first time since June 2013.Overall, euro area composite PMI remains consistent with our forecast...

Read More »Italian material deprivation rates still the worst among large euro area economies

Latest poverty figures provide government with an argument for fiscal stumulus.Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase instalments or other loan payments; one week’s holiday away from home; a meal...

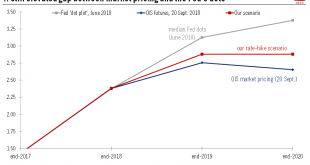

Read More »Fed preview: raising the ceiling

Next week’s Fed policy meeting is likely to confirm that the central bank is still on the path of gradual rate hikes, but could also see some hawkish signals on future policy.The Fed is very likely to raise rates by 25bps on 26 September, dismissing the trade war risk and emphasising the strong domestic economy and healthy job market instead.With a rate widely anticipated, the focus will be on any signals about future rates. We expect Chairman Jerome Powell’s press conference and the update...

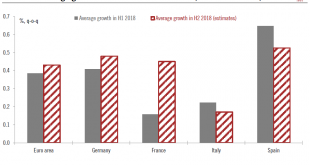

Read More »Contrasting Fortunes within the Euro Area

While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes. The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators...

Read More »Cut to Swiss inflation forecast

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019.At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation of the situation on foreign exchange as “fragile”. The SNB emphasized that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org