Despite the recent fall in French consumer confidence, spending should pick up in the second half of the year. The French economy disappointed in the first half of this year. While there was a widespread ‘soft patch’ in the euro area, the source and size of the slowdown in France stands out. The real GDP growth rate fell by 0.5 points, much more than the rest of the euro area. Moreover, while the slowdown in the other countries was mainly due to net trade, in France weakening in household’s expenditure also contributed. French households have been hit on several fronts this year: real wages have been dented by higher headline inflation, front-loaded tax hikes and uncertainty over labour market reforms have all played

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Despite the recent fall in French consumer confidence, spending should pick up in the second half of the year.

The French economy disappointed in the first half of this year. While there was a widespread ‘soft patch’ in the euro area, the source and size of the slowdown in France stands out. The real GDP growth rate fell by 0.5 points, much more than the rest of the euro area. Moreover, while the slowdown in the other countries was mainly due to net trade, in France weakening in household’s expenditure also contributed.

| French households have been hit on several fronts this year: real wages have been dented by higher headline inflation, front-loaded tax hikes and uncertainty over labour market reforms have all played a role in curbing consumer spending. Moreover, spending on utilities was hit by unseasonably warm temperatures in April, while the decline in spending on services stemmed largely from transport strikes.

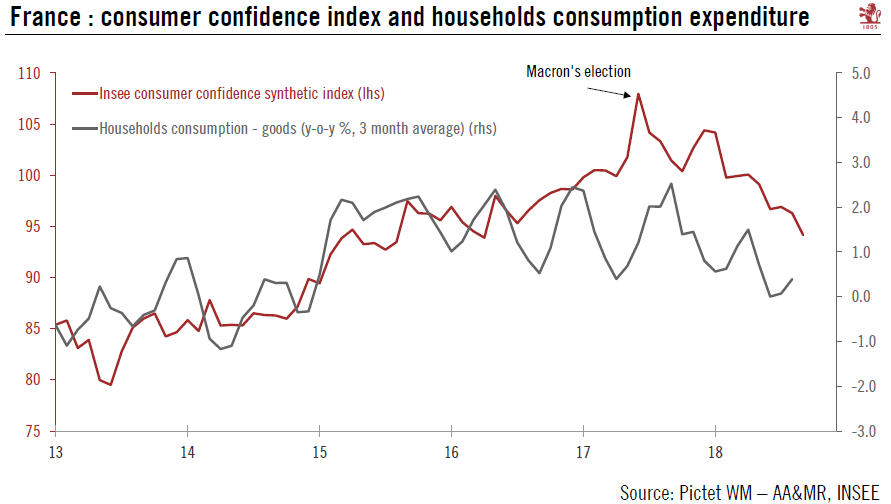

The question now is whether or not a pick-up in private consumption is likely in the near term? So far, data have been mixed. The French consumer confidence index fell by 2 points to 94.2 in September, the lowest level since April 2016 (see Chart). By contrast, consumer spending rose 0.8% m-o-m in August, having stabilised in July. The French statistics agency INSEE mentioned that the headline figure was boosted by a jump in spending on new cars “in anticipation of the tightening of test standards for new cars in Europe on September 1st“. Looking ahead, beyond short-term volatility, there are reasons to believe that French consumer spending will pick up as headwinds continue to fade. |

France: consumer confidence index and households consumption expenditure |

Tags: Featured,Macroview,newsletter