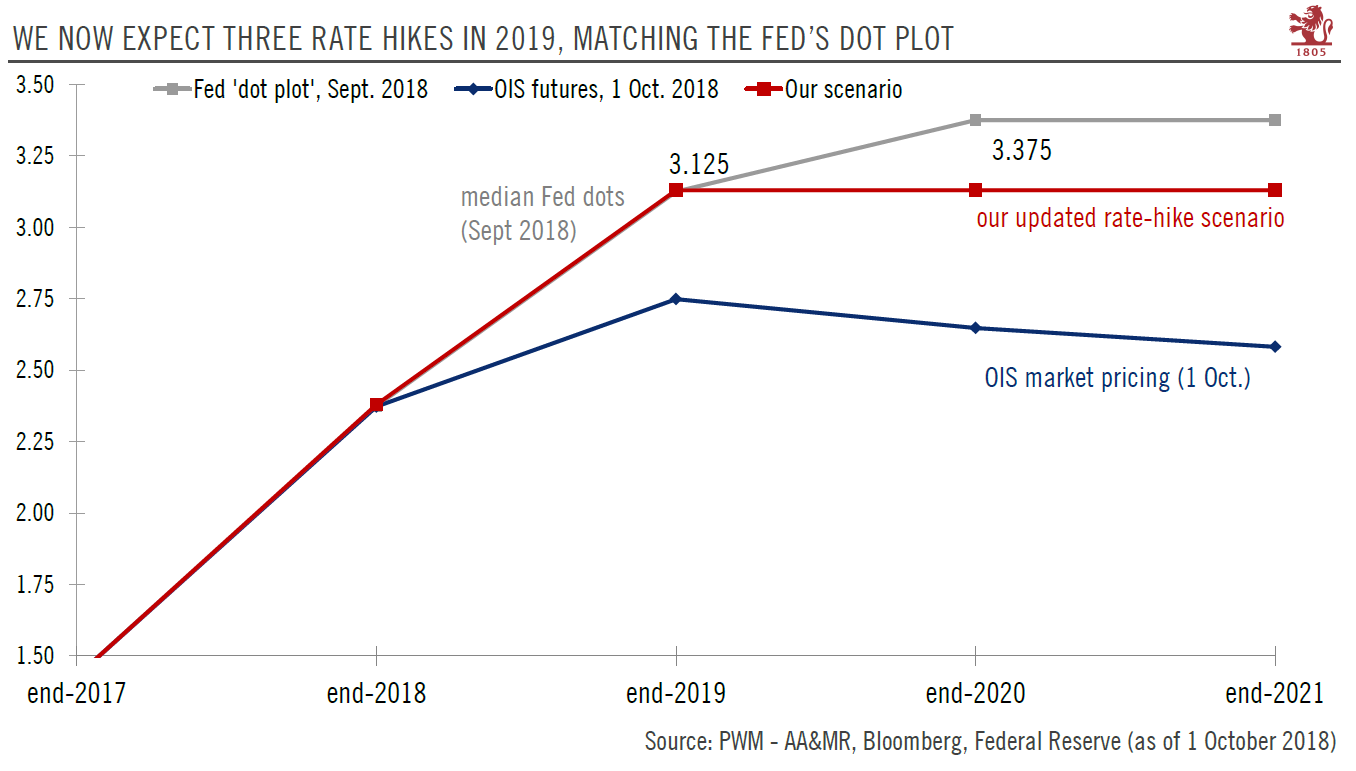

We now expect the Fed to raise rates three times next year instead of two.The Federal Reserve (Fed) is subtly turning more hawkish, mostly due to its increased confidence in the US outlook. While the Fed’s ‘dot plot’ chart (which illustrates the central bank’s rate hike projections) was unchanged in September from June, we think the chart’s message that there will be three Fed rate hikes next year should be taken more seriously by the market.Consequently, we are revising up the number of rate hikes we expect in 2019, from two to three. We believe the Fed is likely to deliver on its dot plot projections given Fed’s confidence about prospects for the US economy, with Fed chairman Jerome Powell saying the economy is “running at a healthy clip”.In addition, the Fed appears to be stepping back

Topics:

Laureline Chatelain and Thomas Costerg considers the following as important: Fed dot plot, Fed rate hikes, Jerome Powell, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

Stephen Flood writes Here are three things you can learn from the Fed

Joseph Y. Calhoun writes Weekly Market Pulse: Just A Little Volatility

Joseph Y. Calhoun writes Weekly Market Pulse: The Real Reason The Fed Should Pause

We now expect the Fed to raise rates three times next year instead of two.

The Federal Reserve (Fed) is subtly turning more hawkish, mostly due to its increased confidence in the US outlook. While the Fed’s ‘dot plot’ chart (which illustrates the central bank’s rate hike projections) was unchanged in September from June, we think the chart’s message that there will be three Fed rate hikes next year should be taken more seriously by the market.

Consequently, we are revising up the number of rate hikes we expect in 2019, from two to three. We believe the Fed is likely to deliver on its dot plot projections given Fed’s confidence about prospects for the US economy, with Fed chairman Jerome Powell saying the economy is “running at a healthy clip”.

In addition, the Fed appears to be stepping back from its concerns about the so-called ‘neutral rate’ as acting as a potential barrier for further rate hikes. The importance of 3% as a ceiling for further rate hikes has been diluted, in our view. The scant forward guidance the Fed provided in September (and the associated shortening of Fed statements) should also be read as a hawkish move, in our view.

In short, we now see three rate hikes next year, up from two in our previous scenario. We believe now the Fed will pause rate hikes in December 2019 (unlike the Fed’s dot plot chart, which shows an additional rate hike in 2020). This would be consistent with our view that 2020 growth could be slower than in 2019 as the mini-investment cycle that kicked in this year starts to fade.

From a US rates perspective, we now expect the 10-year yield to end 2018 at 3.3%, up from our previous forecast of 3.0%.