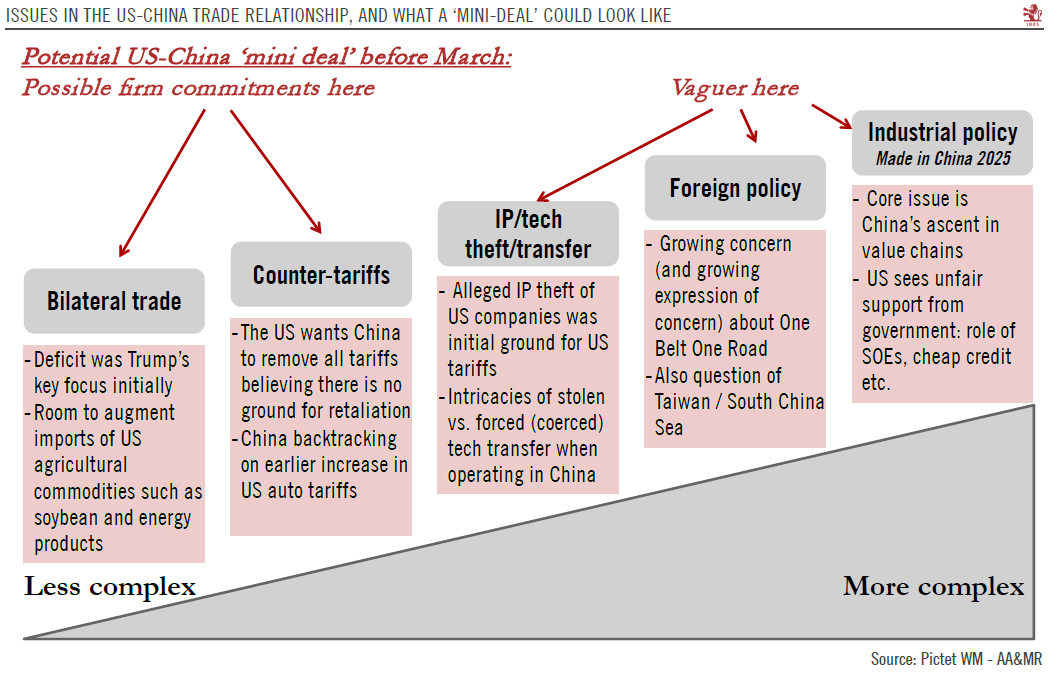

A tentative deal is possible by March, but tensions will likely flare up again.Following the Trump-Xi dinner on 1 December, there are signs of goodwill on both sides, leaving the impression that a ‘mini deal’ is possible before the 1 March 2019 deadline set by the US. This could push back the threat of additional tariffs in the very near term.But we think the devil will be in the details, and particularly in the implementation details. Some sort of hiccup is likely to take place once we enter this phase, in our view.Long-term thorny issues, such China’s economic (and technological) rise are unlikely to find an easy resolution – and there is perhaps not enough time to squeeze in these before the March deadline. These structural concerns could come back and haunt any ‘truce’. Both countries

Topics:

Thomas Costerg and Dong Chen considers the following as important: Macroview, US China confrontation, us china trade, US China trade war

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

A tentative deal is possible by March, but tensions will likely flare up again.

Following the Trump-Xi dinner on 1 December, there are signs of goodwill on both sides, leaving the impression that a ‘mini deal’ is possible before the 1 March 2019 deadline set by the US. This could push back the threat of additional tariffs in the very near term.

But we think the devil will be in the details, and particularly in the implementation details. Some sort of hiccup is likely to take place once we enter this phase, in our view.

Long-term thorny issues, such China’s economic (and technological) rise are unlikely to find an easy resolution – and there is perhaps not enough time to squeeze in these before the March deadline. These structural concerns could come back and haunt any ‘truce’. Both countries are fundamentally on a different wavelength. Geopolitical frictions could also reverberate on the economics.

President Trump has to tread carefully between the need to avoid inflicting too much harm on the US economy, while ‘saving face’ before his core voting base on a crucial 2016 campaign promise. Trade topics could help provide distraction from Democrats’ likely deeper inquisition into Trump’s ‘dossiers’.

As a result, we continue to think that in 2019, further tariffs are more likely than a removal of current tariffs. In other words, trade tensions are likely to continue to pollute economic visibility.