First rate hike still expected in September 2019, although downside risks are growing. The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”. Given the tone of today’s meeting, we see no reason to contradict this view, which is the same as our own. We expect a first 15bp hike in the ECB’s deposit rate in September 2019, followed by a 25bp hike in all policy rates in December 2019. Nevertheless, as we have stressed many times before,

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, ECB forecasts, ecb QE exit, European Central Bank, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

First rate hike still expected in September 2019, although downside risks are growing.

The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”.

Given the tone of today’s meeting, we see no reason to contradict this view, which is the same as our own. We expect a first 15bp hike in the ECB’s deposit rate in September 2019, followed by a 25bp hike in all policy rates in December 2019. Nevertheless, as we have stressed many times before, risks to this scenario are tilted towards a delayed lift-off given recent relatively disappointing data and other events. In order words, there is a rising risk that the ECB is unable to hike rates in 2019.

The central bank also confirmed that net asset purchases will end in December 2018. At the same time, the ECB enhanced its forward guidance on reinvestments, stating that it intends to continue to reinvest the principal payments from maturing securities purchased under the asset purchasing programme (APP) “for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case as long as necessary”. Bank chief Mario Draghi said that the ECB’s Governing Council did not discuss any specific time frame for reinvestments.

| Draghi suggested that there has been some discussion within the bank about TLTROs, but “nothing in substance”. We believe there will be an extension of the ECB’s TLTRO programme sometime in the first half of next year.

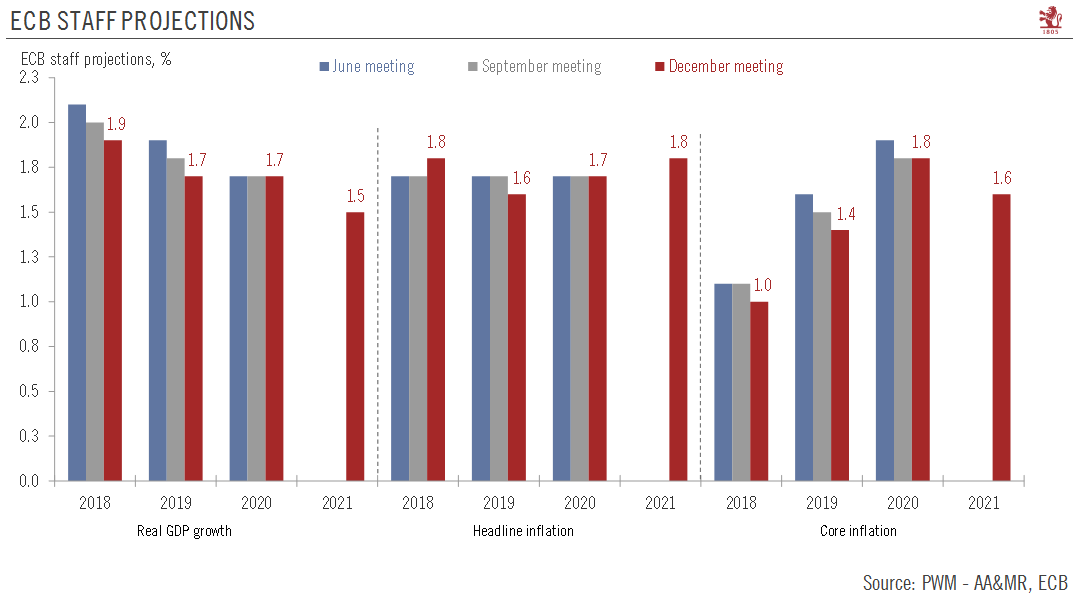

Staff forecasts for euro area real GDP growth were revised slightly down to 1.9% in 2018 (from 2.0% in September) and to 1.7% in 2019 (from 1.8%). The forecast for 2020 (1.7%) was left unchanged. For the first time, the ECB released a growth forecast for 2021, (1.5%). Meanwhile, Draghi maintained his confidence that “underlying inflation, while still subdued, is on track to converge towards its target”, helped in part by recent positive developments in wage growth. This optimism contrasts with the ECB’s slight lowering of its inflation forecasts for 2019 (to 1.6% from 1.7%). However, the ECB maintained its 2020 inflation forecast at 1.7%. |

ECB Staff Projections |

Tags: ECB forecasts,ecb QE exit,European central bank,Featured,Macroview,newsletter