Fed shows shows signs of adopting a more flexible approach to future rate hikes.The Federal Reserve (Fed) is widely expected to increase the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, marking the fourth rate increase of 2018. This increase would push up the new FFTR range to 2.25%-2.50%.The focus will be on the rate guidance for 2019, including the one given by the ‘dot plot’ (summary of Fed policymakers’ interest rate forecasts). We think the 2019 median dot will shift down to show two rate hikes, in contrast to the three in September’s dot plot.The Fed may indicate that the auto pilot rate rises of 25bps per quarter in place since December 2016 could transition to a more ad hoc tightening. We expect that the Fed will likely remove the guidance about

Topics:

Thomas Costerg considers the following as important: Macroview, US economy, US Fed hikes, US Fed policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Fed shows shows signs of adopting a more flexible approach to future rate hikes.

The Federal Reserve (Fed) is widely expected to increase the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, marking the fourth rate increase of 2018. This increase would push up the new FFTR range to 2.25%-2.50%.

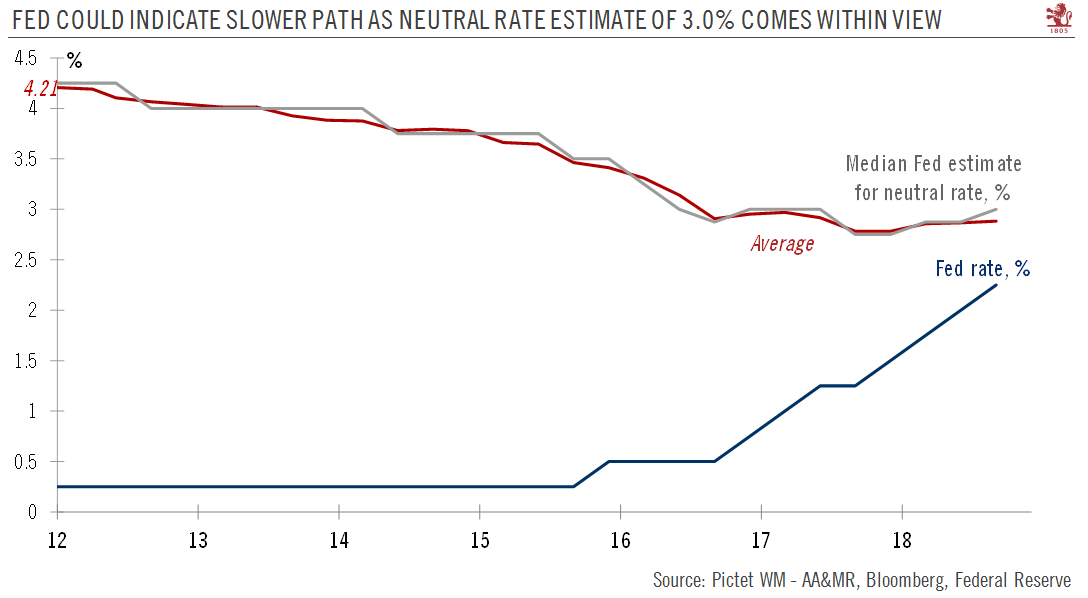

The focus will be on the rate guidance for 2019, including the one given by the ‘dot plot’ (summary of Fed policymakers’ interest rate forecasts). We think the 2019 median dot will shift down to show two rate hikes, in contrast to the three in September’s dot plot.

The Fed may indicate that the auto pilot rate rises of 25bps per quarter in place since December 2016 could transition to a more ad hoc tightening. We expect that the Fed will likely remove the guidance about “further gradual increases” in the post-meeting statement, as it seeks more flexibility while approaching the neutral rate.

Our fundamental view that 2019 could mark the end of the Fed’s tightening still holds, but the path around our scenario of three rate hikes (with a risk of two) is under review, pending the Fed’s decision and more precise signals about next year’s path.

An underappreciated possibility is that the Fed may space out rate hikes in 2019, breaking the 2018 pace of one rate hike per quarter. We still think the Fed’s goal is to gradually bring rates toward 3%, their current view of ‘neutral’, particularly as the Fed does not see a recession in the growth pipeline.