Fed chair Jerome Powell still wants to “normalize” monetary policy in 2019.The Federal Reserve (Fed) raised the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, as widely anticipated. The new FFTR range is 2.25-2.50%. This marked the fourth rate increase of 2018.There was no formal guidance about the next hike and clues were rather hazy. It seems like the Fed still wants to bring rates towards ‘neutral’ in 2019 (currently 2.75% based on the median Fed dot – within close reach from where we are now). Entering the neutral rate zone also allows for a slower rate-hiking course, with clues that the next rate hike could be several months away as the Fed relies increasingly on incoming data, particularly inflation, and financial market behaviour.More than recent

Topics:

Thomas Costerg considers the following as important: Fed December meeting, Macroview, Uncategorized, US Fed hikes, US Federal Reserve

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Fed chair Jerome Powell still wants to “normalize” monetary policy in 2019.

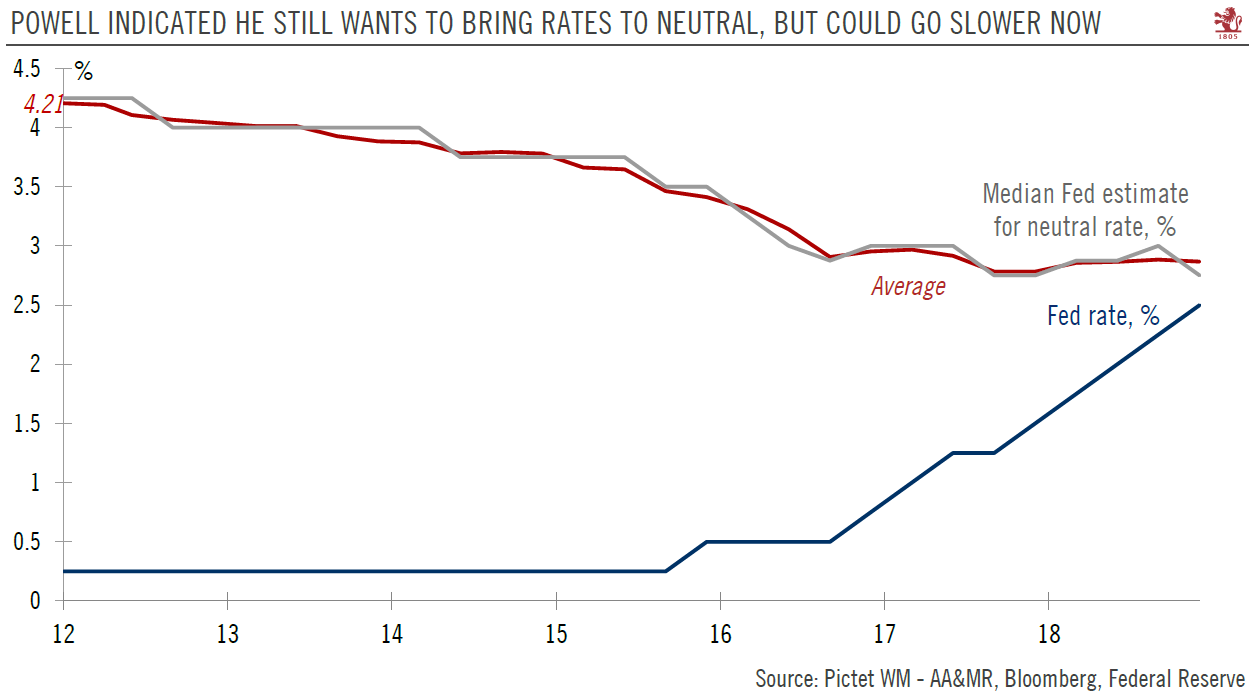

The Federal Reserve (Fed) raised the Fed funds target range (FFTR) by another 25 basis points (bps) on 19 December, as widely anticipated. The new FFTR range is 2.25-2.50%. This marked the fourth rate increase of 2018.

There was no formal guidance about the next hike and clues were rather hazy. It seems like the Fed still wants to bring rates towards ‘neutral’ in 2019 (currently 2.75% based on the median Fed dot – within close reach from where we are now). Entering the neutral rate zone also allows for a slower rate-hiking course, with clues that the next rate hike could be several months away as the Fed relies increasingly on incoming data, particularly inflation, and financial market behaviour.

More than recent market volatility, a growing “mood of angst” among US businesses seemed to be Powell’s bigger concern, particularly as reported by the Fed’s Beige Book (a collection of local-level anecdotes in Fed districts). This anxiety around the current mood supports the view that the Fed will pause rate hikes until the spring, at least.

By stressing that “further” rate hikes remain on the table in 2019 and underlining the still healthy growth outlook, it seems that Powell does not want to appear as entirely ‘caving in’ to market demand for a policy reversal – or to President Trump’s criticism of ongoing monetary tightening. The 2019 median dot showed two expected rate hikes, down from three shown previously.

Powell also downplayed the importance of the ongoing balance sheet shrinkage – despite being now a key worry for the markets. It is “pretty small”, in his view, and Powell sounded determined to keep this shrinkage on ‘auto pilot’ in the background.

After highlighting the downside risks, we are formally adjusting our Fed scenario and now see two rate hikes next year (versus three previously) with considerable risk of only one hike, given the rising sensitivity of the US economy to rising financing costs and lower liquidity conditions. Big picture wise, we have long highlighted that 2019 should mark the end of the Fed’s interest-rate tightening, a view which still holds. A crucial element to watch in 2019 will be a potential pivot back to balance sheet aspects.