It's always darkest before dawn, and dawn is not yet in sight.It was another eventful week in British politics, although there was still no meaningful progress on clearing the way for a smooth Brexit before the crucial deadline of March 2019. While a smooth exit remains our base-case scenario, uncertainty remains sizeable.PM Theresa May postponed the British Parliament vote on her Brexit divorce deal, and vowed to re-open discussions with European Union (EU) partners. However, things are not off to a great start as discussions so far have confirmed that her European counterparts remain reluctant to budge.May survived an internal party leadership contest by 200-117; but the vote also showed a significant minority in the Tory party could challenge May’s divorce deal, even with tweaks, when

Topics:

Team Asset Allocation and Macro Research considers the following as important: Brexit, Brexit politics, Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

It's always darkest before dawn, and dawn is not yet in sight.

It was another eventful week in British politics, although there was still no meaningful progress on clearing the way for a smooth Brexit before the crucial deadline of March 2019. While a smooth exit remains our base-case scenario, uncertainty remains sizeable.

PM Theresa May postponed the British Parliament vote on her Brexit divorce deal, and vowed to re-open discussions with European Union (EU) partners. However, things are not off to a great start as discussions so far have confirmed that her European counterparts remain reluctant to budge.

May survived an internal party leadership contest by 200-117; but the vote also showed a significant minority in the Tory party could challenge May’s divorce deal, even with tweaks, when it finally arrives before the British Parliament.

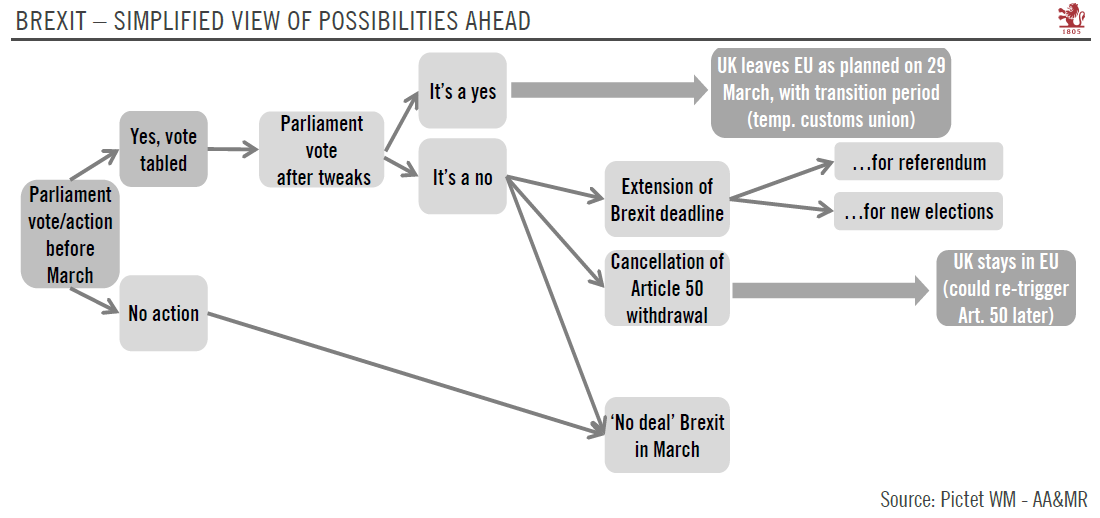

If parliamentary gridlock persists, the UK could slide into a ‘no-deal Brexit’ (cliff edge) in March – meaning an abrupt exit from the EU – but we still believe that a majority exists to oppose a slide into such ‘unknown’ territory. In our view, the risk of asking the EU for an extension of the March deadline or cancelling Brexit is rising.

The pound sterling is likely to remain range-bound in the near-term as crucial parliament steps near. A smooth exit or the reduced anxiety about a no-deal Brexit could eventually boost sterling from current levels.

Brexit uncertainty could cap gilts yields for longer as well.