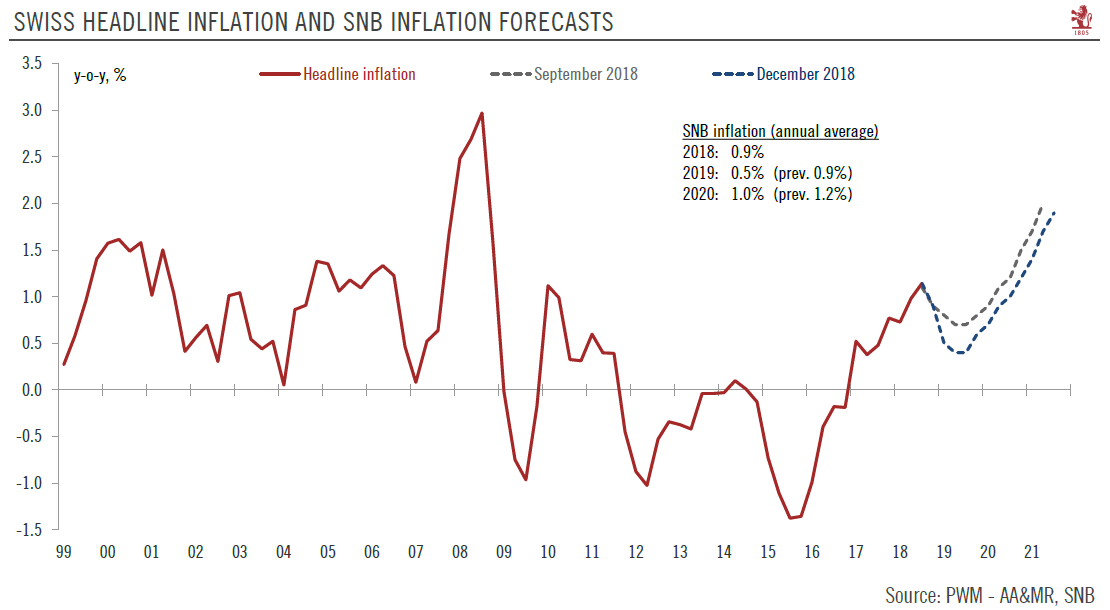

Fresh inflation projections likely to keep the central bank on the path of prudence. The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today. The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge. Importantly, the SNB’s inflation forecasts for 2019 and 2020 were significantly revised down—another argument for the SNB to remain cautious and wait for the European Central Bank to start hiking its own policy rates. Swiss Headline Inflation and SNB Inflation Forecasts 1999-2021 - Click to enlarge Read full report here Related posts: Swiss

Topics:

Nadia Gharbi considers the following as important: 1) SNB and CHF, Featured, Macroview, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

Fresh inflation projections likely to keep the central bank on the path of prudence. The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today. The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge. Importantly, the SNB’s inflation forecasts for 2019 and 2020 were significantly revised down—another argument for the SNB to remain cautious and wait for the European Central Bank to start hiking its own policy rates. |

Swiss Headline Inflation and SNB Inflation Forecasts 1999-2021 |

Tags: Featured,Macroview,newsletter