Macroview In-house simulations of growth impact match those of the ECB PWM has on-boarded the models used in the major central banks to tell us the cost of Brexit for the euro area economy. Using the same models used in major central banks gives our asset allocation policy important advantages. We have the same diagnosis of the situation as the monetary authorities and we are able to enter their mind-set. In the case of Brexit, the challenge has been how to simulate what is essentially a...

Read More »Chinese nonmanufacturing activity holds up, but manufacturing slightly down

Macroview Nonmanufacturing helped by construction, but growth may slow given stimulus pull-back China’s official and Caixan purchasing manufacturing indices (PMI) declined in June. The official figure stood at 50 (down from 50.1 in May), right at the mid-point between expansion and contraction, while the Caixin PMI fell to 48.6. At the same time, the official PMI figures show that activity at large companies, many of them state owned, was much stronger than at small and medium-sized...

Read More »The ECB and the capital key question

We see the ECB making its QE programme progressively more flexible in response to the shortage of eligible bonds Press reports suggest the European Central Bank (ECB) may be weighing up the idea of loosening its QE rules via a deviation from the capital keys which the central bank uses as a basis for balancing its sovereign bonds purchases across euro area member states.The ECB faces a problem, because a Brexit-led flight-to-safety has reduced the universe of core bonds eligible for...

Read More »Post-Brexit uncertainties favour certain currencies

Following the Brexit referendum, prolonged GBP weakness is likely, while the Swiss franc faces renewed upward pressure Greater uncertainties, such as those caused by the Brexit vote, generally favour lower risk appetite. As a result, safe-haven currencies like the US dollar and currencies with positive current accounts and/or positive net international investment positions (JPY and CHF) are expected to outperform. Between the Bank of Japan and the Swiss National Bank, the latter would seem...

Read More »US GDP growth expectations tilted to the upside

Healthy consumer spending figures lead us to believe that US GDP growth might actually be better than we have been forecasting. Inflation pressures look likely to remain modest for a while Real consumer spending in the US rose by a healthy 0.3% month over month in May, according to the Bureau of Economic Analysis (BEA) on 29 June, beating consensus expectations. Moreover April’s number was revised up, so that between Q1 and April-May, US personal consumption grew by an astonishing 4.8%...

Read More »Brexit means the Fed will act even more cautiously

Brexit puts upward pressure on US financial conditions, but growth forecast remains unchanged Read full report hereSo far, the UK vote to leave the UE has only led to a modest tightening in US monetary and financial conditions. Nevertheless, Brexit will probably mean lasting upward pressure on the US dollar and on US financial conditions.The UK absorbs less than 4% of US exports and the total of EU countries around 18%. This corresponds to 0.5%, respectively 2.3% of US GDP. Even a recession...

Read More »Spanish general elections: inconclusive, but…..

The re-run of the Spanish general elections produced a fragmented parliament again, but a minority government could take shape. In Europe, Greece, Portugal and Italy remain political flash points. Read full report hereAfter an inconclusive vote in the December general election and the subsequent failure of Spain’s political parties to reach an agreement to form a government, Spaniards returned to the polls on 26 June. Once again, the results produced a fragmented parliament, but traditional...

Read More »Brexit: what now for the ECB?

QE guidance, front-loading of asset purchases, and augmented TLTROs in the offing Read full report hereThere is considerable uncertainty around the modalities and consequences of Brexit, but one thing looks certain: central banks will be under great pressure to act again as circuit-breakers.The Bank of England (BoE) has issued a statement saying that it “will not hesitate to take additional measures”, including injecting “more than GBP250bn” of additional liquidity into the market. Rate...

Read More »UK’s Brexit vote to have wide repercussions, changes economic & market scenarios

By referendum, UK voters have decided the UK should leave the EU. This result leads us to alter our economic and market forecasts Looking at the referendum result in terms of macroeconomics, financial markets and politics, our views are as follows:Macroeconomics. The vote for Brexit is, we believe, likely to reinforce a recent loss of momentum in parts of the UK economy. We believe the result of the referendum will hit consumer and business confidence, at least in the short term. Business...

Read More »PMI figures point to marginal decline in activity in euro area

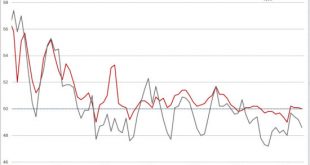

Macroview We maintain our above-consensus forecast of 1.8% for euro area GDP growth this year Read full report hereThe euro area composite ‘flash’ purchasing managers’ index (PMI) compiled by Markit fell marginally, from 53.1 in May to 52.8 in June, slightly below consensus expectations. The sector breakdown showed that the drop was driven by a fall in the services sectors while the manufacturing PMI index rose from 51.5 to 52.6 in June, beating consensus expectations and reaching a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org