QE guidance, front-loading of asset purchases, and augmented TLTROs in the offing Read full report hereThere is considerable uncertainty around the modalities and consequences of Brexit, but one thing looks certain: central banks will be under great pressure to act again as circuit-breakers.The Bank of England (BoE) has issued a statement saying that it “will not hesitate to take additional measures”, including injecting “more than GBP250bn” of additional liquidity into the market. Rate cuts and quantitative easing (QE) expansion are likely to be part of the BoE’s first monetary easing choices, in our view.The European Central Bank (ECB) issued its own statement, essentially confirming that it stood ready to provide additional liquidity, including in foreign currencies, through existing swap arrangements between central banks, thus reducing systemic risks.Having reduced systemic risks, we think that the ECB may have the luxury to wait a little longer before it makes its next significant move ─ probably until its next policy meeting on 21 July. Ultimately though, tighter financial conditions, rising economic and political risks are likely to force the ECB to consider additional monetary easing.We do not see a further rate cut, at least in the near future, in light of the lingering concerns over the European banking sector.

Topics:

Frederik Ducrozet considers the following as important: Brexit ECB, ECB policy easing, ECB QE, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

QE guidance, front-loading of asset purchases, and augmented TLTROs in the offing

There is considerable uncertainty around the modalities and consequences of Brexit, but one thing looks certain: central banks will be under great pressure to act again as circuit-breakers.

The Bank of England (BoE) has issued a statement saying that it “will not hesitate to take additional measures”, including injecting “more than GBP250bn” of additional liquidity into the market. Rate cuts and quantitative easing (QE) expansion are likely to be part of the BoE’s first monetary easing choices, in our view.

The European Central Bank (ECB) issued its own statement, essentially confirming that it stood ready to provide additional liquidity, including in foreign currencies, through existing swap arrangements between central banks, thus reducing systemic risks.

Having reduced systemic risks, we think that the ECB may have the luxury to wait a little longer before it makes its next significant move ─ probably until its next policy meeting on 21 July. Ultimately though, tighter financial conditions, rising economic and political risks are likely to force the ECB to consider additional monetary easing.

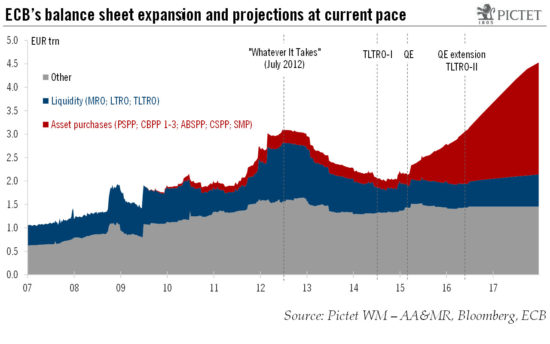

We do not see a further rate cut, at least in the near future, in light of the lingering concerns over the European banking sector. However, if it proves necessary, we would not rule out another “whatever it takes” moment to preserve the euro area’s integrity. To begin with, the ECB could make full use of the flexibility of existing tools, including: 1) stronger forward guidance; 2) QE extension beyond March 2017 as well as a temporary front-loading of asset purchases; 3) more favourable TLTRO conditions, especially after today’s weaker-than-expected net demand at the first TLTRO-II operation (around EUR30bn).