Brexit puts upward pressure on US financial conditions, but growth forecast remains unchanged Read full report hereSo far, the UK vote to leave the UE has only led to a modest tightening in US monetary and financial conditions. Nevertheless, Brexit will probably mean lasting upward pressure on the US dollar and on US financial conditions.The UK absorbs less than 4% of US exports and the total of EU countries around 18%. This corresponds to 0.5%, respectively 2.3% of US GDP. Even a recession in the UK and a sharp slowdown in the rest of the EU would therefore only have a marginal direct impact on US economic growth. However, through the transmission channel of tighter monetary and financial conditions, the negative implications for the US economy could potentially be quite sizeable. Less growth in Europe, rising political uncertainty and higher risk aversion may have a lasting upward impact on the dollar, together with downward implications for risky assets.All this is placing downside risks on US growth and inflation. Uncertainty is high.

Topics:

Bernard Lambert considers the following as important: Fed Brexit, Fed rate forecast, Macroview, US Federal Reserve, US growth Brexit

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Brexit puts upward pressure on US financial conditions, but growth forecast remains unchanged

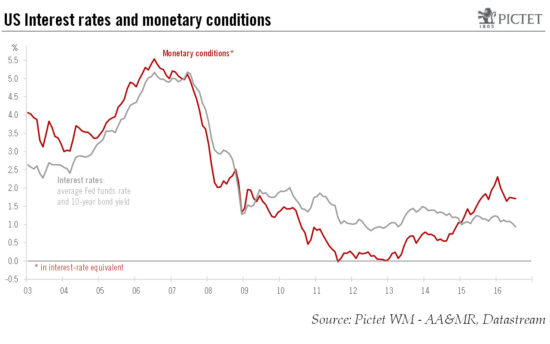

So far, the UK vote to leave the UE has only led to a modest tightening in US monetary and financial conditions. Nevertheless, Brexit will probably mean lasting upward pressure on the US dollar and on US financial conditions.

The UK absorbs less than 4% of US exports and the total of EU countries around 18%. This corresponds to 0.5%, respectively 2.3% of US GDP. Even a recession in the UK and a sharp slowdown in the rest of the EU would therefore only have a marginal direct impact on US economic growth. However, through the transmission channel of tighter monetary and financial conditions, the negative implications for the US economy could potentially be quite sizeable. Less growth in Europe, rising political uncertainty and higher risk aversion may have a lasting upward impact on the dollar, together with downward implications for risky assets.

All this is placing downside risks on US growth and inflation. Uncertainty is high. Will there be a ‘hard’ or a ‘soft’ exit of the UK from the EU? What kind of political contagion will occur? To what extent will US financial conditions tighten? How will the Fed react? There are also important domestic US uncertainties, notably the results of the presidential elections in November and what they mean in terms of fiscal stimulation next year.

But for the moment, we actually remain relatively comfortable with our US economic forecasts for the moment. We do not believe it is necessary to cut our GDP projections, and continue to expect GDP growth to average 1.8% in 2016 and 2.0% next year. Our inflation forecasts also remain unchanged. We continue to expect core PCE inflation to end this year at 1.9% y-o-y and at 2.2% in 2017.

However, the Fed should act even more cautiously than we thought before. We still expect a 25bp hike in rates this year, but most probably in December instead of September. And for 2017, we have cut our forecasts from three hikes to two.