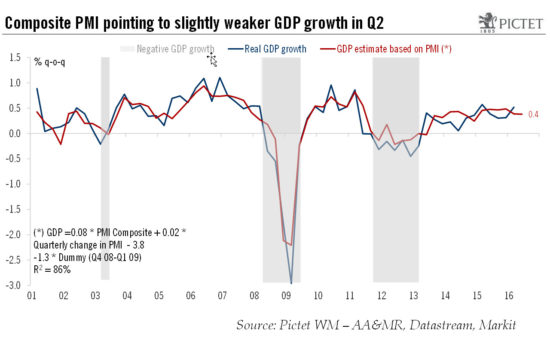

Macroview We maintain our above-consensus forecast of 1.8% for euro area GDP growth this year Read full report hereThe euro area composite ‘flash’ purchasing managers’ index (PMI) compiled by Markit fell marginally, from 53.1 in May to 52.8 in June, slightly below consensus expectations. The sector breakdown showed that the drop was driven by a fall in the services sectors while the manufacturing PMI index rose from 51.5 to 52.6 in June, beating consensus expectations and reaching a six-month high.The biggest source of disappointment was France, where the composite PMI fell to a 4-month low of 49.4 in June. While activity in the services sector proved more resilient overall, the near-term activity outlook remains mixed at best as weak demand and a difficult social climate are weighing on business confidence. In Germany, the manufacturing sector surprised to the upside, boosted by a solid increase in new export orders. Markit indicated that the pace of expansion in activity in the rest of the euro area picked up from May’s 17-month low.Overall in Q2, the euro area composite PMI looks consistent with a marginally weaker pace of economic growth compared with the average recorded in Q1 (53.2). Markit mentions a quarterly growth rate of real GDP of around 0.3% q-o-q in Q2, slightly below our forecast of 0.4%.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We maintain our above-consensus forecast of 1.8% for euro area GDP growth this year

The euro area composite ‘flash’ purchasing managers’ index (PMI) compiled by Markit fell marginally, from 53.1 in May to 52.8 in June, slightly below consensus expectations. The sector breakdown showed that the drop was driven by a fall in the services sectors while the manufacturing PMI index rose from 51.5 to 52.6 in June, beating consensus expectations and reaching a six-month high.

The biggest source of disappointment was France, where the composite PMI fell to a 4-month low of 49.4 in June. While activity in the services sector proved more resilient overall, the near-term activity outlook remains mixed at best as weak demand and a difficult social climate are weighing on business confidence. In Germany, the manufacturing sector surprised to the upside, boosted by a solid increase in new export orders. Markit indicated that the pace of expansion in activity in the rest of the euro area picked up from May’s 17-month low.

Overall in Q2, the euro area composite PMI looks consistent with a marginally weaker pace of economic growth compared with the average recorded in Q1 (53.2). Markit mentions a quarterly growth rate of real GDP of around 0.3% q-o-q in Q2, slightly below our forecast of 0.4%. Based on a strong carryover effect, we are maintaining our above-consensus forecast for euro area GDP growth of 1.8% this year although our projections remain predicated on favourable political outcomes in the UK Brexit referendum (today) and in the Spanish general election (on Sunday).